Vietnam’s consumer income set to rise over 80% in next decade: HSBC

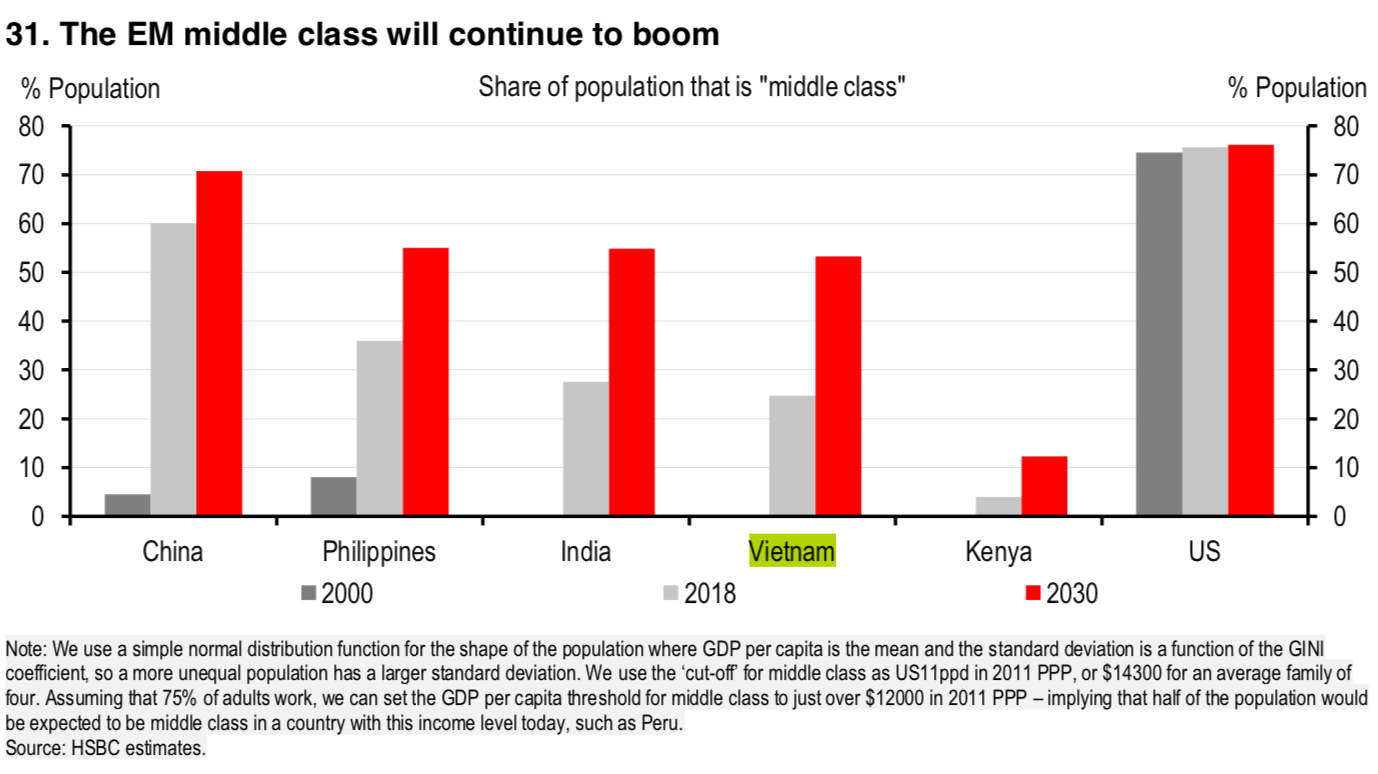

As incomes rise in the likes of India, Indonesia, the Philippines and Vietnam, their populations will also make the transition into driving global consumption in new ways, informed HSBC in its latest report.

The USD spending power of these consumers will still be a fraction of the middle class in the west, but will bring about a very different pattern of consumption from the world’s emerging markets.

As populations rapidly move through the income groups, spending will shift away from subsistence – such as food and shelter – and on to having more ‘fun’, best highlighted by the share of income being spent on “others” in the charts below doubling between low and high income groups. Transport also sees a notable increase in the share of the consumption basket as incomes rise, as consumers start to spend on personal vehicles and flights.

These shifts in consumption will impact the make-up of CPI baskets in emerging markets, where food prices play a big role in overall inflation as well as changing the relationship between emerging markets and the rest of the world. As many emerging markets start to consume more and more services, the winners from growth in the emerging world may transition from commodity producers to service providers.

Vietnam, along with Bangladesh, the Philippines, Malaysia and Pakistan, are predicted to be the five fastest-growing economies out of 75 developed, emerging and frontier economies included in HSBC’s projection by 2030.

Under HSBC’s latest report, Vietnam is likely to be the fourth biggest mover in the global GDP ranking (47th to 39th), ahead of Malaysia in the top five in subject. So that by 2030, the contribution to global growth from emerging Asia excluding China will be converging on that of the whole of the group of countries currently classified as developed by MSCI.

By 2030, Vietnam’s GDP is expected to reach around US$500 billion from over US$200 billion in 2018 and GDP per capita of US$2,015, while trade continues to remain a vital part of the economy, accounting for 184.7% of GDP.

Meanwhile, Vietnam is also included in the top 10 countries that would be the most vulnerable to climate change in 2030, which is part of HSBC’s view that the fastest growing economies are also the ones most at risk from climate change.

The trend of the past five years, of just below 3% global growth, looks like it could be sustainable, implying that by 2030, global GDP is about 40% higher than in 2017. Growth in both emerging markets (EM) and developed markets (DM) is projected to be a little weaker than over the past decade but EM now makes up a larger share of the world.

Assuming countries undertake the necessary action to keep addressing their economic flaws, HSBC expected that global growth can be maintained at close to 3% over the next decade or so, with nearly 70% of that growth being driven by EM.

English

English