Vietnam: Measures needed to aid recovery

PETALING JAYA: The two-week extension of the lockdown, although deemed necessary to break the chain of Covid-19 infections, is expected to weigh down the already struggling economy and corporate earnings of some of the hardest-hit sectors.

With business and consumer sentiment taking a hit, only a comprehensive recovery strategy by the government, on top of additional stimulus measures, could jumpstart the economy.

Speaking with StarBiz, Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid said it was “prudent” for the 2021 gross domestic product (GDP) growth forecast to be revised lower, considering the full swing lockdown in June. “Constraints on production activities are likely to have material impact on the growth momentum, ” he said.

Bank Negara had expected a growth of 6% to 7.5% for this year.

Echoing a similar view with the business community, Mohd Afzanizam said the economy required more help from the government. In particular, the assistance measures should be tailored towards managing cash flows for businesses, apart from facilitating unemployed Malaysians to look for new jobs as well as those who have been experiencing salary cuts.

“Wage subsidies, special grants as well as cash transfers have been the main tools and we expect this will continue in the immediate terms. More important is the vaccination programme. It has to be accelerated so that the economy can be reopened convincingly, ” he added.

AmBank Research and Maybank Kim Eng Research expect the monthly GDP for May and June to deteriorate as the country entered into tighter restrictions last month and followed by a lockdown or full movement control order (FMCO) beginning June 1.

In April, AmBank Research estimated that the economy surged 33% to 37%. The strong monthly expansion was underpinned by a 50.1% year-on-year (y-o-y) growth in industrial production as well as a 66.2% y-o-y growth in distributive sales.

Besides the strong economic data reported, the extreme low base effect is also expected to provide a big push to April’s GDP performance.

“However, the economic performance in May and June remains a challenge. There is more downside risk due to the restrictive measures to contain the high numbers of Covid-19 cases. Our full-year (2021) growth is anticipated to be around 4.5%, ” it said in a note yesterday.

Meanwhile, Maybank Kim Eng Research expects Malaysia’s monthly GDP to post slower growth in May 2021 and shrink in June 2021. For the full year, the research house has revised its GDP growth forecast downward to 4.2% compared to 5.1% previously. For comparison, Malaysia’s economy shrank 5.6% in 2020.

“At the same time, we estimated daily real GDP losses under the FMCO Phase 1 to be RM1.5bil, less than the reported RM2.4bil in MCO 1.0 as we believe sectors, industries and businesses allowed to operate are more prepared for the lockdown this time around, ” according to Maybank Kim Eng Research.

In deriving the estimate, the research house assumed a one month-long Phase 1 FMCO, where sectors, industries and businesses that contributed to 50% to 55% of GDP are expected to operate subject to standard operating procedures and workforce restrictions.

This will be followed by another month of Phase 2 FMCO where more sectors, industries and businesses are allowed to operate.

On the other hand, CGS-CIMB Research has left its GDP forecast of 4.4% for 2021 unchanged. It expects the impact from the extension of Phase 1 lockdown to be offset by greater leniency in sectors allowed to operate than its initial assumption. In addition, the RM40bil Permerkasa Plus aid package, which was announced on May 31 ahead of the FMCO, is set to provide support for the economy.

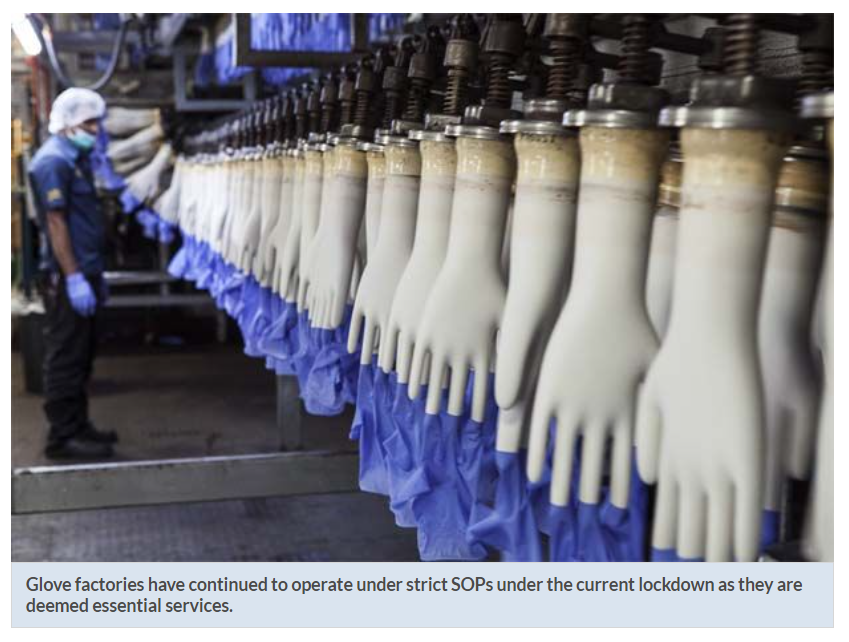

“However, the extension will raise the risk of a second-quarter 2021 corporate earnings disappointment for gaming, retail, auto, real estate investment trust, property, construction and tourism-related plays. Sectors least affected are export-oriented (technology, glove makers, petrochemicals and plantations) and utilities, ” it added.

The potential earnings disappointment and the country’s political uncertainty could weigh on near-term sentiment for the market, according to the research house.

Nevertheless, CGS-CIMB Research reiterated its end-2021 target for FBM KLCI at 1, 709.

Source: https://www.thestar.com.my/business/business-news/2021/06/15/measures-needed-to-aid-recovery

Thailand

Thailand