Vietnam: Lack of raw materials threaten wood prices

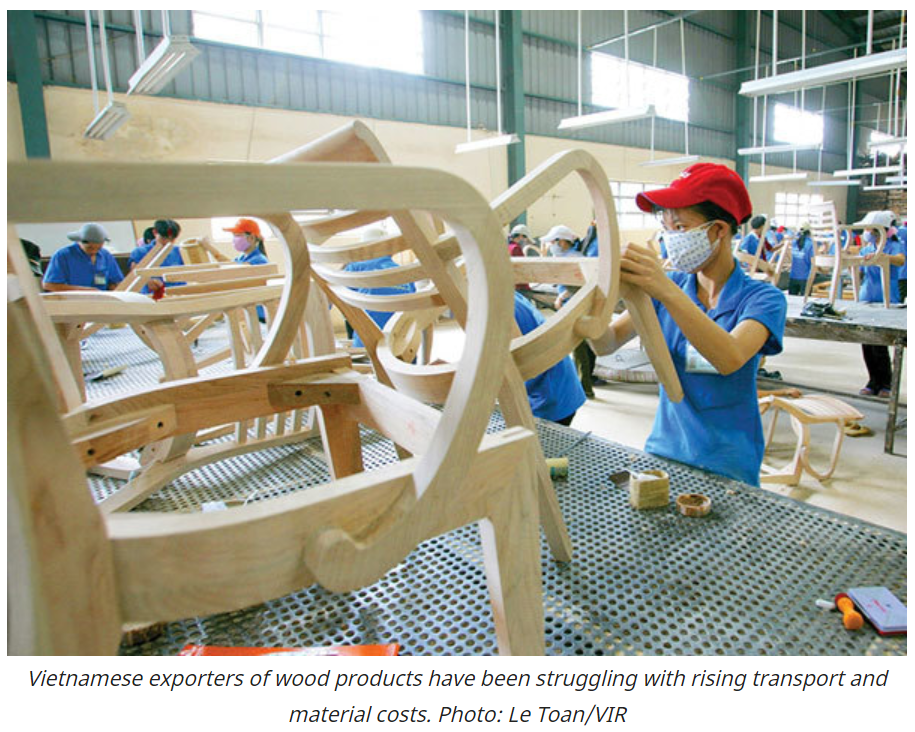

Input material prices for Vietnamese wood exporters have risen sharply, but most of them are stuck in the mud as there seems no suitable way to increase their selling prices accordingly.

As global supply chains were affected by the Suez Canal incident, the supply issues for raw materials for Vietnam’s export wood processing were further exacerbated.

“Raw material prices have increased by 10-25 per cent since July last year, depending on the source of imports,” said Nguyen Liem, general director of Lam Viet JSC – a manufacturer of wooden chairs, boards, and beds for the US and UK markets.

The Vietnam Administration of Forestry under the Ministry of Agriculture and Rural Development estimated the import value of wood and materials at $696 million in the first three months of 2021, up 31 per cent on-year. The high value comes from an increased demand as well as increased raw material prices in the first months of the year. Vietnamese businesses are importing raw wood from China, the United States, Cameroon, Thailand, and Chile, accounting for about 55 per cent of the total imported wood and forest products in the past three months.

Many traders and wood processors are concerned that raw material prices will further rise due to the impact of the Suez Canal incident.

Data from TigerWood Co., Ltd., a company specialising in the trading of raw wood imported from the US and Europe with an office in the southern province of Binh Duong, noted many reasons for the recent rise in prices. For instance, fees for logistics, like containers and shipping, have pushed up the selling price of raw pine, poplar, oak, and ash by about $2-3 per cubic metre compared to mid-2020. During the first quarter of 2021, many companies had orders but lacked raw materials for production, and thus had to accept buying raw materials at high prices. Some of the materials are lacking due to supply disruptions in China, and many have currently not found alternative markets.

Large companies with long-term strategies have been increasingly collecting raw materials to produce large orders, pushing smaller companies away and leaving them with insufficient timber and other raw materials for production.

Raw wood from major sources, especially the US and Europe, has decreased due to a significant increase in the domestic demand in these markets. Data compiled by TigerWood shows that the demand for wooden kitchen and bathroom products in Europe and the US increased by 40 per cent from a year ago. Meanwhile, home extensions and repairs increased by 52 per cent, and security concerns seemed to have caused a much greater demand in fences and repairs, resulting in a rise of 166 per cent.

The US consumes half of Vietnam’s wood products, and Americans increased their purchases of imported products due to lower prices, consistent with a lower per capita income due to the effects of the pandemic – a trend that will continue in 2021 as the health crisis remains complicated, according to industry researcher IBISWorld.

TigerWood stated that the price of imported raw materials has mainly risen because of the slow global trade in goods. Meanwhile, the container demand in China is growing strongly with the recovery of its export industry pushing the demand further. Also, China’s exporters seem to be willing to spend more money for carriers bringing empty containers back to them.

Currently, the cost of transporting goods from China to the US is almost 10 times higher than in the opposite direction, so carriers want to ship empty containers rather than goods, according to online freight shipping marketplace Freightos.

The increase in input material costs moves many small- and medium-sized manufacturers to also raise the selling prices of their products. However, buyers of Vietnamese wood products, such as in Europe and America, are still suffering from the pandemic while their purchasing power has not increased.

“It is extremely difficult to raise issues with European and American customers at this time,” said Lam Viet’s Liem.

According to Liem, most customers buy Vietnamese wood products at ‘free on board’ prices, meaning that they have to bear the shipping costs. While the value of the goods in each container amounts to just over $10,000, the price of the container has increased from $2,000 to nearly $9,000 after just one year. If Vietnamese manufacturers also add the raw material price increase to their finished product prices, buyers refrain from purchasing at some point.

Moreover, for traders in Europe or America, input prices have been kept stable for around five years. Liem said, “The renegotiation of these selling prices could have been still possible if Vietnamese companies had raised the issue last September.”

However, the bargaining position of Vietnamese wood product suppliers has changed after efforts to train human resources and invest in and apply high-tech solutions in the operations.

Liem found that more major buyers around the world were working directly with Vietnamese suppliers on product sales. They typically order for a long term, instead of a month or a quarter like years ago. “But, the only companies with large scales have this strong bargaining position. Smaller businesses still have to accept each quarter, even every month,” he said.

As the pandemic is still progressing, the competitiveness of the Vietnamese wood industry will largely depend on the vaccination strategies of supplying and purchasing markets. Meanwhile, Vietnam’s goal of exporting wood and forest products worth of $14 billion in 2021 remains in the distance.

VIR

Source: https://vietnamnet.vn/en/business/lack-of-raw-materials-threaten-wood-prices-726183.html

Thailand

Thailand