Vietnam: Central Bank expected to cut key rate to aid economy

The Hanoitimes – The inflation in 2020 is forecast at 3.3%, significantly lower than the target of 4% set by the government.

Current low inflation is opening up room for the State Bank of Vietnam (SBV), the country’s central bank, for further cutting its policy rates and aid the economic recovery process.

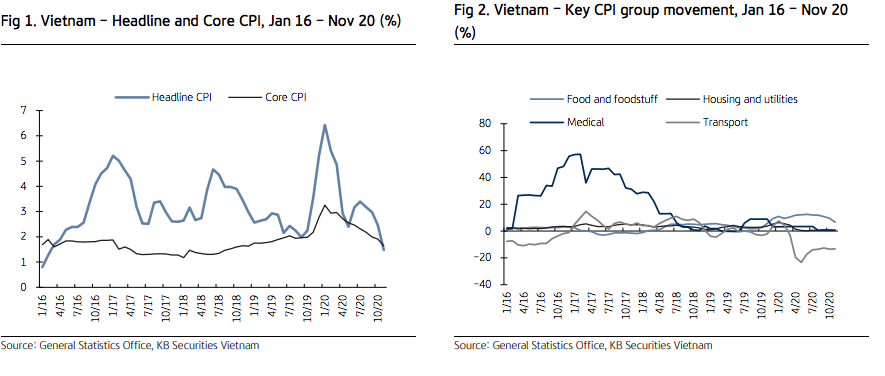

November consumer price index (CPI)’s reading posted at -0.01% month-on-month – the first drop since May this year, when all economic activities were temporarily suspended as a result of a nationwide social distancing order.

This has resulted in the inflation rate of 1.48% in November – the lowest since February 2016, and the average 11-month headline CPI was 3.5%, much lower than the annual target of 4% of the government.

KB Securities Company (KBSC) outlined major factors affecting CPI in November, including: average pork price decreased by 3.44% month-on-month, and helped prices of food group fall by 0.06%. Thus, prices of food and foodstuff group rose only 6.5% year-on-year – the lowest growth this year; gasoline price in November decreased by about 3% month-on-month and helped prices of transport group continue its downturn, -0.47% month-on-month and -13.27% year-on-year.

KSBC forecast December CPI to increase marginally by 0.5% month-on-month, due to average gasoline price in the global market is forecast to increase by about 8% month-on-month; and higher demand for household shopping and home repairs at the end of the year.

“We lower our average inflation forecast for 2020 to 3.3% from the previous 3.5% as pork prices are currently on a downturn thanks to the improvement in supply and fuel prices remain at lower level than the same period last year,” KBSC noted.

“Tamed inflation signals higher possibility that the SBV will conduct another policy rate cut in December, in an effort to boost economic growth,” it added.

According to KBSC, the recent rate cut by SBV in October has yielded positive outcomes such as a rebound in credit growth (only in the first half of November, credit increased by 1%, equivalent to nearly VND 90 trillion compared to the end of October); and recovery in November retail sales and industrial output.

Inflation rate estimated at 3.42% in 2020

In a survey conducted by the SBV recently, economists suggested the average inflation rate in 2020 is estimated at 3.42%, while the figures for the subsequent two years could remain modest rates of 3.55% and 3.69%, respectively.

Since the beginning of the year, the SBV has lowered its interest rate caps four times to support the economy amid Covid-19 impacts, with the latest made on September 30 by slashing 0.5 percentage points to the refinancing interest rate, discount interest rate, overnight lending rate, and interest rate via open market operations (OMO).

Accordingly, the refinancing interest rate is down from 4.5% per annum to 4%, rediscount rate from 3% to 2.5%, overnight interest rate from 5.5% to 5% and interest rate via OMO from 3% to 2.5%.

The SBV also lowered the interest rate cap to 4% annually from 4.25% for deposits with maturities of one month to less than six months.

Meanwhile, the SBV ordered banks to lower the maximum lending rate for short-term loans to 4.5% from 5%, with the aim of helping companies operating in the fields of agriculture, high-tech industries and exports, among others. Similarly, that rate at people’s credit funds and micro finance services is down from 6% to 5.5%.

Source: http://hanoitimes.vn/low-inflation-put-cbank-in-position-for-cut-policy-rates-further-315133.html

English

English