Travel tech’s story shows it’s good time for start-ups in Indonesia

Passpod, a Wi-Fi modem rental and online travel agent that took part in a state-sponsored start-up training program, was oversubscribed 10 times during its initial public offering (IPO). The three-year-old company is projected to serve 2 million Indonesians traveling overseas by 2021.

The company, which has served 58,000 customers to date and claims a 50 percent market share, is a good example of how investor confidence, active government support and digital economy euphoria can make major Indonesian cities, especially Jakarta, ideal places to launch tech-based start-ups.

“Passpod is now still only one-third of where we plan it to be,” said cofounder and president director Hiro Wardhana during an interview at the company’s new office in Kuningan, Jakarta.

The oblong office, which overlooks Kuningan from the 28th floor, has a typical start-up interior design with an open-space floor plan, wooden floor, a large communal work desk and bean bag lounge.

Seated upright on a bean bag, Hiro told The Jakarta Post that the company was founded after several chit-chats with friends and fellow travel enthusiasts Wewy Suwanto and Tiang “Ahwi” Chun Hui in 2015.

“We enjoyed traveling abroad but realized that we spent a lot of money on mobile connectivity, especially when we brought our wives and children along,” he said.

“We then talked to other friends, family and co-workers and they all felt the same way.”

Thus, the trio, veterans in the digital economy, pooled their own money to acquire 100 modems from a Singaporean company and rented them to a handful of trusted travel agents around Jakarta.

“There was a good response from customers and we got a profit margin of around 35 percent,” said Hiro.

Armed with the success of this small-scale test, the trio reached out to more contacts to bootstrap over Rp 5 billion (US$343,000) in seed money and with the help of a notary, legally established Passpod under the name PT Yelooo Integra Datanet in 2016 with Wewy as operational director and Ahwi as commissioner.

Investment analyst Eric Hendrickus told the Post that bootstrapping was common among Indonesian start-ups because the country lacked investors for seed-level start-ups, which usually only needed between $100,000 and $200,000.

Beyond seed-level funding, however, major cities are awash with investor organizations such as Angel Investment Network Indonesia (ANGIN), CyberAgent Ventures, Ideosource and Venturra Capital.

Eric’s advice to entrepreneurs seeking investors is to present a genuine problem-solving product with a clear competitive advantage and consumer base.

“But first, I look for passion. I look at whether or not the founders really believe in their business because there are people who open start-ups just to look cool,” he said.

Business boomed so much for Passpod that it ran out of modems to rent by November 2017, forcing the company to stop advertising.

“We realized then that we needed a lot more modems,” said Hiro.

Hence, the company’s leadership looked into larger fundraising options, including venture capital, private equity and going public.

It was while researching the latter option that they discovered the Indonesia Stock Exchange (IDX) Incubator program, which was launched early last year to help train local start-ups while also urging them to go public.

Indonesia has many start-up training programs, including Digitaraya, Plug and Play Indonesia and coding school Purwadhika, all of which contribute to an “ecosystem” that is fostering the creation of start-ups.

Other elements in the ecosystem include, among others, investors, co-working spaces, associations and entrepreneurs.

Passpod’s management joined the IDX’s Incubator program in February last year, learned about the technicalities of conducting an IPO and then graduated from the six-month course, which convinced them that going public would allow them to raise the necessary funds without losing control over the company or reveal sensitive financial details.

However, the company’s leadership knew that having more modems were insufficient to sustain business growth, especially with the presence of rivals such as Jet Fi Indonesia, Wi2Fly and Java Mifi — which is a year older than Passpod. Hence, the company needed to diversify its services

Dell Technologies’ infrastructure director, Adir Ginting, expressed similar cautiousness, saying that tech-based start-ups were among the fiercest businesses in terms of competition “so it makes sense that many of them have short business cycles”.

Thus, Passpod began selling attraction tickets on its app in March, taking advantage of its modems’ ability to track the location and group size of customers to deliver more personalized packages.

The company can now detect if a customer is, for example, in Tokyo with five individuals then offer exclusive family packages to Disneyland on the assumption he or she is on a family vacation.

“I was initially skeptical about selling attraction tickets because I assumed people bought them before departing but Wewy and Ahwi convinced the company otherwise. And they were right,” said Hiro with a chuckle.

He added that selling attraction tickets were so successful in multiplying the company’s monthly revenue that it planned to expand its online travel agent services next year by selling travel insurance and souvenirs.

A recent Google e-Conomy report supports Passpod’s diversification as it projects that Indonesia’s online travel market will triple from $8.6 billion this year to $25 billion by 2025, the largest in Southeast Asia.

Prior to going public, the Passpod founders did their own market research, stumbling upon a Mastercard travel outlook report, then calculated that the company could capture up to 2 million Indonesians traveling abroad by 2021 who need to stay connected whether using Instagram, WhatsApp, Google Maps or TripAdvisor.

Three months after graduating the IDX program, Passpod sold a 45.41 percent share to the public aiming to raise Rp 48 billion (US$3.3 million) but was instead valued 10.27 times over at Rp 492 billion.

The funds raised were close to the average $5 million investment secured by Indonesian start-ups in the first half of this year, according to the Google report.

“This [Indonesia] is the time and place for digital entrepreneurs,” said Google Southeast Asia head of strategy and insights Samuele Saini on the day of the report’s launch.

Google previously calculated that Southeast Asia would need to secure $50 billion in investments between 2015 and 2025 to build a solid digital economy but Samuele was particularly excited that day because the region managed to secure almost half (48 percent) of the investments in one-third of the time.

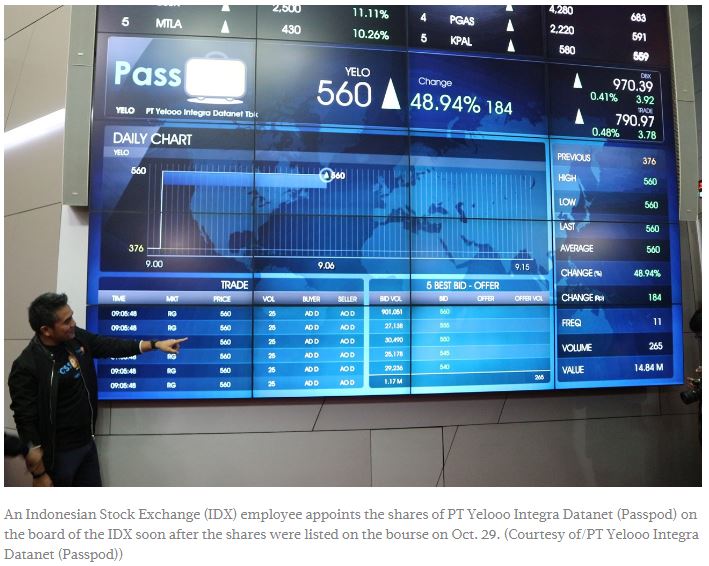

Having conducted the IPO, Passpod was officially listed on the IDX with the codename YELO on Oct. 29.

Today, the company has 34 employees and 9,000 modems with a plan to buy another 1,000 for next year.

“Business is good,” said Hiro. (nor)

Source: https://www.thejakartapost.com/news/2019/03/05/travel-techs-story-shows-its-good-time-for-start-ups-in-indonesia.html

Thailand

Thailand