Thailand:Taxing e-commerce

Does it make sense to impose a new tax on cross-border e-commerce transactions in Thailand to tackle profit shifting and tax avoidance by multinational firms?

The government, for obvious reasons, certainly thinks so. Industry experts, however, may need some convincing.

Thailand is making inroads into new tax rules with the government seeking what it terms a specialised tax on e-commerce operators with a presence either inside or outside of the country.

The move is intended to increase tax collection efficiency, particularly for fast-growing cross-border e-commerce transactions for which merchants are not required to pay valued-added tax to the Thai government. International e-commerce allows consumers to shop online, buying products from websites or markets in other countries such as Alibaba Group’s Tmall.co, which hosts multinational merchants.

The move is intended to increase tax collection efficiency, particularly for fast-growing cross-border e-commerce transactions for which merchants are not required to pay valued-added tax to the Thai government. International e-commerce allows consumers to shop online, buying products from websites or markets in other countries such as Alibaba Group’s Tmall.co, which hosts multinational merchants.

“Our development [to tax e-commerce] comes after many countries have attempted to demonstrate multinational anti-tax avoidance laws in digital services, like in Europe, Australia, India and Indonesia,” says a study from the National Reforming Steering Assembly.

“If the government can collect tax from foreign online service providers, we could earn between 2-3 billion baht in revenue annually,” says Paiboon Amonpinyokeat, an adviser to the National Reforming Steering Assembly committee, which is mulling over tax measures for foreign online service providers.

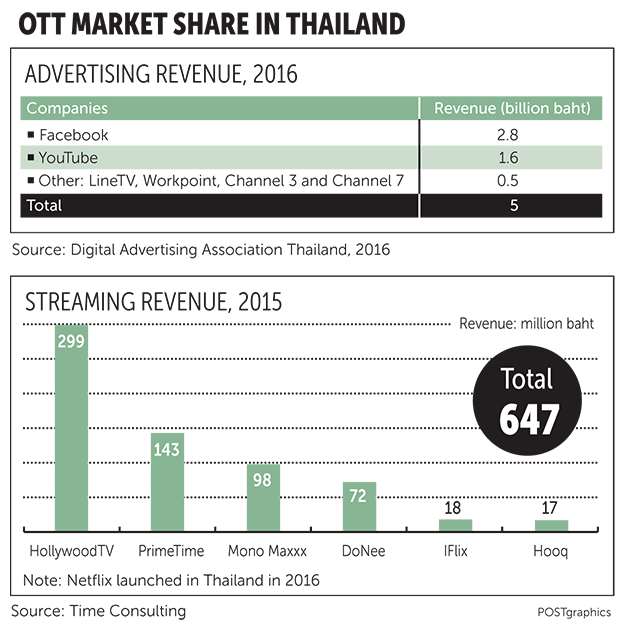

There were no clear figures but the industry estimates that tax revenue collected by the government from Thailand’s digital media spending stood at 15-20 billion baht in 2015 out of the 100 billion total for media spending.

No tax is collected from foreign online service providers, which Mr Paiboon says is unfair to local players who face higher costs on account of the levy.

Moreover, online advertising payments are also made via credit card without paying value-added tax (VAT).

In Europe, countries such as the UK and France impose taxes on foreign online service providers to cut down on tax avoidance and make a level playing field for local firms.

The report found that globally, almost all major online service providers like Google and Facebook have their headquarters in the US but have established subsidiaries in countries with lower taxes such as Luxembourg and Ireland to serve as source origins for products and services, including transfer payments for product sales or advertising.

Mr Paiboon says there are multiple measures to tackle tax avoidance on corporate income, VAT and customs duties.

Equalisation levies are one means of ensuring tax neutrality on commerce conducted through differing business models or firms residing inside or outside of the taxing jurisdiction, particularly for online businesses.

He suggests imposing an equalisation levy of between 6-8% on the e-commerce transactions of foreign e-commerce companies that are not registered as legal entities in Thailand.

Local e-commerce companies have to pay excise tax based on the value of their online sales transactions.

Mr Paiboon says the Revenue Department could impose an excise tax on online transactions worth over 50,000 baht in the first stage.

A source at the Electronic Transactions Development Agency (ETDA) who asked not to be named said the government should consider using tax incentives to attract online companies into the country’s tax system.

Poramate Minsiri, founder of Kapook.com, says the government’s efforts to introduce new taxes would benefit the country, bringing in additional tax revenue.

Dhiraphol Suwanprateep, head of the IT/Communications Practice Group and co-head of the Intellectual Property Practice Group at Baker & McKenzie, says there are many factors to consider before regulating e-commerce and over-the-top (OTT) service providers in Thailand.

First, only certain functions of OTT should be regulated and the methods of regulation should be clear and specific.

For example, Germany regulates only specific OTT services. Should the government wish to regulate the content of OTT service providers, it might want to consider which types of OTT services should be regulated or reclassify the types of licences for telecom and broadcasting services. But imposing taxes and regulatory requirements on all types of OTT service providers might not meet those objectives.

Second is jurisdiction. Should the government wish to collect taxes from offshore e-commerce service providers, the related criteria and process should be made clear. There are models from other countries that regulate offshore e-commerce and OTT service providers, such as Japan, Indonesia and Australia.

The last factor to be considered is competitiveness of small and new entry operators. The government’s Thailand 4.0 plan is aimed at promoting innovation by Thai startups.

“Heavy regulations and taxes on local e-commerce and other OTT startups could detrimentally affect their ability to compete on a global level, as they do not have the same capital or sources of funding as global tycoons,” Mr Dhiraphol says. OTT is borderless, so any moves to regulate it in Thailand could have international effects, he says.

Balancing local legal approaches to promote a level playing field is as important as having clear and concrete policies, so that local and international parties that are expected to follow them can do so smoothly.

Bunyati Kirdniyom, director for government relations at Vriens & Partners, a Netherlands-based business consulting firm, says there are ongoing discussions on the global stage on how to collect VAT. Should it be garnered by the original country of service or digital goods, the country that receives the service or goods, or should it be based on the nationality of the service operators or end-users?

The telecom regulator needs to bolster an environment of fair competition between traditional media/telecom operators and OTT players, he says.

Mr Bunyati is also calling for deregulation to cut costs for traditional media and telecom operators, rather than imposing a new regulatory regime on OTT, as it seeks to figure out ways to control internet-based services.

More importantly, the regulator should make benefits for the country its first priority, including how to encourage the development of the internet ecosystem, instead of focusing on accelerating its efforts to collect more taxes and flexing its muscles to control OTT.

He says OTT helps stimulate creative and innovative service markets in Thailand, like the digital book business, under which authors gain higher revenue from selling content online than in print form, as the former allows them to bypass the distribution system.

Source: http://www.bangkokpost.com/business/telecom/1245786/taxing-e-commerce

Thailand

Thailand