Thailand: Year-end bonuses a mixed bag

It’s that time of year again, when salarymen yearn for year-end bonuses as a reward for their tireless efforts to boost productivity and strengthen companies’ operating results.

Despite stronger corporate profits and improved economic momentum, employees should keep in mind that these factors do not always translate into higher bonuses, as cost-cutting measures and business uncertainties could keep a lid on them.

Many year-end bonuses are tied to performance metrics, and the amount can vary depending on whether certain milestones are met.

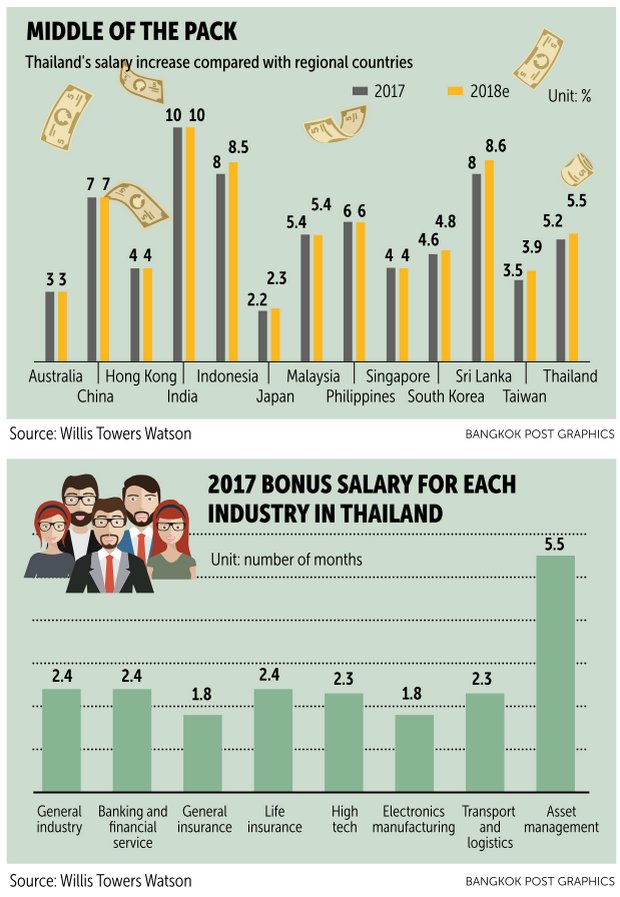

Willis Towers Watson, a global advisory, broking and solutions firm, forecasts salaries in Thailand to rise 5-6% annually in the short term, saying the country’s economy and inflation are stable but lacking in positive factors.

In 2018, the company’s survey projects overall salaries in Thailand to increase by 5.5%, slightly higher than the 5.2% uptick estimated for this year. Willis Towers Watson’s 2017 salary survey received over 4,000 responses in Asia-Pacific, including from 132 firms in Thailand.

Compared with other countries in the region, Thailand’s salary hike ranks in the middle of the pack.

Identical to Last Year

Salaries and bonuses in the insurance sector seem to be in line with last year’s, even though low interest rates are affecting business, said a source from Bangkok Life Assurance (BLA).

At BLA, the year-end bonus is comprised of two parts, including fixed-based bonus (which pays 3-4 times an employee’s monthly salary) and performance-based (which varies depending on an individual’s performance).

The source said an adjustment in bonus and salary has not been finalised yet, but it will be based on the industry’s average of 5-7% recorded last year.

“Most insurance companies are trying to maintain the industry average, but it depends on their own operating performance,” the source said. “For companies that pay lower than the industry average, their human resources will be headhunted.”

Next year will be a challenging one for the insurance business, as the financial market environment looks to have higher volatility, with interest rates forecast to rise.

More importantly, insurance companies are required to comply with new accounting standards, whereby they may be obligated to set aside additional provisions because of the changes.

It is expected that salaries in the securities business will increase by 5-6% next year, while bonus payments are anticipated to be similar to last year’s, said Pattera Dilokrungthirapop, chairwoman of the Association of Securities Companies.

Bonus payments seen among securities companies averaged 4-6 months salary in 2016.

Mrs Pattera said daily stock trading value in 2017 is about 50 billion baht — a slight decrease from 51 billion last year, due to how active stock trading had prevailed over the previous three months — but is set to taper off in December.

The average securities trading fee this year is also lower than last year’s because of higher competition in the industry, lowering securities businesses’ net profit generated from equity trading fees, she said. Profits from non-equity trading fees like derivative warrants, block trades and investment banking fee income have increased.

The credit rating business is a part of the financial market where there is a difference in bonus and salary rate relative to other market participants, such as insurance and banks.

A source said this will be another year that Tris Rating, Thailand’s first credit rating agency, registers better-than-expected revenue, as the low interest rate has encouraged companies to issue bonds to raise funds.

The amount of long-term corporate bond issuance had exceeded 500 billion baht over the past two years, breaking the 400-billion-baht threshold in the first half of this year.

The source said the minimum bonus payment over the past five years had exceeded six months, but the rate cannot be disclosed.

“Our salary is higher than banks’ and we pay more bonuses than them,” the source said.

Sticking to the Usual Formula

Not all banks or insurance companies know how much their employees will get in bonuses for 2017, as their full-year earnings and individual performance will determine such extra payments.

At present, Bangkok Bank (BBL) and Siam Commercial Bank are still sticking to the same bonus formula, paying a fixed one-month sum twice a year, with one paid at the end of December and the other after the fourth-quarter financial results are released.

There is also a special incentive determined by overall performance and individual performance.

BBL staff typically receive a fixed bonus in June and December, while a special incentive is paid in January. For the bank’s executives, they get the fixed bonus once a year in December and a special incentive in January, said a source at the bank.

The country’s largest lender by assets offered a 1½-month salary bonus to all employees for 2016, while SCB’s special incentive payment averaged 2½ months.

On the other hand, Krungthai Bank’s bonus payment is varied, as it depends largely on individual performance.

Similarly, the state-owned Government Savings Bank said that its bonus payment varies based on the bank’s overall and individual performance, according to a source who declined to be named.

The bank, which normally pays bonuses in March, has made bonus payments of 5-6 months’ salary over the past two years.

For large insurers, they normally pay bonuses in a range of 2.5-4 months’ salary on average, depending on overall and individual performance.

The country’s largest non-life insurer, Viriyah Insurance, for instance, averages bonus payment of 2.5-3 months’ salary every December.

Thai Life Insurance rewards staff bonuses of 3-4 months’ salary per year, paid biannually in July and December.

This year has been a fruitful one for energy firms as oil prices, which remain at a relatively low level, have pushed up demand for petroleum and boosted sales.

As a result, oil firms are set to grant bonuses to their employees of 4-6 months’ salary this year.

Industry officials said that while there have been no specific oil stock gains or losses this year, a rise in the oil retail segment at home and greater profit margins in the petrochemical and petroleum byproduct segments have allowed energy firms and energy-related companies to give out good bonuses to their employees.

Moreover, some major oil companies have generated greater profits from special cost-cutting measures, while other energy firms have made profits from mergers and acquisitions.

PTT Plc, the national oil and gas conglomerate, recently announced that it had approved a six-month salary bonus — on a par with last year — to its employees.

Sriwan Eamrungroj, senior executive vice-president for corporate strategy, said PTT and its subsidiaries have received a net profit this year of more than 100 billion baht. Half of that sum derives from its business operations, while the rest comes from uncontrollable factors such as global prices for oil, coal and liquefied natural gas, which have buoyed the conglomerate in 2017.

As global oil prices have not fluctuated much this year, midstream and downstream businesses have enjoyed a higher gross refining margin, particularly in the oil refinery segment.

Moreover, greater demand at fuel retailers and in the petrochemical segment has lent the company support.

Meanwhile, the automotive sector has registered a robust performance, giving employees as much as a seven-month salary bonus.

Toyota Motor Thailand will pay a seven-month salary bonus, with an additional 20,000-baht sweetener, for 2017.

A source said the bonus is based on manufacturing plant and domestic sales performance in Thailand, though it is normally calculated from the company’s performance in the previous year.

But Toyota’s total sales dipped 7.9% to 245,087 units and its exports fell 15% to 318,658 units in 2016.

“Normally, the annual bonus is agreed upon between the company and labour union and divided into biannual payments,” the source said.

At present, Toyota employs 16,477 people with a production capacity of 760,000 units a year at three plants in Samut Prakan and Chachoengsao.

Sunset Industry

Despite euphoric bonuses offered to those employed in the financial and industrial sectors, bonus payments among print media remain in the doldrums because operating results have not been well in this so-called sunset industry.

Some print media companies are set to offer at least a two- or three-month salary bonus to employees, while others seek to offer limited financial assistance in terms of providing a one-time payment based on a one- or two-week salary, according to a survey done by Krobkruakao of Channel 3.

In retrospect, Thai Rath newspaper offered a three-month salary bonus to employees in 2015, while the Daily News gave the same, though the payment was not made as a lump sum, but instead paid out over a six-month time frame.

On the other hand, some digital TV operators in the media industry are likely to get bonuses because business performance is getting better.

Sources from Mono 29, RS’s Channel 8 and Workpoint TV said there is a high possibility that bonuses will be given for a one- or 1½-month salary, thanks to higher profits and revenue this year, with employees’ salary at each company poised to rise.

GMM Grammy’s One 31 and GMM 25 digital TV channels opted not to discuss bonus payments, citing confidentiality.

Source: https://www.bangkokpost.com/business/news/1371871/year-end-bonuses-a-mixed-bag

Thailand

Thailand