Thailand: Wage hike to give SMEs tax windfall

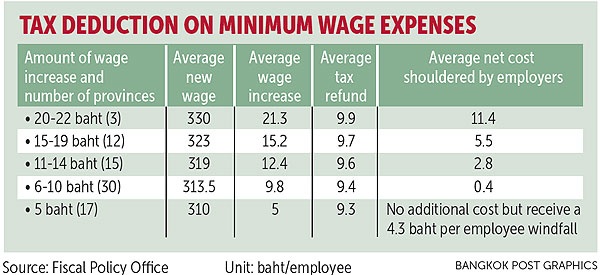

Small and medium-sized enterprises (SMEs) with annual sales of up to 100 million baht in 17 provinces where the daily minimum wage will be raised by an average of five baht will enjoy a double windfall from the government’s measure that lets them deduct expenses for minimum wages.

The tax deduction is 1.15 times expenses, offering SMEs in provinces with the five-baht wage increase not only a refund on the uptick, but also an additional 4.3 baht per employee per day, said Finance Ministry spokeswoman Kulaya Tantitemit.

These 17 provinces where the average daily minimum wage is increased to 310 baht per employee include Tak, Chaiyaphum, Ratchaburi, Satun, Sukhothai, Maha Sarakham and Sri Sa Ket.

The cabinet on Tuesday approved the daily minimum wage hike in a range of 5-22 baht nationwide from April 1. It also endorsed relief measures, one of which is the tax deduction of 1.15 times for the minimum wage raise, to alleviate the impact.

The tax incentive will last from April 1 to the end of this year.

Ms Kulaya said that about 400,000 business owners will benefit from the tax incentive and employers’ costs will increase by a mere 1.2%.

The Revenue Department will lose 5.4 billion baht from the tax relief measure.

The 1.15-times tax deduction will help absorb employment costs of SMEs with sales of up to 100 million a year by 9.3-9.9 baht per employee.

Employers operating businesses in 30 provinces where the minimum wage is increased in a range of 6-10 baht will shoulder a net additional cost of a meagre 0.4 baht per employee, while they can claim 9.4 baht per employee for the tax deduction. These provinces include Trang, Sa Kaeo, Udon Thani, Narathiwat, Kanchanaburi, Loei, Ranong and Surin.

Those living in Chon Buri, Phuket and Rayong will be subject to a net additional cost of 11.4 baht per employee per day, while the government will shoulder costs of 9.9 baht per employee per day if the tax deduction is taken into account.

Ms Kulaya said the cabinet also approved a deduction for individuals who invest up to 100,000 baht in startups engaged in the country’s 10 target industries. The investment must be made from Jan 1, 2018 to Dec 31, 2019.

To benefit from the tax break, individuals must invest for at least two straight years in these startups registered between Oct 1, 2015 and Dec 31, 2019. The startups must have registered capital of up to 5 million baht; at least 80% of annual income must be generated from the 10 target industries; and they must have an annual income of no more than 30 million.

The 10 industries are next-generation cars; smart electronics; affluent, medical and wellness tourism; agriculture and biotechnology; food; robotics for industry; logistics and aviation; biofuels and biochemicals; digital; and medical services.

Ms Kulaya said the tax measure is aimed at encouraging startup investment.

Source: https://www.bangkokpost.com/business/finance/1405422/wage-hike-to-give-smes-tax-windfall

Thailand

Thailand