Thailand: Understanding mortgage growth in Thailand: a regional perspective

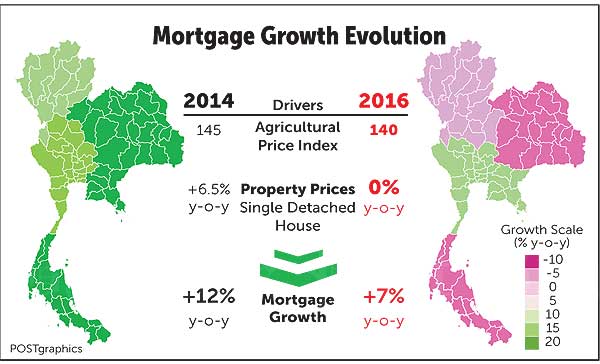

The mortgage market in Thailand was nothing short of spectacular from 2010 to 2014, with annual growth exceeding 12% for five consecutive years, reflecting rising demand in urbanised areas and government incentives for first-home buyers. However, growth slowed to 9% in 2015 and 7% last year, despite government stimulus through reductions in registration and transfer fees until April 2016. What has caused this slowdown? Mortgage growth is driven by two components: the number of borrowers and the prices of property. As of the third quarter of 2016, the number of mortgage borrowers was 1.34 million, representing just 3% average annual growth, down significantly from 12% in 2014.

Borrowers’ ability to service debt, represented by the debt-to-income (DTI) ratio, is also a key here, as it’s the criterion most commonly used by banks. A higher DTI means a borrower has less capacity to take on another mortgage. Typically, banks believe the ratio should not exceed 40-50%.

Another representation of borrowers’ indebtedness is national household debt, which peaked at 80% of GDP in 2014. According to the National Statistical Office, DTI ratios peaked around the same time. This meant that households’ debt-servicing ability in subsequent years would decline, leading to reduced loan growth, especially in areas outside Bangkok.

Demand for mortgages in the provinces typically reflects the health of the agricultural sector, as many households rely on healthy production and prices for agricultural products. About 40% of all household income in the provinces is generated from the agricultural sector.

TMB Analytics’ study suggests that agricultural prices trigger regional mortgage growth one quarter ahead. In 2013 and 2014, agricultural product prices were relatively high, with rice fetching between 7,800 and 10,000 baht per tonne because of the former government’s pledging scheme. Prices of rubber were also healthy at 55 baht per kilogramme. Key beneficiaries were households in the eastern and the southern regions of the country.

However, in 2015 and 2016, rice and rubber prices plunged, eroding incomes and curbing mortgage demand. In Surat Thani, one of the top rubber cultivation areas, mortgage demand dropped from 12% in 2014 to zero in 2016. Fortunately, farm prices are forecast to revive this year, consistent with the upward trend in commodity prices — more costly oil reduces demand for petroleum-based synthetic rubber, for example — and the increasing demand for China. This will push purchasing power up, improve DTI ratios, and banks can again approve more borrowers.

The other component affecting loan growth is the average loan amount per borrower. This depends on two factors: loan-to-value ratio, or the loan amount relative to the value of the property, and the actual property value partially reflected in the price.

This price effect plays a major role in mortgage growth. Last year the average loan amount grew only 2%, compared with 11% in previous years, as property price growth slowed. In particular, prices of single detached houses, which accounted for the majority of loans in the provinces, were flat even though the average LTV figure grew by 7% from a year earlier.

Urbanisation lifts property prices as well. For example, in 2014, prices grew by 7% because of expectations of megaproject construction and special economic zones (SEZ). Mortgage demand grew as well, especially in hub cities. For instance, mortgage lending in Sa Kaeo and Mukdahan grew by more than 20% in 2014, but in 2016 the rate dropped to 6% as SEZ development remained stalled.

To gauge where price growth is most likely to occur, look for the most attractive areas. Areas where new mass transit and motorways are planned will attract significant attention. Also, the Eastern Economic Corridor (EEC) will be a growth driver for Rayong, Chon Buri and Chachoengsao.

Keep in mind also that housing stock has been reduced now that earlier government stimulus packages have expired. Therefore, prices should rise, but contingent on how quickly infrastructure projects and the EEC can take off. For this year, achieving double-digit mortgage growth could be very challenging.

However, there is light at the end of the tunnel. A recovery of purchasing power owing to improved farm prices should put demand for housing and home loans back on track.

Source: http://www.bangkokpost.com/business/news/1191833/understanding-mortgage-growth-in-thailand-a-regional-perspective

Thailand

Thailand