Thailand: Survey shows digital opportunity for banks

Use of online and mobile banking is on the rise, giving banks an opportunity to use customer data and digital transformation to enhance the customer experience, says Marketbuzzz, an online survey unit of Buzzebees, a mobile commerce platform.

Marketbuzzz partnered with Potentiate, a data technology company, to monitor the banking industry, evaluating the customer experience at big banks in Thailand. They have produced a comprehensive benchmark study that compares all the major retail banks and looks at touchpoints at which the customer interacts with the banks.

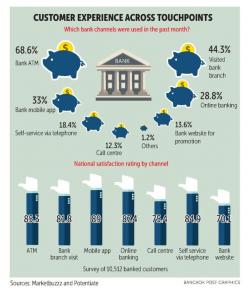

The survey polls more than 10,000 banked customers per quarter, and found 68.6% of them used ATMs in the past month and 44.3% have gone to branches in that period.

The use of mobile banking and online banking is on the rise.

Some 33% of customers used mobile apps for their banking needs and 28.8% used online banking. These channels also show the highest industry satisfaction expectations, with customer satisfaction ratings of 89 out of 100 for the mobile app and 87.4 out of 100 for online banking.

Grant Bertoli, chief executive of Marketbuzzz, said there is widespread recognition that to remain relevant, banks must also transform. This is reflected in the Banking Benchmark Monitor, which found that the solution for banks lies in the ability to offer a consistent experience across all interactions with the bank and its innovative branch formats and technology investments, which customers believe will help do this and build closer relationships between them and their banks by facilitating new in-branch customer journeys.

The banks have a perfect opportunity to use the data they hold and the digital transformation to boost the customer experience. This requires having an open mind about new technology investments, which regularly prove essential to unlocking new levels of customer engagement.

“Failure to respond to customer demands and changes in habits could potentially mean losing out to competitors who choose to put customer needs at the heart of their plans and their strategy,” Mr Bertoli said. “Technology has an important role to play here, and it’s clear that banked customers are increasingly comfortable and confident with it. We look forward to seeing more banks continue to innovate, and embrace new forms of technology, to truly put their customers first.”

He said the Banking Benchmark Monitor in Thailand is intended to better understand the customer experience at banks and financial institutions and provide a benchmark for future strategies.

No other benchmark study exists in Thailand whereby the industry can gain insight into the level of customer satisfaction and compare scores against other banks in the country.

Just as important for the banks is understanding the customer experience at all major touchpoints, be it the branch, ATM, call centre, online banking or mobile app, Mr Bertoli said.

Source: https://www.bangkokpost.com/business/finance/1364787/survey-shows-digital-opportunity-for-banks

Thailand

Thailand