Thailand: Spending headed to 20-year low

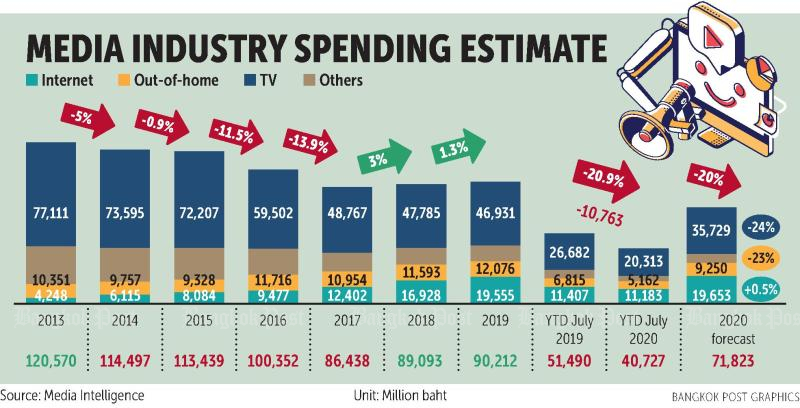

Media spending plummeted 20.9% in the first seven months this year because of the pandemic and is expected to fall to a two-decade low of almost 72 billion baht this year, according to Media Intelligence (MI), a media planning and creative agency.

The spending plunged to 40.7 billion baht between January and July, compared with 51.5 billion in the same period last year.

The research firm said there are positive signs for September after spending bottomed out in the second quarter.

A second wave of the coronavirus and political uncertainty remain threats that could affect the spending next year.

“We expect the lowest level of media spending in Thailand happened in the second quarter and could rebound by September,” said Pawat Ruangdejworachai, media director for MI.

In 2020, media spending is forecast to fall 20% to 71.8 billion baht, with the biggest contraction of 24% to 35.7 billion baht seen in TV, followed by out-of-home media with a fall of 23% to 9.3 billion baht.

The contraction in spending this year is expected to be the biggest in the 20 years since the Asian financial crisis.

The only media platform that could see growth is online, possibly gaining 0.5% to 19.7 billion baht, Mr Pawat said.

Earlier this year the online channel was projected to grow by 13%.

He said the signal for a rebound is in performance media, a channel that can bring out sales leads and conversion to brands.

Brands are likely to pay less attention to engagement during this time, said Mr Pawat.

The digital channel is thriving through performance media, such as via Google search advertising, the e-marketplace CPAS, Facebook and Instagram.

He said a second wave of the pandemic, political concerns and the recession are three important factors that could affect ad spending in 2021.

“If nothing happens overall media spending could still be flat,” said Mr Pawat.

Although short video app TikTok is gaining engagement via influencers, this channel is not being used to create brand awareness and the young audience does not appear to focus on making purchases when looking at content, he said.

In Thailand Tiktok has 12 million active users, up from 8 million last year, partly driven by the pandemic.

In 2019 Twitter had 11 million users, with explosive growth coming from political engagement from younger users, said Mr Pawat.

Brands are less interested in this channel and they need to engage more as Twitter is gathering steam, he said.

Mr Pawat attributed the dip in media spending to the pandemic, especially for traditional media such as TV and newspapers. The opposite is true for digital media.

Digital disruption continues to be a threat for traditional media, even in the post-pandemic period, he said.

According to MI, the proportion of TV ad spending is expected to decline to around 50% of the industry in 2020, versus 52% last year. The ratio is expected to fall further to 45% in 2021.

The ratio of ad spending on the internet channel is expected to reach 27.4% this year and 30% in 2021.

“Digital can surpass TV within 2-3 years,” said Mr Pawat.

In terms of media consumption behaviour for July, TV consumption is projected to grow 10% and online to rise 25%. Out-of-home media, print, radio and cinema are expected to see drops in consumption of 15%, 50%, 10% and 60%, respectively.

During the lockdown from March to May, online channels saw growth of 40% in consumption, while out-of-home, print, radio and cinema saw contractions of 50%, 50%, 15% and 100%, respectively.

Source: https://www.bangkokpost.com/business/1971275/spending-headed-to-20-year-low

Thailand

Thailand