Thailand: Some Retail Chains Fight for Survival

First, the store doors shut. Now, the walls are closing in.

Retailers have furloughed hundreds of thousands of workers, cut executive pay and stopped paying rent, all to conserve cash. For the most indebted retailers, particularly those already struggling before the crisis began, those measures may not be enough.

Neiman Marcus Group Inc. and J.C. Penney Co., both of which have looming debt payments, have been reaching out to creditors in the hopes of buying more time, according to people familiar with the situation. Representatives for Neiman Marcus and Penney declined to comment.

“A lot of debt will have to be refinanced across these companies,” said Oliver Chen, an analyst with Cowen Inc., speaking about retailers in general. “They are all working to renegotiate loan terms.”

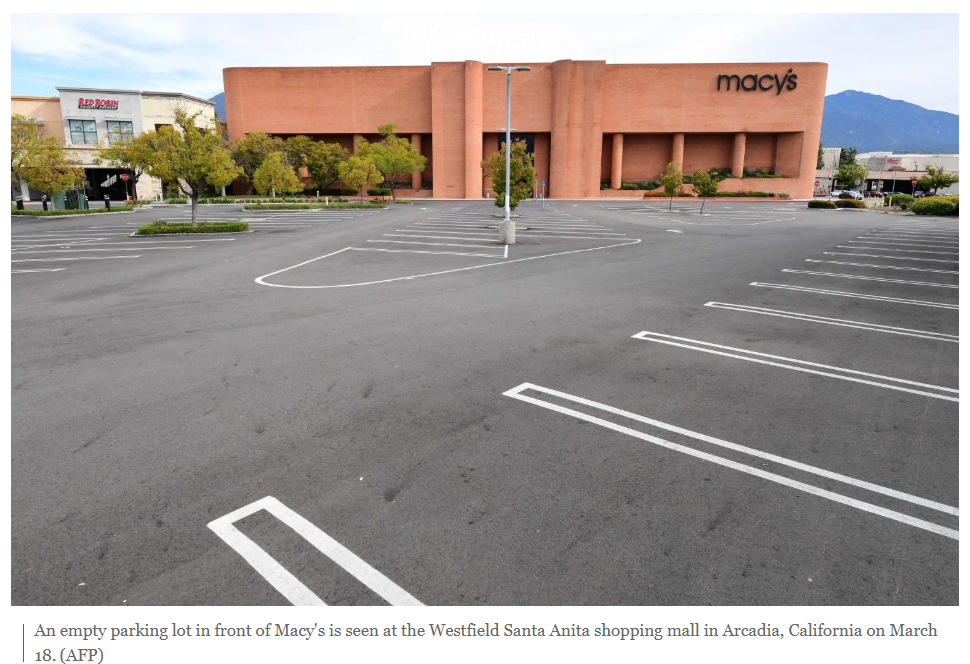

The retail industry was going through a shakeout before the coronavirus pandemic hit. As shoppers migrated away from malls and bought more online, specialty-apparel retailers and department stores were among the hardest hit. A record number of chains have filed for bankruptcy protection in recent years, and others have closed hundreds of stores. As the virus keeps American businesses temporarily closed, the weak will only get weaker, analysts said.

“Companies we weren’t that concerned about a month ago, we are now concerned about,” said Mickey Chadha, a senior analyst with Moody’s Investors Service. Mr. Chadha estimated that operating income for department stores, which have been losing market share to fast-fashion retailers and discounters, will fall 20% this year. He predicted operating profit for the retail sector overall will fall by 2% to 5%, a drop not seen since the 2008 financial crisis.

Moody’s and Fitch Ratings Inc. recently downgraded the debt of major retailers, including Macy’s Inc. and Gap Inc., to junk status, which could make it more difficult for them to refinance loans or tap into a government rescue package.

The Federal Reserve and Treasury Department are in the process of writing the rules that will govern how $2 trillion in federal aid will be dispensed. Unlike for airlines or national defense, the stimulus package didn’t include any specific help for the retail industry.

The National Retail Federation has been lobbying the government to ensure that companies with credit ratings that fall below investment grade have access to loans. “We want them to design these programs to be broad enough to tackle the significant problems of distressed industries such as retailing, which employs a large chunk of the population,” said David French, the trade group’s senior vice president of government relations.

Mr. French said he is concerned that as retailers stop paying rent to landlords, a crisis could be triggered in the mortgage-backed securities market similar to what happened during the 2008 financial crisis. “If the government doesn’t help retailers stay liquid, the system runs the risk of seizing up,” he said.

Retailers have been tapping their credit lines at a furious pace. Of the roughly $185 billion in revolving credit facilities drawn in March, 15% were by retailers. The only industry that drew down more credit was automobiles, according to a report by Goldman Sachs Group.

Companies with debt payments coming due this year are the most vulnerable. They include Neiman Marcus, with $120 million due next week; J.Crew Group Inc., which has a $4 million payment due at the end of the month; and, J.C. Penney, with $147 million due in June, according to Fitch and company filings.

J.Crew had planned to raise money by spinning off its Madewell division into a separate publicly traded company, but the deal has been shelved for now, according to people familiar with the situation. Like Neiman Marcus, J.Crew is burdened with about $1.7 billion in long term debt from a leveraged buyout.

J.Crew, which has suffered from fashion missteps and quality issues, in January hired former Victoria’s Secret executive Jan Singer as its new chief executive. Neiman Marcus, which had been struggling with sluggish sales and losses, reached an agreement with lenders last year to push a substantial portion of maturities on its roughly $4.7 billion in debt to 2023 and beyond.

Retailers are cutting every cost they can, including delaying payments to suppliers and canceling orders. “In this environment in which 90% of our stores are closed to the public, we are forced to make difficult decisions,” wrote an executive of Harmon Stores Inc., a health and beauty-products chain that is owned by Bed Bath & Beyond Inc., in a letter viewed by The Wall Street Journal. The letter notified suppliers that payments would be delayed by an additional 60 days.

“Retailers have cut variable costs, but there are a lot of fixed costs that they can’t reduce,” said James Gellert, CEO of RapidRatings, which analyzes the financial health of companies.

RapidRatings recently conducted a stress test in which it assumed revenue fell by 15% for the nearly 40,000 companies it monitors. Retailers experienced some of the biggest drops in financial health ratings, which attempt to predict default risk over the next 12 months. Companies with a rating below 40 have a higher risk of default.

Nordstrom’s rating fell to 34 from 78 precrisis. Macy’s dropped to 34 from 65, and Gap declined to 45 from 72. Ratings are on a scale of zero to 100; the analysis took into account cost reductions at various chains.

A Macy’s spokeswoman said the company is taking the necessary steps to manage through the crisis, including by suspending its dividend and drawing down its credit line. Gap and Nordstrom declined to comment.

“Retail bankruptcies are coming, but not necessarily immediately,” said Deborah Newman, a lawyer in the bankruptcy and restructuring practice of Quinn Emanuel Urquhart & Sullivan LLP. She said there are public-relations and economic ramifications when companies are forced into bankruptcy during the pandemic. “Now is not a good time to find buyers for assets,” she added. “It’s also hard to get a true sense of a company’s value.”

Also, with stores shut, companies that do seek bankruptcy protection can’t hold the liquidation sales often used to repay creditors. Pier 1 Imports Inc., which filed for bankruptcy in February, canceled an auction to sell itself in March and instead secured a judge’s blessing to temporarily stop paying rents.

Chains that survive will have to grapple with consumer demand that may not snap back quickly. Consumer spending had buoyed chains before the crisis, but now many shoppers are facing reduced income and they may be skittish about rushing back to public spaces.

Craig Johnson, the president of consulting firm Customer Growth Partners, said it took six weeks after the Sept. 11 terrorist attacks for retail sales to start growing. In countries where the spread of the coronavirus has slowed, such as China and South Korea, business is coming back gradually.

PVH Corp., which owns Calvin Klein and Tommy Hilfiger, has reopened all its stores in China. Yet, sales for March fell 35% compared with a year ago. On an April 2 conference call, PVH CEO Manny Chirico told investors, “We know it clearly will take some time to return to normalcy.”

Source: https://www.bangkokpost.com/business/1896900/some-retail-chains-fight-for-survival

Thailand

Thailand