Thailand: SET sell-off on US-China trade concerns

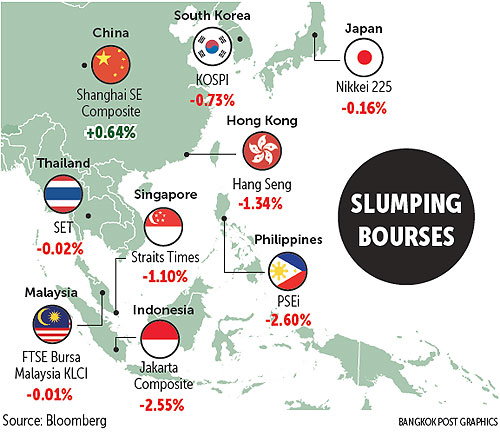

Thailand’s bourse was among several regional stock markets experiencing a sell-off Thursday on concerns over the US-China trade dispute and the US Federal Reserve’s signal that it would raise interest rates further.

The Stock Exchange of Thailand (SET) index closed at 1,790.80 points, down 0.02%, in trade worth 58.7 billion baht.

Foreign investors were net sellers of 3 billion baht, with retail investors selling 607 million worth of shares. Institutional investors were net buyers of 2.9 billion baht and brokerage firms bought 745 million.

The market was led by a sell-off in stocks associated with banking, petrochemicals and telecommunications, such as KBANK (-2.3%), PTTGC (-0.77%), IVL (-0.4%), ADVANC (-0.96%), and TRUE (-0.64%).

All Asean stock markets slipped on Thursday as the US-China trade tension hurt investor risk appetite, with Indonesia’s main index sinking to a seven-month closing low of 5,858.73 points as foreign investors continued to trim their equity exposure.

A US trade delegation has arrived in China for talks on tariffs.

The discussions are expected to cover a wide range of US complaints about China’s trade practices, from accusations of forced technology transfers to state subsidies for technology development.

The policy-setting Federal Open Market Committee also remarked that the US economy “will evolve in a manner that will warrant further gradual increases in the federal funds rate”. The Fed’s inflation target is set at 2%.

Poranee Thongyen, executive vice-president of Asia Plus Securities (ASP), said the Fed is projected to raise interest rates two more times this year, depending on inflation results, with high oil prices and reasonable US economic growth in the first quarter forming the basis for further rate hikes.

Such rate hikes would make the greenback appreciate and the baht fall, a boon for Thai exports in the second quarter, Mrs Poranee said.

On the domestic front, Thailand’s general election could be delayed to next year’s second quarter after the Constitutional Court reviews two organic laws on May 23, she said.

If they are deemed constitutional, they will be submitted for royal endorsement. But if the laws are deemed unconstitutional, they will be amended, which will take time to complete.

“Investors have to keep an eye on all these long processes. Domestic political issues will continue to put pressure on the SET index,” Mrs Poranee said.

Foreigners remained net sellers in Asian stock markets earlier this week, including in Taiwan, South Korea, Indonesia, the Philippines and Thailand, ASP said.

For the bond market, foreigners were also net sellers of Thai bonds, tallying a seven-day combined value of 15.4 billion baht as of May 3, said the brokerage house. As a result, Thailand’s 10-year bond yield rose to an 11-month high of 2.64%, while the US bond yield stayed at 2.96%.

Phillip Securities Thailand said markets don’t expect a change in interest rates from the Fed, but investors will be on the lookout for signs of its view on the health of the US economy. This could offer hints about rate hike trajectory for the rest of 2018.

Source: https://www.bangkokpost.com/business/finance/1457689/set-sell-off-on-us-china-trade-concerns

Thailand

Thailand