Thailand: Private sector girds for third wave

Business sectors are preparing to face a more critical impact than last year’s nationwide lockdown after a fresh wave of the contagion with more than 2,000 daily cases triggering stricter measures to contain the outbreak in Bangkok and other cities.

Even though there is no order to close hotels in Bangkok, hospitality has been paralysed as there have been no guests since the outbreak emerged last year, said Marisa Sukosol Nunbhakdi, president of the Thai Hotels Association (THA).

The third outbreak has worsened the business situation since there are limitations on opening hours and alcohol sales in restaurants and meetings and conventions, so hoteliers don’t expect any earnings over the next two weeks.

Of 985 registered hotels in Bangkok, only 5-10% could remain open with revenue coming from restaurants and meetings.

She said the co-payment scheme for monthly salary, using the budget of the Social Security Fund (SSF), is necessary.

The government has to come up with personal debt relief efforts as everyone has to be responsible for their loans on houses, cars or education in the tough economic situation.

Moreover, hoteliers also would like electricity bills to be lowered by 15-20% and adjusted to installments to reduce operation costs.

Loy Joon How, general manager of Impact Exhibition Management, who operates conventions and exhibition venues in Muang Thong Thani, Nonthaburi, said the third outbreak is a huge wave that wiped out any growth momentum that the Mice (meetings, incentives, conventions and exhibitions) industry just gained after the second wave subsided.

The governor of Nonthaburi province recently imposed a curfew from 9pm to 4am, along with announcements to close many businesses and not allow the organization of any activity with over 10 attendees from April 24 until further notice.

Based on the previous outbreaks, recovery would take 2-3 months, while effective and speedy vaccine rollouts to achieve herd immunity remain the key.

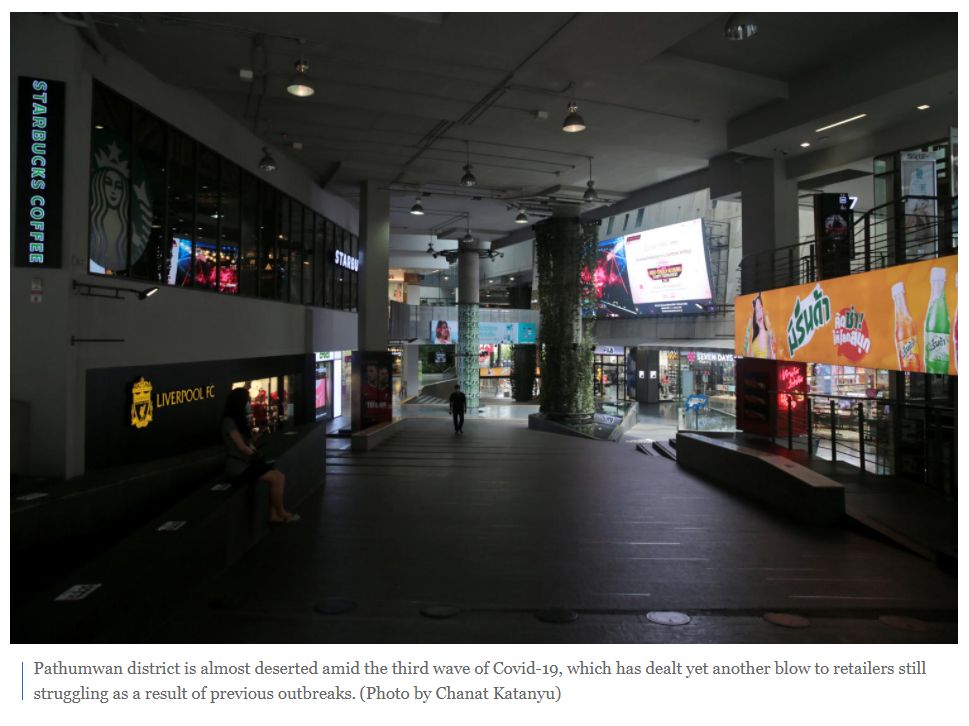

LOCKDOWN-LIKE MOOD

Key business groups welcome the state’s attempts to avoid imposing broad lockdown measures as the current mood is enough to batter the economy.

“Though the government has not enforced a complete lockdown across the country, people don’t dare leave their homes for fear of the outbreak,” said Sanan Angubolkul, the new chairman of the Thai Chamber of Commerce.

But as long as the government does not order a countrywide lockdown, the manufacturing sector, which is important to exports, can continue to support the economy, he said.

Thai exports, which depend on global economic recovery, show bright prospects this year and should grow further without hindrances.

Supant Mongkolsuthree, chairman of the Federation of Thai Industries, said the ongoing strict measures should help the government control the outbreak without resorting to a drastic approach.

Since the third outbreak, people have restricted their travel and become more careful about their spending. The economy has already bore the brunt as a result, he said.

NO TIME FOR JOY

Noppagarn Luengamornlert, deputy managing director of Siam Park Bangkok, the operator of Siam Amazing Park amusement and theme park, said the lockdown directly impacted its business as April and May are the peak season for amusement and theme parks.

She said amusement and theme parks have faced a more serious impact than other businesses because it’s not among the four requisites. This activity will be cut immediately when the economic is slow.

Between the second wave and the fresh wave, about 200 customers visited the amusement per day, down from 3,000 prior to the outbreak. During weekends, the number declined to 1,500 visitors, down from 10,000.

Somchai Pornrattanacharoen, president of the Wholesale and Retail Trade Association, said that with the new restrictions, fewer people will go to retail stores, while the spending power of some groups will decline, resulting from income shortage.

“Expenditure on shopping is not as good as the first lockdown last year as people refrain from panic buying,” said Mr Somchai.

Wutthiphon Taworntawat, managing director of commercial property developer UHG, said the disease control measures had an impact on the company’s businesses including hotels, retail units and offices for rent.

For office and shop tenants, UHG have to give discounts on rent by evaluating case by case if tenants have less income. If they are ordered to have a temporary closedown, the company will waive rents.

KBANK ON ALERT

Kasikornbank (KBank)’s co-president Krit Jitjang said the bank continues to keep existing stringent plans in containing the outbreak particularly for branch services, while face mask and social distancing measures are strictly pursued at branches across the country.

“We’ve done everything as much as we can to protect staff from the virus infection. More importantly, the bank has been closely monitoring the situation and it’s ready to comply with regulations and collaborate both with regulatory bodies and the Thai Bankers Association in case stricter measures needed,” he said.

In addition, the bank has also supported customers to do banking transactions through online channels rather than going to branches. KBank may consider temporarily closing some branches, he said.

GAINS AND LOSSES

In regards to stocks, there will be some winners such as hospitals, vitamin manufacturers and rubber glove manufacturers in the short term, while tourism, entertainment and hospitality-related stocks will continue to suffer, said Mongkol Puangpetra, executive vice-president for strategy research at KTBST.

Businesses taking major hits from the new wave include cinema firms like Major Cineplex Group Plc (MAJOR) that has 36 theatres in Bangkok that were forced to close by the government with Bangkok usually accounting for 41-44% of revenue.

The closing of massage parlours will likely affect stocks like Siam Wellness Group Plc (SPA) that has 38 of its 70 branches in Bangkok. If the government extends the shutdown of the Bangkok massage parlours for one month, it could affect SPA’s revenue by about 18%, he said.

Restrictions on restaurant occupancy could affect larger dine-in chains like After You Plc (AU), ZEN Corporation Group Plc (ZEN), MK Restaurant Group Plc (M), Oishi Group Plc (OISHI), S&P Syndicate Plc (SNP), Central Plaza Hotel Plc (CENTEL) and Minor International Plc (MINT).

Private hospitals have benefited from the increased use of Covid-19 testing services. In the past weeks, the number of infections has surged to over 2,500 per day, with the number of people using testing services for Covid-19 reaching as high as 7,000-8,000 per day, meaning hospital revenues are expected to be higher, said Mr Mongkol said.

Pakorn Peetathawatchai, president of the Stock Exchange of Thailand, said the bourse is preparing for more proactive market supervision measures to prepare for an increase in retail trading, as last year’s figures showed a spike in trading during the quarantine period.

Source: https://www.bangkokpost.com/business/2106023/private-sector-girds-for-third-wave

Thailand

Thailand