Thailand: Political unrest limits foreign outlays

Rising political tensions cloud prospects for rapid economic recovery and foreign investment in Thailand, says Moody’s Investors Service.

On Oct 15, Thailand’s government declared a state of emergency that banned gatherings of five or more people amid pro-democracy protests that have become larger and more frequent since September.

“Although the country has a track record of economic and financial resilience to political turmoil, any indication the current protests might lead to violence, such as occurred during 2013-14 and 2010 protests, would hurt Thailand’s attractiveness as a tourism destination, curb foreign investment and have a negative effect on the sovereign’s credit profile,” said Moody’s.

Increased political risk will test Thailand’s institutional effectiveness, which has been weakened by cabinet reshuffles and delays in enacting the previous fiscal year’s budget, said Moody’s.

“Protracted political tensions could reduce the credibility and effectiveness of the institutional framework, particularly if they hampered authorities’ ability to effectively execute macroeconomic policy, such as providing fiscal support to mitigate the economic effects of the coronavirus pandemic, or to enact major reforms to address issues such as an ageing workforce and labour skills formation,” said the service.

Persistent tensions could also erode foreign investor interest, potentially denying Thailand foreign direct investment (FDI) inflows at a time when supply chains are being reconfigured in response to both the pandemic and wider geopolitical trends, said Moody’s.

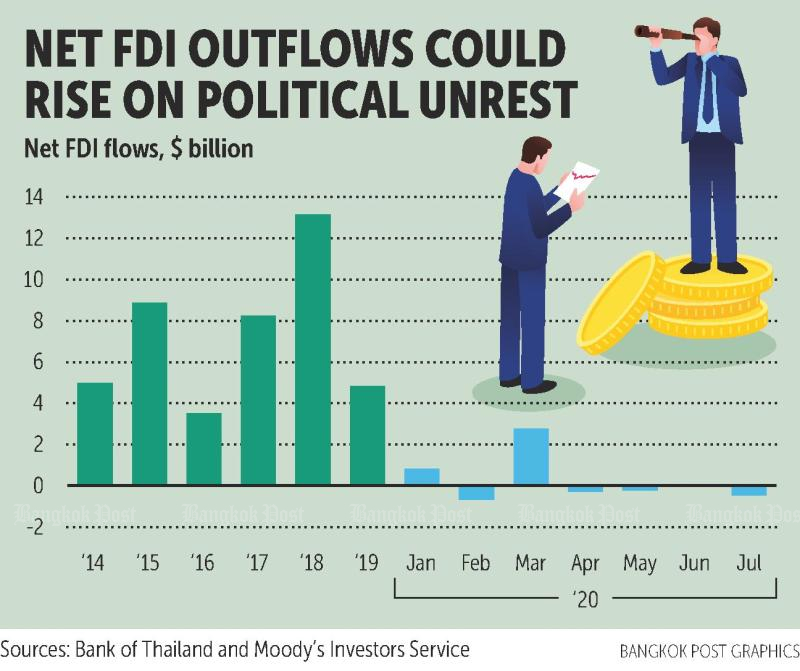

Net FDI inflows into Thailand strengthened in 2017-18 after uncertainty regarding the transition to democracy eased with the adoption of a new constitution in April 2017, and as promotion of the Eastern Economic Corridor initiative boosted sentiment.

However, FDI has softened considerably since 2019, turning to net outflows in five of the first seven months of 2020, in part reflecting the intensification of political tensions since the March 2019 elections and the pandemic shock, said Moody’s.

In contrast, FDI into Vietnam has strengthened over the same period, with inflows continuing in 2020.

Given its relative success controlling the domestic coronavirus infection rate, Thailand is tentatively reopening to some foreign tourists.

Coronavirus-related travel restrictions have led to the sharpest decline in foreign tourist arrivals on record, from around 3.5 million to 4.0 million monthly visitors in 2019 to zero since April 2020.

“Extended protests would tarnish prospects for recovery of the tourism industry, which accounts for around 10% of GDP. Previously tourist arrivals rebounded strongly after episodes of heightened political tension, for example rising 20.6% in 2015 after a decline of 6.5% in 2014, the year of the last coup,” said Moody’s.

“However, a recovery in tourism will be constrained by changes in consumer travel preferences, reduced airline seat capacity and uncertainties related to resolving the pandemic. Moreover, in an environment where tourists will be more selective, a further escalation in political turmoil places Thailand at a disadvantage to other potential destinations.”

Thailand’s sovereign credit rating is Baa1 with a stable outlook, according to Moody’s.

Source: https://www.bangkokpost.com/business/2006203/political-unrest-limits-foreign-outlays

Thailand

Thailand