Thailand: Policy rate unchanged, BoT grim on export, GDP outlooks

The Bank of Thailand kept the policy rate steady for a fourth straight meeting yesterday but painted a bleak outlook by trimming the country’s economic and export growth forecasts for the year.

The seven-member Monetary Policy Committee (MPC) voted unanimously to leave the policy rate unchanged at 1.75% as widely expected amid easing signals from the US Federal Reserve and the European Central Bank.

The committee assessed that the economy would expand at a slower pace than in the previous assessment, mainly due to slowing merchandise and service exports, but said the current monetary policy and financial conditions remain accommodative and conducive to economic growth, said MPC secretary Titanun Mallikamas.

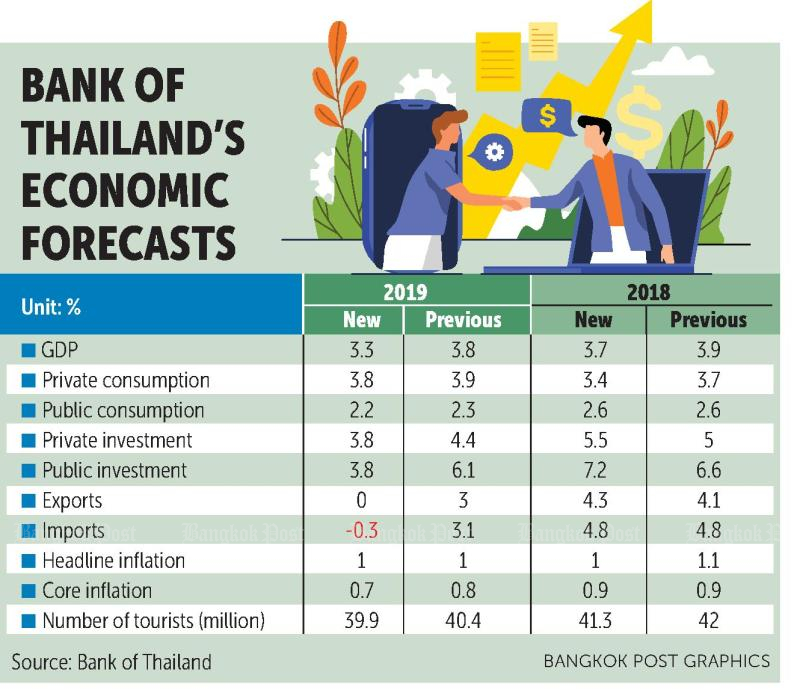

The central bank cut its GDP growth forecast for 2019 to 3.3% from the 3.8% predicted three months ago and the payment-based exports forecast to zero growth from the 3% rise seen in March.

The downward revisions come after the economy grew at its slowest pace in more than four years in the first quarter at 2.8%. Moreover, an export contraction for the third straight month in May clouded the economic outlook.

External uncertainties dim the country’s economic outlook, Mr Titanun said, adding that outbound shipments are expected to grow at a slower pace than in the previous assessment due to the slowdown of trading partner economies and global trade, affected by intensifying trade tensions, particularly between the US and China.

The trade dispute is expected to continue into next year, while geopolitical tensions, particularly US-Iran turmoil, will bring more uncertainties and risk a further blow to Thailand’s exports, he said.

For the January-May period, exports declined nearly 1% year-on-year.

There is a silver lining in that the trade rhetoric will benefit the country’s economy in terms of trade diversion, Mr Titanun said.

The central bank also trimmed its state investment growth forecast for the year to 3.8% from 6.1% previously projected to reflect expected delays in fiscal 2020 budget disbursement.

Spending is likely to be postponed from late this year to the beginning of next calendar year, pushed back from the start of the fiscal year in October, due to the time-consuming formation of the new government.

Financial stability remains sound overall but there is still a need to monitor risks that might pose vulnerabilities to financial stability in the future, Mr Titanun said.

Monitoring is warranted for household debt accumulation, driven particularly by auto-related loans, growth in assets held by savings cooperatives and the interconnectedness among saving cooperatives, adjustments in the real estate sector after the implementation of the revised loan-to-value (LTV) curbs, and leveraging by large corporations that could underprice risks, he said.

Deputy Prime Minister Somkid Jatusripitak said Thailand’s policy rate is likely headed downward because of global economic uncertainty, aggravated by the ongoing trade war.

He said Thailand remains attractive as a safe haven for foreign capital, despite the uncertain political situation and the baht’s appreciation.

“It is possible that the Bank of Thailand will cut the policy rate, following the downward trend of interest rates in many countries,” he said.

Meanwhile, Kasikorn Research Center (K-Research) has slashed its forecast for Thailand’s economic growth this year to 3.1% from 3.7% projected previously due to sluggish exports fuelled by the US-China trade spat and subdued domestic demand.

The research house has lowered its export projection for 2019 to flat growth from 3.2% in the wake of contracting exports in the first quarter and risks from the trade disputes between the world’s two largest economies.

The government’s export figure for the first five months has not taken into account the prevailing sentiment of lethargic global trade and possible effects from additional tariffs worth US$325 billion (10 trillion baht) by the US on Chinese imports, said assistant managing director Nattaporn Triratanasirikul.

“If the US implements this measure in the third quarter, Thai exports could face a net effect worth $3.1 billion or around 6% of the country’s GDP,” she said. “The effect will become higher in 2020.”

Source: https://www.bangkokpost.com/business/1702488/policy-rate-unchanged-bot-grim-on-export-gdp-outlooks

Thailand

Thailand