Thailand: Picking cryptocurrency winners

Anyone who follows cryptocurrency has come to expect frequent bouts of volatility in coin prices. Over the past year or two, some coins have gained value and some have dropped. From an investment standpoint, there have been a few successful cryptocurrencies, as bitcoin has demonstrated — even if it too has been subject to wild swings.

Cryptocurrency price trends are always changing because investors pump and dump their holdings. For those seeking advice on how to pick a “good” cryptocurrency to invest in, there is no such thing as a good or bad crypto coin. What traders are looking for is profitable coins, depending on their asset allocation.

Most people feel intimidated by the technology that underpins cryptocurrency, but you don’t need to understand it if all you want to do is trade. Every crypto trader has a chance to profit from picking up a good cryptocurrency, and every trader could also fail to profit depending on how the market behaves.

As changes in coin prices are not annualised, investors tend to look at price performance based on varying time horizons. But having a well structured investment plan can put a trader in a better position to pick a good cryptocurrency. There are two approaches worth considering:

The first approach is to own the coin or purchase futures contracts. There are different ways of doing this — either by purchasing from Bitcoin or Ethereum. This could require a leverage plan involving other coins in case of setbacks. Using this approach, if one purchases bitcoin today, the asset needs to be held for a long period, despite price fluctuations. This method is not suitable for either a bullish or a bearish market.

Purchasing crypto coins for future use in the expectation that they will increase in cost may render the trader penniless. Irrespective of the amount of capital committed, this method can be costly in terms of return on investment because it can be predisposed to disaster. Putting all one’s eggs into one coin basket will result in having only one escape route in the event that the market slumps.

However, purchasing futures contracts may leave open the possibility that the investor can’t afford to witness a price decline, while increasing the risk that they will squander all their investment funds.

The second approach involves diversifying and committing to daily trading. This involves purchasing several coins and separating them into two categories: daily trade in a particular coin, and daily trade of several coins on several exchange platforms.

This method likely offers the greatest potential return, but also exposes the trader to risk. It requires energy and a big investment of time studying coin announcements and keeping up with the coin community on social media platforms to remain well-informed. Trading in this way will lead to liquidation of other digital assets that have lost their value.

Most investors see CoinMarketCap as the primary source of price information, but it is heavily weighted towards trading volume. This means that even if one coin experiences a decline in price while others experience robust price increases, a trader could still see a negative return.

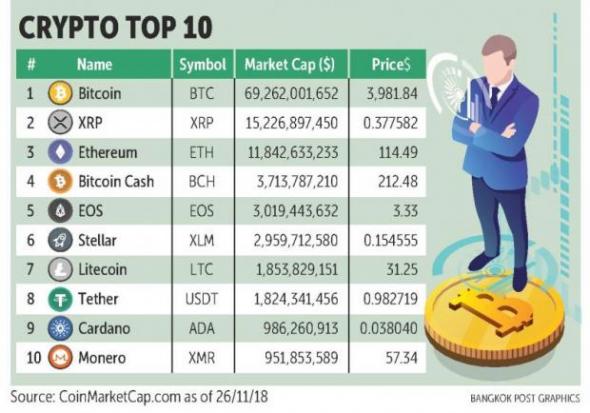

In other words, diversifying assets, regardless of the amount invested, gives investors more options, and they will be less troubled by increased volatility in the crypto market. Several cryptocurrencies, notably Bitcoin Cash, EOS and Litecoin, were established to provide good alternative investment sources. This approach is less likely to expose the trader to market risk of a sharp price decline in any of the coins.

To strategically forecast the most profitable cryptocurrency to invest in, one needs to be able to anticipate demand for a particular coin. This means that the influx of investors into a particular coin determines the very nature of that coin. The more people buy, trade and demand the coin, the more the value increases.

Investors thus need to stay informed, choosing coins based on the project road map of the issuing company, a white paper or other related announcements regarding the development of the coin.

The emergence of cryptocurrency has spurred greater interest in Thailand in blockchain technology, and how it can be applied to other forms of business activity besides crypto trading. That has given rise to crypto exchange platforms to help traders in Thailand buy and sell cryptocurrencies using fiat money, in this case Thai baht. The aim is to make investing in cryptocurrency easier by focusing on the end-user experience.

Source: https://www.bangkokpost.com/business/news/1583090/picking-cryptocurrency-winners

Thailand

Thailand