Thailand – Nielsen: Behavioural changes run deep

The coronavirus outbreak is driving behavioural changes, especially in combined online-offline shopping, food orders, premium and innovative products and domestically produced items, according to research firms.

“Thailand is entering the fourth stage of the pandemic, where people are living with quarantine preparations,” said Somwalee Limrachtamorn, managing director of Nielsen Company Thailand.

The fifth stage is the lockdown or restricted living, such as the situation in Italy, while the final or sixth stage is a new paradigm, like the situation in China and South Korea, said Ms Somwalee.

She was speaking about consumer behaviour at an online conference held by Line Thailand and the Standard, an online media agency.

Ms Somwalee said Thais’ top concerns about the crisis are the economy, debt and health.

As GDP is projected to drop 5.3% this year, this threatens consumer spending, she said.

Spending is more focused on household essentials along with health and hygiene-related products. The opposite is true for impulse or non-essential goods, said Ms Somwalee.

Consumers are shopping more at pharmacies and buying products online while gearing up to order food and eat at home.

Lifestyle changes include indoor exercise and working from home.

“After this crisis, online food delivery will gain momentum even though Thais will maintain a culture of eating out,” said Ms Somwalee.

She said consumers will be more willing to pay for premium and innovative products of higher quality, with safety assurances.

Additionally, Thai consumers will purchase locally made or privately labelled products more than imported ones as they are more confident in local products’ hygiene.

According to Ms Somwalee, the outbreak accelerated online and offline integration in the retail landscape and bolsters online food delivery services. This gives way for supply chain improvements and more innovative logistics.

The pandemic has also boosted consumption of TV content and turned social media into a mainstream channel.

“Brands and businesses need to be prepared for this trend and make advertising more creative in terms of content and communication channels,” she said.

Research firms Wunderman Thompson and Dattel found Thais are the most worried about the economic impact in Asia-Pacific.

Only 15% of Thai respondents believe the economy will recover quickly after the outbreak, while China and Singapore are the most confident the economy will bounce back. The study surveyed 1,243 respondents aged between 15-69 years old in Thailand.

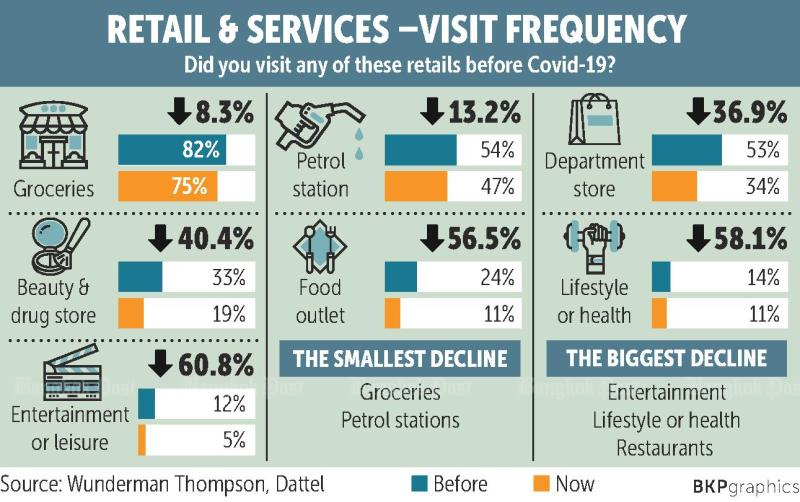

Retail and service visits overall are in decline, but the smallest declines are seen in grocery stores and petrol stations with drops of 8.3% and 13.2%, respectively.

Food and beverages are safe from the pandemic as the majority of consumers indicated they would either maintain or increase purchase volumes and spending. Instant noodles saw the biggest increase at 52%, indicating an increase in purchase volume.

The survey found health and beauty category will remain relatively unchanged during the pandemic.

Source: https://www.bangkokpost.com/business/1900775/nielsen-behavioural-changes-run-deep

Thailand

Thailand