Thailand: Moderation for cryptocurrencies advised

The Securities and Exchange Commission (SEC) warns investors should closely monitor investments in cryptocurrencies due to high volatility, suggesting they invest and trade only with market players regulated by the SEC.

Analysts, meanwhile, suggested investors with a moderate appetite for risk rebalance their portfolios by allocating no more than 10% of their assets to digital currencies.

Bitcoin, the world’s most popular cryptocurrency, soared to a record high of 1 million baht per unit during the New Year celebrations.

Trading value on the local Thai cryptocurrency exchange, Bitkub, reached 2 billion baht on Sunday while traditional asset exchanges closed during the break, making nearly 20% returns in just a week against 871,000 baht, its 2019 record.

The local price as of 5.30pm yesterday corrected to a low of 900,000 baht.

The price surge has also led other cryptocurrencies such as Ethereum, the second most popular cryptocurrency, Litecoin and Bitcoin Cash to rise over 20%.

“Cryptocurrencies are traded around the world just like gold,” said Ruenvadee Suwanmongkol, SEC secretary-general. “Investors must closely follow regulations as there are many digital exchanges worldwide and there is a risk as we can only regulate players we have authorised.”

Ms Ruenvadee said investors should be careful with cryptocurrency investment and trade only with market players regulated by the SEC.

Trading for cryptocurrencies and digital assets in Thailand is regulated under the Emergency Decree on Digital Asset Business Operation B.E. 2561 (2018) of Thailand by the Ministry of Finance and the SEC.

At present, the SEC has authorised eight digital asset exchanges, five digital assets brokers, four initial coin offering portals and one digital asset dealer.

She said the authorised digital exchanges are required to maintain capital reserves as the rules indicate.

The SEC has also taken public legal action against fraud related to cryptocurrencies.

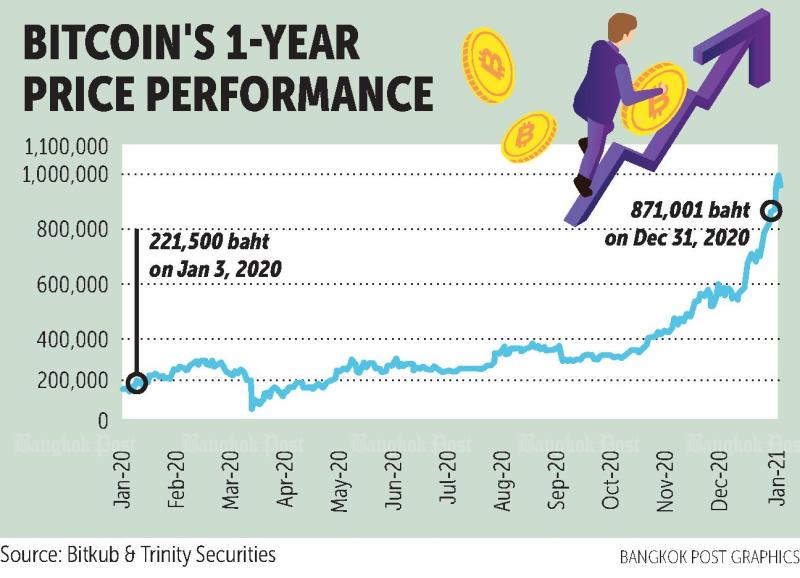

Nuttachart Mekmasin, an analyst from Trinity Securities, said Bitcoin has outperformed by 293% last year from 221,500 baht on Jan 3, 2020 to last year’s peak at 871,001 baht.

“We still recommend investors maintain an alternative investment portion of 10%, 5% for cryptocurrencies and 5% for gold,” he said.

He said people can allocate excess weight to growth stocks in the first half of this year then relocate to value stocks when the global economy shows signs of recovery in the second half.

Jirayut Srupsrisopa, founder and group chief executive at Bitkub, said the exchange’s trading volume broke 2 billion baht for the first time within 24 hours after Bitcoin surpassed 1 million baht.

Over the holidays, 20,000 accounts a day were created on Bitkub from roughly 7,000 accounts a day previously, driving total accounts to 600,000.

On Sunday alone, 40,000 new accounts were created on Bitkub.

While in the past Bitcoin traders skewed younger, recently cryptocurrencies have caught on in the 25-45 demographic and even among professional stock traders.

Local gold prices reached a two-month high, spurred by outbreak fears.

The gold price announced by the Gold Traders Association yesterday morning opened at 27,150-27,250 baht, an increase by 300 baht from 2020.

Tanarat Pasawongse, chief executive at Hua Seng Heng Group, said the US dollar was pressured by an increase in outbreaks in the US, where the total stands at 20.6 million cases.

“The outbreak fears will support the gold price in the short term,” he said. “Although the progress of vaccine development could drive some correction in gold prices, it will be a while before the vaccine can be widely distributed to the public.”

The trade deficit is also a supporting factor for local gold as it could slacken the appreciation of the baht, allowing investors to benefit from both the gold price and exchange rates in short-term trade.

Source: https://www.bangkokpost.com/business/2045719/moderation-for-cryptocurrencies-advised

Thailand

Thailand