Thailand IPO and M&A activity to peak in 2019

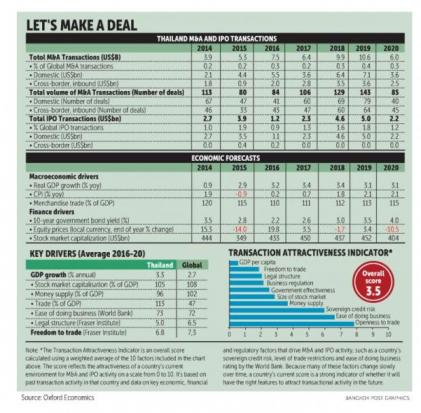

Thailand’s dealmaking cycle is predicted to peak in 2019, with the value of both mergers and acquisitions (M&A) and initial public offerings (IPO) forecast to climb over the next two years, before easing back in 2020, according to the third edition of the Global Transactions Forecast, issued by Baker McKenzie and Oxford Economics.

Globally, the easing of key economic and political risks and the emergence of positive macroeconomic deal drivers will accelerate global deal activity in 2018, after a period of apprehension for global dealmakers early last year.

Following on the momentum created in recent months, the new survey predicts the global deal cycle to peak this year, while Thailand and the wider Asia-Pacific region are set to peak a year later.

“After a few soft patches in 2017 we have a more optimistic outlook for the global economy and dealmaking in 2018, as long as the brakes are not put any further on global free trade,” said Paul Rawlinson, the global chair of Baker McKenzie, a multinational law firm.

“We see an uplift in both M&A and IPO activity as dealmakers and investors gain greater confidence in the business prospects of acquisition targets and newly listed businesses.

“However it’s not a done deal, with the threat of a ‘hard’ Brexit and a collapse of the North American Free Trade Agreement [Nafta] both still very real. Business will need to continue to make the case for liberal trade and investment frameworks.”

According to Oxford Economics, dealmaking in Thailand “held up well in 2017 against an uncertain political backdrop and tight credit conditions”.

The country’s economy remains in good shape, it said, with the global trade upturn supporting manufacturing and tourism. “We forecast a gradual pickup in M&A activity to about US$10 billion in both 2018 and 2019.”

The survey predicts the number of M&A deals in Thailand to rise to 129 this year, from 106 last year, with the value of the deals jumping from $6.4 billion to $9.9 billion, and to $10.6 billion in 2019. Meanwhile, the value of Thai IPOs is set to peak at $5 billion next year.

Asia-Pacific M&A activity is forecast to peak at $754 billion and domestic IPOs at $82 billion in 2019, the study said.

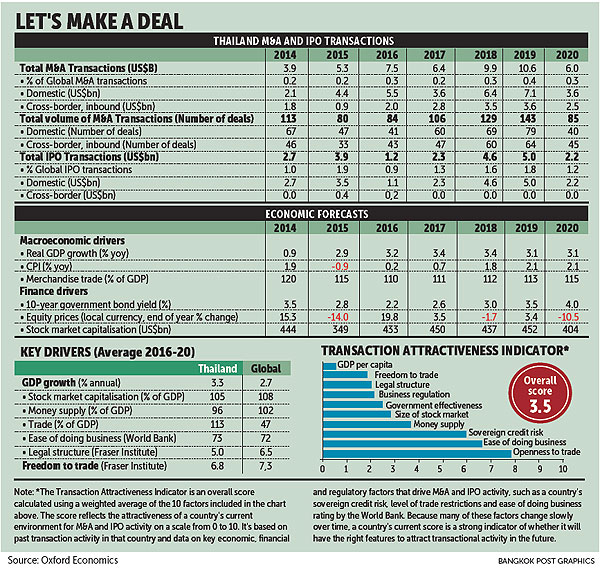

Oxford Economics uses statistical techniques to estimate the historic relationship between M&A and IPO activity in 40 markets based on key drivers, such as GDP growth, equity prices, trade flows, money supply, legal structure and property rights and freedom to trade.

The forecast uses data on completed deals rather than announced deal values. “From an analytical modelling perspective, it makes more sense to use completed deals for forecasting as it reflects actual outcomes,” the company says.

“While the forecast numbers prepared by Oxford Economics are quite bullish, we do see a definite pickup in interest around dealmaking in Thailand, both domestically and by foreign investors,” said Sorachon Boonsong, a partner with Baker McKenzie Thailand. “Macroeconomic conditions remain favourable, and Thailand is well-positioned as a global destination for tourism and high-value manufacturing.”

Source: https://www.bangkokpost.com/business/finance/1393210/thailand-ipo-and-ma-activity-to-peak-in-2019

Thailand

Thailand