Thailand: International issues to influence baht rate this week

The Bank of Thailand will hold a press conference tomorrow on the monetary policy and baht exchange rate situation, amid concerns of the baht remaining strong.

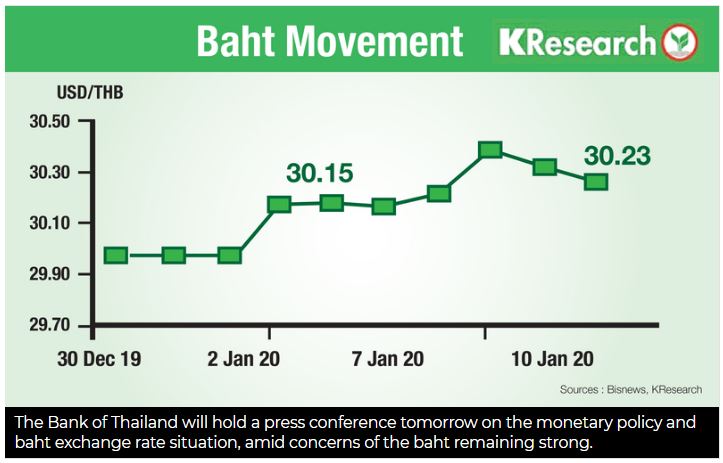

Last week, the baht moved within a tight range early in the week before hitting a one-month low of Bt30.37 to the US dollar in line with weak regional currencies amid concerns over rising tensions in the Middle East, after Iran attacked US troops in Iraq in response to the US airstrike on January 3, according to KBank report.

However, the baht pared losses somewhat later in the week, as US announced economic sanctions instead of military actions against Iran, which helped calm market concerns over the situation in the Middle East.

Meanwhile, the market shifted its focus to preparations for the signing of the first phase of the US-China trade deal around mid-January.

On Friday (January 10), the baht closed at Bt30.23 to the dollar, versus Bt30.15/USD reported on Friday (January 3).

During the week January 13-17, KBank expects the baht will move within a range of Bt30.00-30.40/USD. Key factors to be monitored closely include signals for subsequent phases of the US-China trade talks, issues surrounding Brexit and the situation in the Middle East. The US economic data to be released during the week include consumer price index, producer price index, retail sales, housing starts, and industrial production data for December 2019, plus the NAHB Housing Market Index, NY Fed Empire State Manufacturing survey, Philly Fed Business Outlook survey and Preliminary Consumer Sentiment survey for January 2020. In addition, market participants may monitor China’s fourth-quarter GDP report for 2019 and December 2019 economic data.

Source: https://www.nationthailand.com/business/30380477?utm_source=category&utm_medium=internal_referral

Thailand

Thailand