Thailand: Inflation worries take steam out of shares

Recap: Global stocks extended declines on Friday as hotter-than-expected consumer prices raised fears the US Federal Reserve will lift interest rates faster to fight inflation.

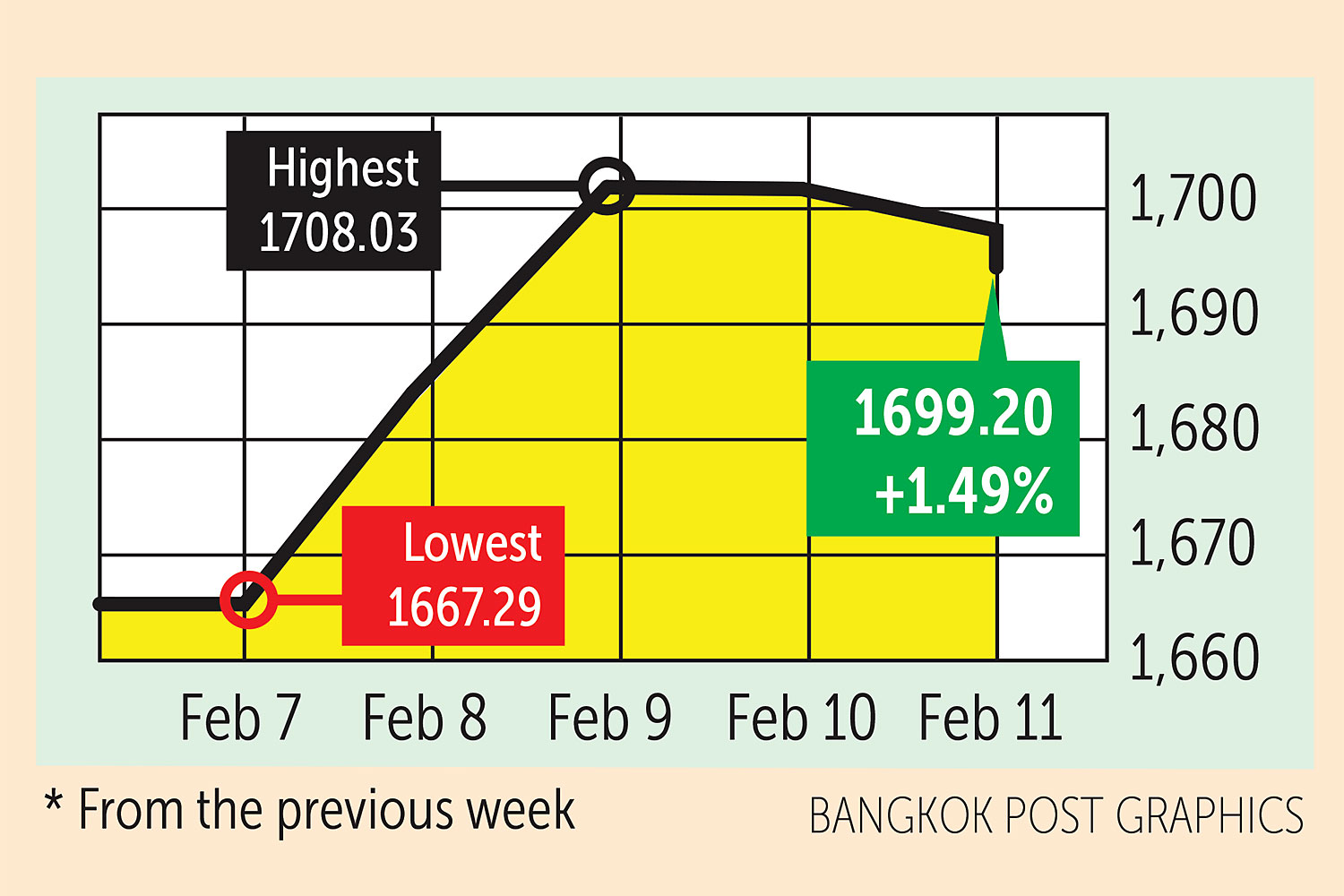

The SET index moved in a range of 1,667.29 and 1,708.03 points this week before closing yesterday at 1,699.20, up 1.49% from the previous week, in high daily turnover averaging 100.86 billion baht.

Foreign investors were net buyers of 42.05 billion baht and brokerage firms bought 1.79 billion baht. Retail investors were net sellers of 22.4 billion baht and institutional investors offloaded 21.44 billion baht worth of shares.

- The streaming television race is heating up, with Disney+ reporting subscriptions rising to 129 million, closing the gap with market leader Netflix (221 million), whose growth has slowed.

- A US solar panel maker is asking trade officials to investigate whether to impose tariffs on imports from four Asian countries including Thailand, arguing that Chinese manufacturers had shifted production to those nations to avoid paying duties.

- Pfizer has forecast more than $50 billion in 2022 sales for its Covid-19 vaccine as the pharmaceutical giant reported a more than doubling of annual profits on strong sales.

- The EU has launched a plan to raise tens of billions of euros to boost semiconductor production in Europe and end the bloc’s digital dependence on Asia.

- The Covid lockdown this week of a relatively unknown Chinese city sent global prices of aluminium rocketing to a 14-year high. Located near the border with Vietnam, Baise produces about 2.2 million tonnes of the commodity per year.

- Japan’s SoftBank confirmed Tuesday that its planned $40-billion sale of the chip business Arm to Nvidia had collapsed because of “significant regulatory challenges” over concerns about competitiveness, and said it planned to now take the unit public.

- Toshiba on Monday announced plans to split into two companies, revising a controversial proposal to divide into three following a tumultuous period for the storied Japanese industrial conglomerate.

- Singapore is taking steps to ease growing concerns over an imminent increase in taxes, including explainers on social media and in local newspapers to justify the need for the move.

- PTT Exploration and Production Plc will seek to acquire the combined 59.5% stake held by TotalEnergies and Chevron in the Yadana gas field in Myanmar, where the French and US companies are ceasing operations. The Thai firm currently holds 25.5% in the venture.

- Finance Minister Arkhom Termpittayapaisith is confident of the kingdom’s economic outlook, saying it will achieve 4% growth this year as forecast by several domestic and foreign agencies.

- The Bank of Thailand predicts headline inflation will exceed the target rate in the early part of this year, forced up by rising raw food and energy prices.

- The Bank of Thailand left its key interest rate unchanged at a record low 0.5% this week to support fragile recovery and tourism rebound amid rising risks from inflation.

- The BoT will wait for at least a year before raising interest rates to support the tourism-dependent economy, a Reuters poll has found.

- The cabinet on Tuesday approved an action plan to drive bio-, circular and green (BCG) economic development between 2022 and 2027 with a total budget of almost 41 billion baht.

- The Thai National Shippers Council expects the country’s exports to see year-on-year growth of 5% in the first quarter, helped by the global economic recovery.

- Consumer confidence dropped in January for the first time in five months, hurt by a new coronavirus outbreak, a slow economic recovery and the high prices of goods, a survey showed on Thursday.

- Thailand’s official unemployment rate eased in the fourth quarter of last year, and bachelor’s degree holders still have the highest unemployment rate, according to the National Statistical Office.

- Insurance companies have become reluctant to offer Covid-19 coverage to foreign tourists as the industry was beset by a liquidity crunch, with two companies ceasing operations after losing large sums on Covid policies.

- Tourism receipts in 77 provinces set another historic low in 2021 with revenue declining by 69.5% to 241.3 billion baht.

- The government plans to hold travel bubble talks with China and Malaysia this month, days after resuming a quarantine-free visa programme to boost tourist arrivals.

- MPs on Wednesday voted to let the cabinet examine a bill seeking to liberalise liquor production and allow small-scale producers to enter the market.

- The Thai Chamber of Commerce is scheduled to lead a business delegation to Saudi Arabia this month to restore trade and investment relations after a three-decade freeze.

- Bilateral trade between Thailand and Saudi Arabia is forecast to surge by 20% this year after the two countries recently agreed to restore full diplomatic relations, according to a Commerce Ministry study.

- The Government Savings Bank (GSB) plans to restructure the debt of individuals and small and medium-sized enterprises (SMEs), totalling some 410,000 accounts and debt of 230 billion baht, says GSB president Vitai Ratanakorn.

- Thailand Post is expanding its services to cater to more specific e-commerce demand to create more value for its business amid intense competition in the courier segment.

- The global online payment service PayPal is scheduled to suspend most services for consumers, freelancers and sole proprietors in Thailand from March 7 as it is struggling to comply with Thai regulations.

- SET-listed Advanced Info Service (AIS), the country’s largest mobile operator, registered year-on-year revenue growth of 4.9% to 181 billion baht in 2021, buoyed by core service revenue improvement and a rise in handset sales.

- SET-listed RS has announced the acquisition of the entire business of Unilever Life (ULife), a direct sales business unit of the global consumer product conglomerate Unilever, with an investment of roughly 880 million baht.

Coming up: The euro zone will release December industrial production on Monday. Japan will release fourth-quarter GDP, Britain will release December unemployment and labour productivity and Germany will release February economic sentiment. Also on Tuesday, the euro zone will release fourth-quarter GDP and December trade data and the US will release January producer prices.

- The US will release weekly crude oil stocks and January retail sales, export and import prices and industrial production on Wednesday. China, Britain, and Canada will release January inflation figures.

- Australia will release January employment data on Thursday. The US will release January building permits and existing home sales, Britain will release January retail sales and Canada will release December retail sales on Friday.

Stocks to watch: Phillip Securities recommends stocks expected to benefit from eased Covid containment measures, Test & Go and and the fourth phase of the We Travel Together campaign, including ERW, CENTEL, MINT, AOT, AAV, BA and ASAP. For value plays, the brokerage recommends KBANK, BBL, SCB, EA, GULF, ADVANC, TRUE and DTAC.

- KTB Securities Thailand recommends stocks eyed by foreign investors, including KBANK, PTTEP, SCB, PTT and ADVANC. For portfolio adjustment, it recommends MAKRO (10%), TIDLOR (10%), GULF (15%), THCOM (15%), TU (10%) and PTT (15%).

Technical view: SCB Securities sees support at 1,685 points and resistance at 1,720. Thanachart Securities sees support at 1,690 and resistance at 1,720.

Source: https://www.bangkokpost.com/business/2263079/inflation-worries-take-steam-out-of-shares

Thailand

Thailand