Thailand: Industrial and logistics property results mixed

The Thai industrial and logistics property sector has been proclaimed as the preferable market in these uncertain times for developers and investors. And while it has fared better than other commercial property sectors, it has not all been plain sailing, according to the property consultancy CBRE.

The industrial and logistics market has undergone areas of growth, but in other areas it has faced challenges that can be eased by a supportive government policy and the right expansion strategies.

“Before Covid-19, the ‘China Plus One’ model saw manufacturers looking to diversify supply chains and manufacturing bases outside mainland China due to rising labour costs, diversification of risk and trade disputes,” said Adam Bell, head of transaction and advisory services (industrial and logistics), with CBRE Thailand.

“Thailand, Vietnam and Malaysia were predicted to be the main beneficiaries of this movement, yet to date in Thailand, the land sale numbers on industrial estates are not showing this.”

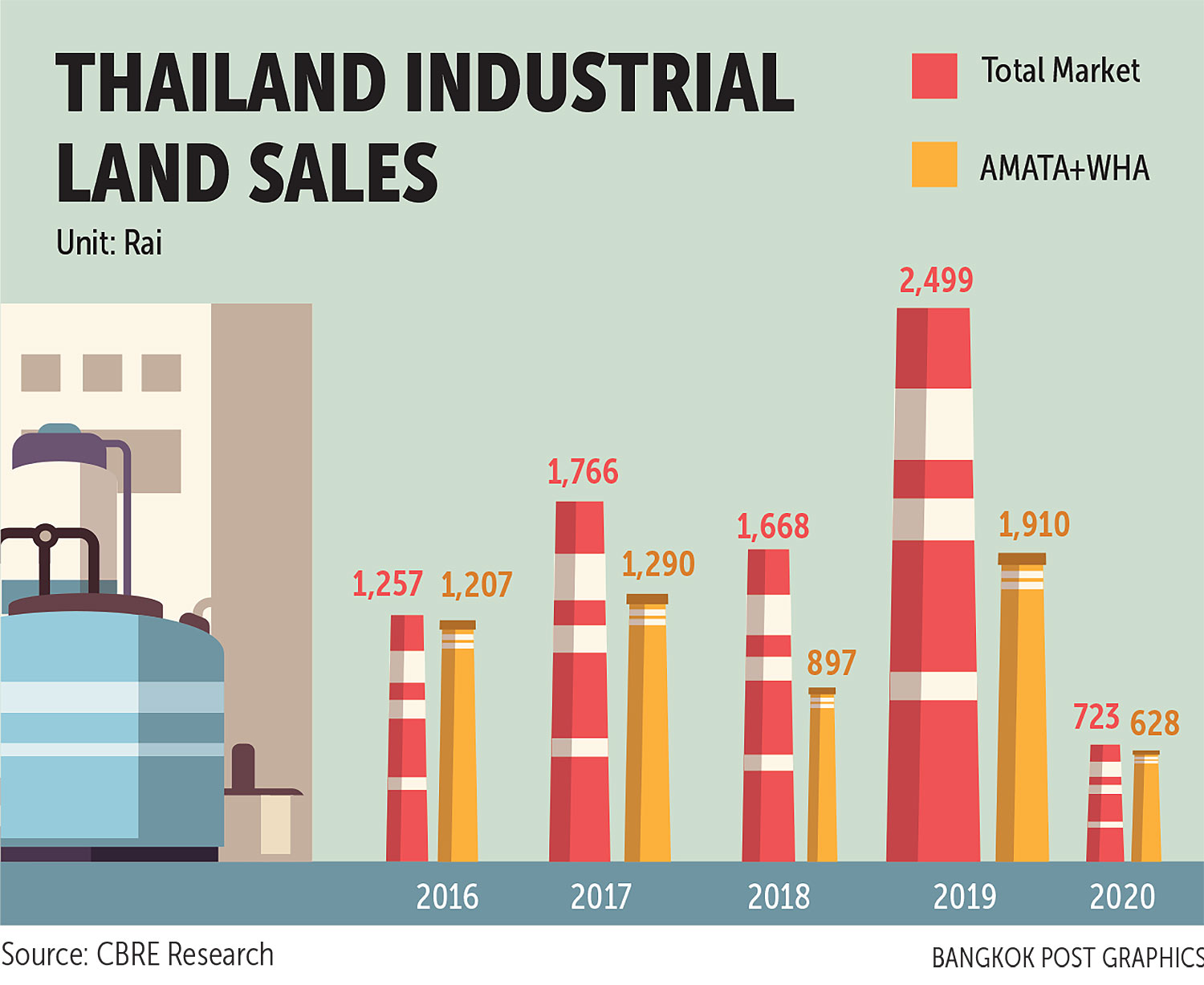

To gauge Thailand’s success in capturing this foreign direct investment (FDI), CBRE looked at industrial estate land sales from developers like WHA Corporation and Amata Corporation.

“Between 2016 and 2020, land sales did not show that Thailand was benefiting from the China Plus One model,” he said.

Vietnam has been more successful in attracting this investment, with its competitive advantage being a large, young workforce and the low labour rates. Labour-intensive manufacturers have shown preference to Vietnam over Thailand.

“While Thailand may no longer compete in terms of labour rates; it still does have competitive advantages over Vietnam,” added Mr Bell. “A well-developed infrastructure, professionally developed and managed industrial estates, extensive clusters of specialised suppliers and skills and a track record over 40 years of attracting FDI. This should enable Thailand to benefit from the China Plus One model.”

CBRE believes there is significant pent-up demand for industrial land, especially on the major industrial estates in the Eastern Seaboard, but given current Covid travel restrictions, and difficulties for Chinese nationals travelling abroad, Thailand is still waiting to benefit from this potential.

One area that has undoubtedly seen growth is the warehouse market. With the growth of e-commerce, this segment has been expanding for several years, but the pandemic has turbocharged that growth.

E-commerce companies are expanding exponentially as people are moving to online shopping with lockdowns and work/stay at home advisories in effect. CBRE believes a focused government stimulus programme for the industrial and logistics market can unlock potential growth and ease the warehouse zoning challenges the sector is facing.

Paul Srivorakul, group chief executive of aCommerce, recently commented in the Bangkok Post that the country’s e-commerce sector is growing at extraordinary rates. The growth in 2020 alone was remarkable, although only 3-4% of total retail has gone online.

Many brands and retailers are speeding up their digital transformation. As a result, e-commerce now represents 25-30% of some players’ total revenues, compared with 5-8% in pre-Covid times.

This type of growth has been driving enormous demand for warehouse space from the large e-commerce players like aCommerce, JD.Com, Shopee and Lazada to store goods prior to nationwide distribution.

“There are certain challenges on the horizon, but they are positive challenges from this rapid growth. With the nature of e-commerce, the ideal location should be close to town and convenient for connectivity,” said Mr Bell.

“The hot spot for e-commerce warehousing is on Bang Na-Trat Road between Km 18 and Km 23, where connectivity to Bangkok, Suvarnabhumi and Laem Chabang deep seaport come together in an area zoned for large warehouse properties favoured by e-commerce companies.

“In this location, CBRE is now seeing significant shortage of large developable land plots, and of those plots available, the land prices are making justification of warehouse development challenging.

“Certain businesses, like e-commerce, in the warehouse market have flourished during the pandemic. Nonetheless in the coming years, CBRE expects to see upward pressure on rents in this area, or developers and occupiers alike will have to start looking at alternative locations where lower rents or land prices could offset slightly inferior location.

“These are the challenges from productive changes. With a dedicated governmental policy towards new town planning with expanded zoning, Thailand will once more gain advantages in the regional warehousing competition.”

Source: https://www.bangkokpost.com/business/2170859/industrial-and-logistics-property-results-mixed

English

English