Thailand: Hotel outlook remains negative

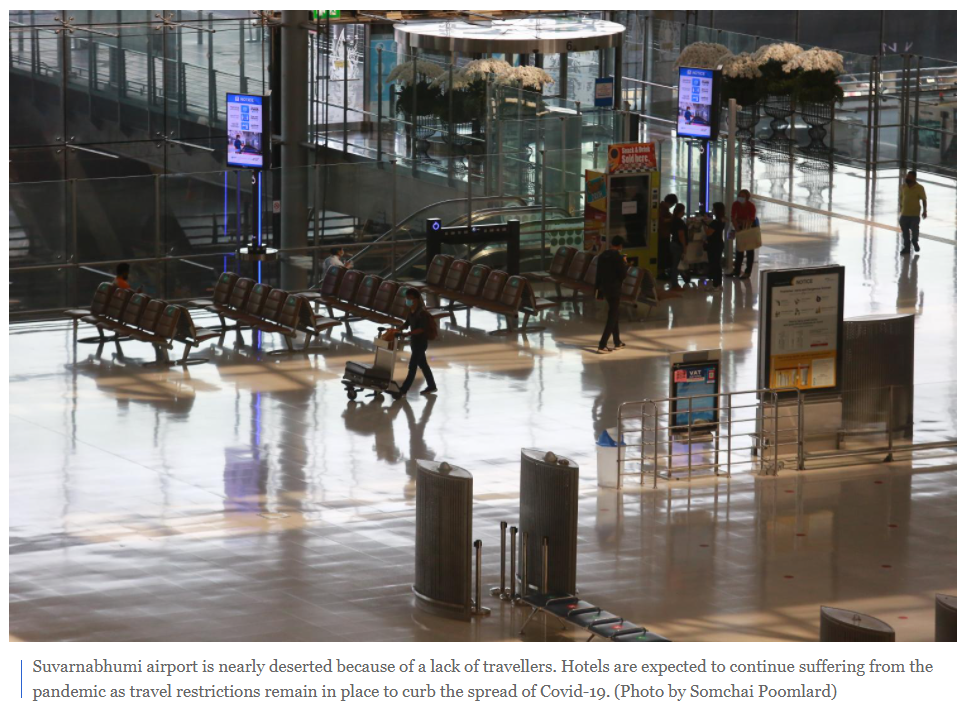

Tris Rating maintains a negative outlook for the hotel industry in Thailand, with performance to remain under extreme pressure from the slow recovery of travel and tourism demand.

As a result, hotels are likely to offer discounts and non-price promotions to draw customers, leading to intense competition, while also focusing on cost management to minimise losses. Some companies may face a severe liquidity squeeze from a precipitous drop in revenues.

The hotel industry in 2020 suffered an unprecedented decline in business volume, reflected by the 60-70% year-on-year decline in revenue per available room (RevPAR) to an average of 331 baht per night nationwide. The average occupancy rate slipped to 29.5%.

We believe hotels will continue to endure the severe impact from the pandemic as travel restrictions will likely remain in place until late 2021. Most hotels may need alternative sources of funds to cope with liquidity problems. Consequently, weakening financial conditions are likely to continue.

Tourism in 2021 is expected to recover slowly, mostly from domestic travel. International arrivals are projected to reach between 1.5 million and 3 million in 2021, depending on the rollouts of vaccinations and their effectiveness worldwide.

The tourism industry is one of the most important economic sectors in Thailand, with tourism receipts accounting for 18% of GDP in 2019. Receipts from foreign visitors were 1.9 trillion baht, or 64% of the total, with Thai travellers accounting for the remaining 1.1 trillion. Of international tourism expenditure in 2019, accommodation accounted for 28% and food and beverage 21%.

In 2020, tourism receipts plunged 72.8% to 810 billion baht, which included 500 billion from Thai travellers. International arrivals collapsed to 6.7 million — almost all of them in the first quarter — from 39.9 million a year earlier. Trips made by Thai travellers also plunged by 46.4%.

We believe foreign visitor numbers will recover slowly in the fourth quarter of 2021. The rollouts and effectiveness of vaccinations will be critical factors. We estimate vaccination coverage in advanced economies and key source markets for Thai tourism will reach about 30% in the second half of 2021. Vaccination coverage in Thailand is expected to reach 45% of the population in the last quarter of 2021.

INDUSTRY RECAP

Prior to 2020, inbound and outbound tourism had been on a growth trend, helped by promotions in key destination countries and the emergence of low-cost airlines. To serve global demand and outbound tourism in new destinations abroad and to diversify in terms of location, large Thailand-based operators such as Minor International (MINT), Central Plaza Hotel (CENTEL) and Dusit Thani Plc (DTC) expanded their hotel chains in regional and global markets.

Between 2017 and 2019, operators in Thailand enjoyed increasing revenues from hotel and hotel-related services. Revenues from hotel and hotel-related services of the 13 listed hoteliers on the Stock Exchange of Thailand totalled 136 billion baht in 2019, soaring 65% from 82 billion in 2018. In 2020, total revenues from hotel and hotel-related services contracted by 63% to 50 billion baht.

Among the 13 listed hoteliers, MINT leads the pack by a wide margin with a market share in hotel revenue of 65.4% in 2020, followed by Asset World (AWC) at 5.8%, CENTEL (5.7%), DTC (5.2%) and Erawan Group (ERW) at 4.6%.

MINT’s market share jumped from 38.8% in 2017 as a consequence of its acquisition of NH Hotel Group SA in late 2018. MINT is ranked among the top 20 hoteliers worldwide.

Cyclicality is an inherent part of the hotel business, induced by changes in economic conditions, the discretionary nature of demand, and unpredictable circumstances related to safety and security, such as natural disasters, disease outbreaks, political violence and other events.

These cyclical factors tend to dampen consumer confidence and tourism demand, leading to a down cycle. However, in most instances in the past, a down cycle would last through a more-or-less predictable period, before a recovery set in as negative effects dissipated.

To attain long-term success, prudent hoteliers need resiliency to cope with the adverse effects of a down cycle. Other challenges are the high upfront investment costs and high selling and administrative expenses.

To mitigate inherent risks and enhance stability, hoteliers have diversified into more stable recurring income-based businesses, such as food and beverage, retail space rental, mixed-use real estate, beauty and health care, and other consumption-related businesses in the retail sector.

The two-year average revenue structure for 2018 and 2019 of the 13 SET-listed hoteliers comprised 66% hotel and related revenue, 20% food and beverage, 8% sales and production, and 6% other revenue.

On the cost side, hotels are a high-cost business given the investments in fixed physical assets, in the maintenance of good-quality assets and standardised services, and in selling, general and administrative (SG&A) expenses. The two-year average cost of goods sold (COGS) represented 50% of total revenue, while average SG&A and financing expenses were 36% and 5%, respectively.

With its high-cost structure, the hotel business generated a two-year average net profit margin of 7% in 2018-19. This is relatively low and more volatile when compared with other types of real estate businesses.

Locally, three listed hoteliers — MINT, CENTEL and Grande Asset Hotels (GRAND) — recorded sizeable non-hotel revenue contributions of 25%, 60% and 17%, respectively in 2019. DTC’s non-hotel revenue increased to 6% in 2019 from 4% in 2018, and is expected to rise further over the next three years with completion of its mixed-use Dusit Central Park project.

HOTEL PERFORMANCE

The performance of hotels has been hard hit by the pandemic since February 2020. Aggregate revenues of SET-listed hotels slipped to 36.7 billion baht in the first quarter of 2020, down 21% year-on-year. In the second quarter, revenues collapsed more than 70% year-on-year to 11 billion baht.

Following the easing of lockdown measures from mid-May 2020, revenues almost doubled to 21.7 billion baht in the third quarter and rose gradually to 23.2 billion in the last quarter.

Consequently, listed hotels reported a loss in aggregate earnings before interest, tax, depreciation and amortisation (Ebitda) of 2.8 billion baht in the second quarter of 2020. In the third quarter, SG&A declined by 47%. However, aggregate Ebitda remained negative by about 600 million baht. In the fourth quarter, aggregate Ebitda turned around to 1.8 billion baht.

Leverage up sharply: The leverage level of hotels has risen due to the substantial drop in Ebitda. The weighted average of adjusted debt to Ebitda shot up to 79.9 times in 2020, from 5.3 times in 2019. We expect leverage to remain high in 2021 as earnings of most hotels are likely to recover slowly.

Shrinking liquidity and cash flow: As the impact of Covid translated into sharp declines in revenues and cash flows, the inevitable results were spikes in leverage and liquidity ratios that indicate weakening financial profiles.

In 2020, the weighted average Ebitda interest coverage ratio plummeted to 0.3 times, from 3.2 times in 2019. The ratio of funds from operations to debt dropped to -1.3% in 2020, far below the average of 14% from 2016-19.

MITIGATION MEASURES

During the period of travel restrictions, hotels’ cost burden remained high even as revenues plunged. Operators focused on aggressive cost management to reduce their financial burden and minimise losses.

Many minimised staff costs by reducing headcounts, cutting salaries and working hours, and integrating service functions. Some slashed outsourced services such as security guards or cleaners. This helped reduce total SG&A of the 13 listed operators by 44% in the second quarter and 47% in the third quarter of 2020.

Strategic marketing: Hotels also introduced strategic marketing initiatives to generate revenue in the short term. Some hotels offered low-priced packages to match the budgets of domestic tourists and created special packages for the alternative state quarantine (ASQ) programme.

With efforts to boost revenues and reduce costs, hotels were able to improve their break-even levels after the lockdown easing in the third quarter of 2020.

Liquidity prioritised: To cope with the short-term liquidity squeeze, hotels secured a variety of funding to strengthen their position and mitigate short-term liquidity risk. They prioritised cash flow by increasing revenues from short-term packages and through cost-control measures. Some raised funds in the equity market or issued debentures to inject cash.

Other solutions included scaling down capital expenditures and divestment of assets in locations considered unprofitable or with poor long-term prospects. Improvements in liquidity positions began to be seen in the third quarter of 2020 as hotels gradually recovered from second-quarter lows.

Non-hotel revenue: Overall, non-hotel businesses were relatively less affected by Covid. In 2020, the 13 listed hoteliers recorded a 63.2% drop in hotel revenue but a 14.3% decline in non-hotel revenue, which combined to make a 50.2% fall in total revenue.

Hotels with a sizeable proportion of non-hotel income fared better than their peers. For example, CENTEL’s hotel revenue shrank 66.5%, while non-hotel revenue dipped 18.1%, resulting in a total revenue dip of 37.7% in 2020. Total revenue of Veranda Resort Plc (VRANDA) grew 14.6% thanks to its property development business.

Source: https://www.bangkokpost.com/business/2114319/hotel-outlook-remains-negative

Thailand

Thailand