Thailand: Economy still likely to grow

The Thai economy is expected to grow 2.6% this year as the third wave of Covid is unlikely to affect the Stock Exchange of Thailand (SET) Index as much as the previous waves, says Asia Plus Securities (ASPS).

Investors are recommended to increase investments in the electric vehicle (EV) and clean energy industry which has shown high potential for long-term growth.

ASPS executive vice-president, Therdsak Thaveeteeratham, said the Thai stock market still has a positive outlook although the country’s economy and path to recovery have been shaken by the re-emergence of Covid-19. He said the government’s current measures to control the outbreak will impact economic activities less than those enforced last year as there are no lockdowns and curfews.

The government will also likely inject more money into the economy to help those affected by the new outbreak and expedite vaccine rollouts to curb the infection rate.

ASPS expects listed firms’ earning per share (EPS) in 2021 to be at 70.2 baht per share while total net profit is expected to rise 32% from the previous year. Moreover, one-third of the market’s net profits will be generated from energy and commodity stocks while 20% will come from banking.

“Excess liquidity is still high as is reflected in over 15.72 trillion baht of deposits in the system which began to move into more risky assets. There is also a steady increase in new stock trading accounts which rose by 270,000 in Feb 2021 or an eight-time increase from the same period last year,” said Mr Therdsak.

“While investment through mutual funds also saw a significant increase, long-term bond yields are also rising faster though short-term bond yields are still low as well as short-term interest rates. This will be followed by an uptrend in the stock market,” he said.

The Thai stock market in April will see a boost by momentum from speculation on dividend stocks. According to the statistics from the past 10 years, the SET Index enjoys the highest average increase — 3.1% — in April compared to other months as investors flock to high dividend stocks.

Investment strategies for the second quarter include investments in fundamental stocks that will benefit from the SET’s adoption of free-float adjusted market cap in calculating the SET Index such as Bangkok Bank (BBL), Bangkok Dusit Medical Services (BDMS), Sino-Thai Engineering and Construction (STEC).

ASPS recommends Asiasoft Corporation Plc (AS) as a mid-cap stock with high-profit growth.

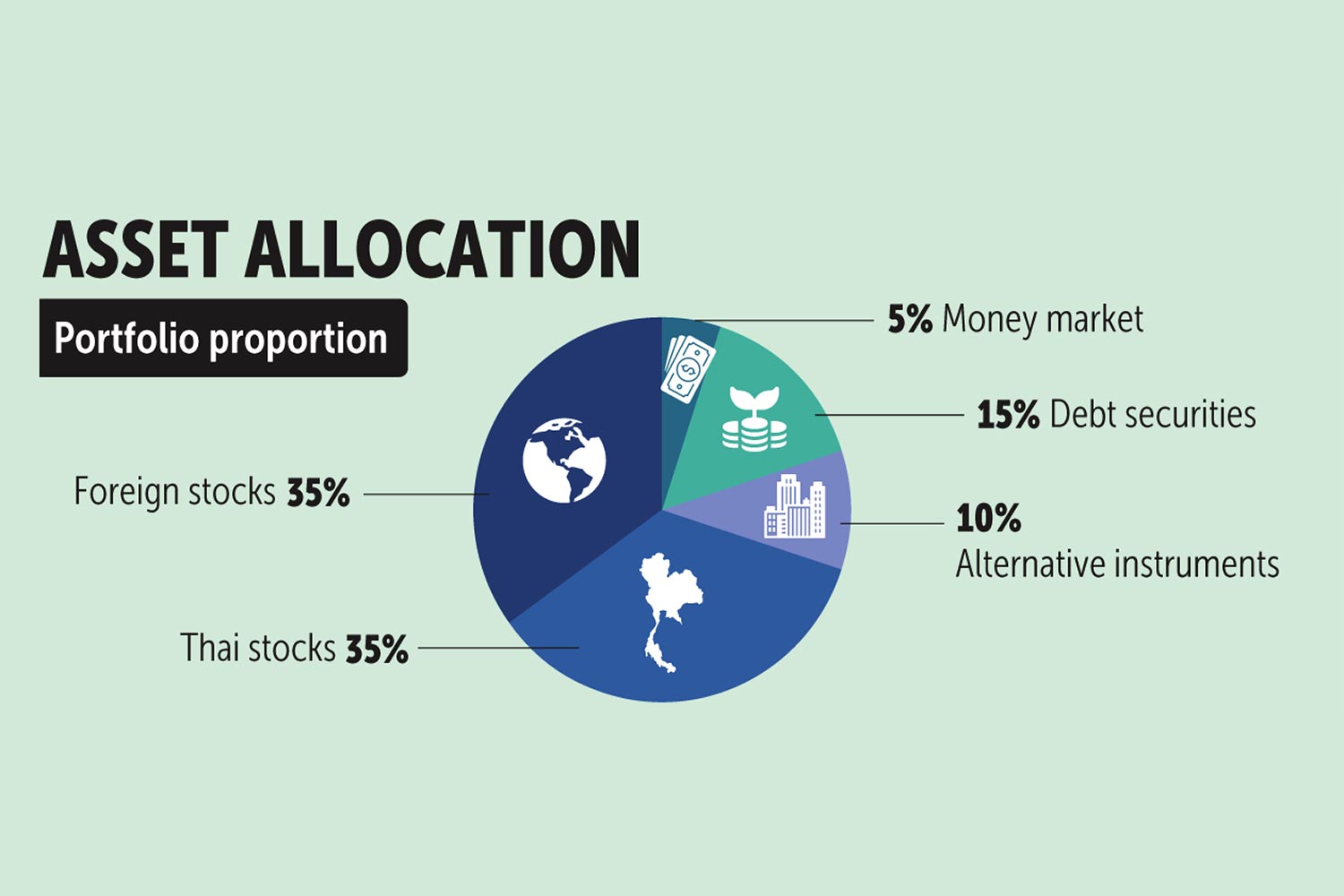

Padorn Suksawad, ASPS’ head of investment advisory and product and strategy, said investors should invest 35% in Thai stocks and 35% foreign stocks as the International Monetary Fund has upgraded the growth forecast for the world’s GDP to 6% and the global vaccination drive is also progressing at a moderate pace.

Source: https://www.bangkokpost.com/business/2103491/economy-still-likely-to-grow

Thailand

Thailand