Thailand: Economy expected to soar, or just improve

Thailand’s stock market is expected to continue its rosy bull run into 2018, assuming the rally will be buoyed by a domestic economic recovery and strong net profits from listed firms.

The Stock Exchange of Thailand (SET) index is likely to reach a new record high of 1,800 points in 2018, thanks to the country’s economic recovery impetus, increased net profits of listed firms and fund inflows headed to Asian equity markets, said Pote Harinnasuta, chief executive of One Asset Management (ONEAM).

The SET index is projected to reach 1,884 points in 2018, driven by positive factors at the macroeconomic level such as exports, tourism and private consumption recovery, Mr Pote said.

In addition to the government’s infrastructure investment projects in the Eastern Economic Corridor (EEC) worth 750 billion baht, the general election slated to take place in late 2018 could be a boon for market sentiment, he said.

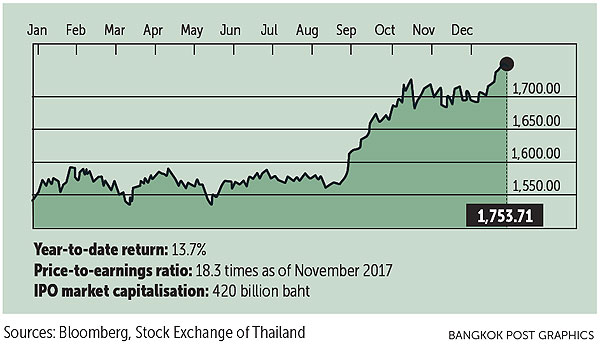

The recent buying spree in domestic mutual funds by institutional investors drove the SET to finish at 1,752.89 points on Dec 27, edging nearer to the highest close since 1994.

The benchmark climbed one point to 1,763.36, the highest intra-day level in almost 24 years.

The last time the SET index reached an all-time closing high was Jan 4, 1994, when the bourse settled at 1,753.73. The very next day saw an intra-day record high of 1,789.16.

Pote: Listed firms to see higher net profit

The SET index plunged during the 1997-98 Asian financial crisis, cratering at 214.53 in August 1998.

Fears of an overheated financial bubble in the bourse, as seen 20 years ago, are muted when considering the position of the stock market’s price-to-earnings ratio.

Prior to the crisis, the ratio stood at 18.3 times, a result of high financial liquidity, and relatively low bad loans in the banking sector.

Mr Pote said net profit of listed firms in the coming year is projected to increase following continuous economic growth and crude oil prices are anticipated remain at US$50 per barrel, keeping a lid on production costs.

The banking sector is considered attractive for investors in 2018 because it will be supported by government spending in infrastructure projects and rising exports.

ONEAM forecasts bank loan growth for 2018 will expand to 5.7% from a 4.5% estimate tin 2017, while non-performing loans are projected to decrease due to improved debt-servicing ability among businesses.

Consumer and retail sectors are poised to recover in 2018 in light of EEC projects’ role in increasing employment rate and boost consumption going forward.

Advertising and media are also projected to record a recovery following a Nielsen survey suggestion that ad spending will grow around 12-14% in 2018.

“Stocks will be the most attractive investment for 2018. [Investors] should accumulate stocks to invest in recovery sectors and purchase good fundamental stocks,” said Mr Pote.

Growing optimism

A rosy outlook is also foreseen by Montree Sornpaisarn, chief executive at Maybank Kim Eng Securities Thailand (MBKEST).

Thailand’s economic recovery will continue in 2018, propelled by growth in exports, private investment, manufacturing production, and a continuous recovery in private consumption, he said.

Government spending on infrastructure development projects in the EEC is expected help shore up private consumption further, Mr Montree said.

MBKEST forecasts Thailand’s economy will expand by 3.5-4% in 2018, but an upward revision will be made soon.

The SET index in 2018 is expected to beat its previous intra-day record high at 1,789 points in January 1994 given an upside gain on capital inflows, Mr Montree said.

Capital inflows flowing into the SET in 2017 kept entrepreneurs and investors gleeful as funds streamed their way.

Montree: Uncertain factors still at play

There were 44 new listings in 2017, including 22 deals listed on the SET, 16 deals listed on the Market for Alternative Investment, five real estate investment trusts and one infrastructure fund. These exclude merger and acquisitions and reverse takeover deals.

Total market capitalisation in 2017 IPOs reached an all-time high of 420 billion baht as the SET celebrated its 42nd anniversary.

Institutional investors are expected to embark on accumulative purchases of stocks in the consumer sector to capture benefits from a rise in private consumption, Mr Montree said.

Consumer stocks identified as investment targets are CP All Plc (CPALL) and Berli Jucker Plc (BJC), he said.

Sectors considered attractive for investment in 2018 include logistics: Precious Shipping Plc, (PSL), Wice Logistics Plc (WICE), Sahathai Terminal Plc (PORT); banks: Kasikornbank (KBANK), Bangkok Bank (BBL); and out-of-home media: Master Ad Plc (MACO), VGI Global Media Plc (VGI).

Despite growing optimism, a note of caution must be considered.

Uncertainty from US tax reform, the US Federal Reserve’s interest rate normalisation and Thailand’s general election are all known variables for 2018, Mr Montree said.

Private investment as key driver

The bull run is not constricted to 2017 and a horde of bulls will stampede the Thai bourse in 2018, with SCB Securities (SCBS) senior vice-president Pornthep Jubandhu giving the SET index an ultra-bullish outlook of around 1,900 points in 2018, a 12% rise from 1,700 points projected by SCBS in 2017.

The target is based on the assumption that earnings growth will be around 10%, or 1.5-2 times nominal GDP growth, which is forecast at about 5%, combined with 4% real GDP growth and inflation projected slightly above 1%.

“The key driver for 2018 is clearly the investment cycle, led by public investment, that we expect to grow 11-12%,” Mr Pornthep said.

Normally, real investment capital from the government is channelled into the economic cycle two years after infrastructure megaprojects are approved, he said.

At least 5% of the country’s GDP, estimated at 16-17 trillion baht, will be catalysed by these projects, which have been approved over 2016-17, such as the mass transit train projects, motorways and railway projects, Mr Pornthep said.

The investment budget for 2018, including the mid-year budget, is expected to be about 620 billion baht, higher than 500 billion baht registered in 2017, he said.

Additional infrastructure megaprojects that are expected to receive approval include the U-tapao aerotropolis and a high-speed train linking Don Mueang, Suvarnabhumi, and U-tapao airports.

“Public investment will ignite private investment, which is 2-3 times public investment,” Mr Pornthep said. “The capacity utilisation of the private sector has increased to more than 60%. At this level, we will start seeing new capacity expansion.”

Sectors expected to benefit from the investment efforts include construction and banking, in which investment cycles normally come with loan growth, he said.

Mr Pornthep said banks will also benefit from global inflation picking up, resulting in a wider spread in government bonds and higher costs for corporate bond issuance.

Geopolitical risks still remain in 2018. Financial markets will keep an eye on geopolitical tensions in both the Korean Peninsula and the Middle East, with general elections happening in many countries and monetary policy tightening by central banks seen as other factors keeping a lid on a bull run, he said.

Thailand

Thailand