Thailand: Digital asset licences at hand

The Finance Ministry’s announcement on approving digital asset licensing took effect Tuesday, and interested parties can apply for licences from the Securities and Exchange Commission (SEC).

Existing businesses that already operate a digital asset business or newcomers interested in obtaining licences as brokerage firms, traders or trading centres for digital assets can apply for official licences at the SEC.

“The SEC is [now] open for application approval for operating a digital asset business, as the Finance Ministry’s announcement on digital asset licences has come into force,” said SEC secretary-general Rapee Sucharitakul.

“The SEC is [now] open for application approval for operating a digital asset business, as the Finance Ministry’s announcement on digital asset licences has come into force,” said SEC secretary-general Rapee Sucharitakul.

“The SEC has a duty to standardise business practices to ensure that operators are well-equipped in terms of management, work systems, particularly an efficient technology systems, and a system to consider and evaluate customers’ suitability, which is very important because digital assets are high-risk.”

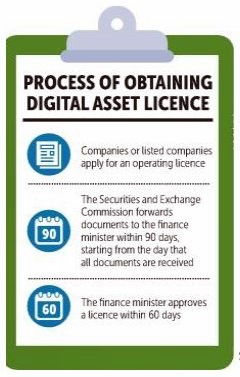

Once firms or listed companies make a filing for licence approval, the market regulator will forward documents to the Finance Minister within 90 days, starting from the day that the documents are received. Then the Finance Minister will consider licence approval within 60 days.

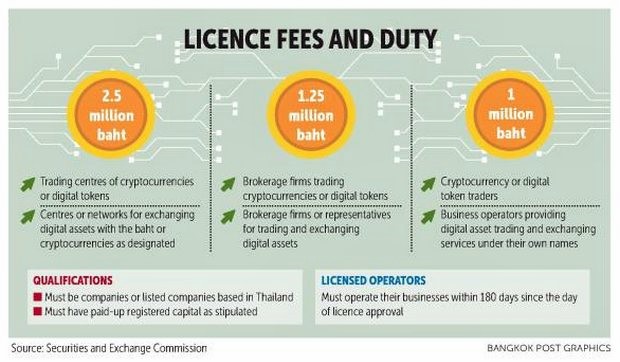

Qualifications for those seeking a licence to operate a digital asset business include being a company or listed firm with business operations based in Thailand; having paid-up registered capital as stipulated; and having a well-prepared work system and sound financial status. The directors, executives and company shareholders must also have SEC approval.

Companies seeking a digital asset licence must ensure that there are no conflicts of interest between their other operations and their digital asset business. Appropriate mechanisms to prevent a conflict of interest must be in place, and annual financial statements approved by an auditor must be provided. The firms must also maintain capital reserves in accordance with the law governing corporate conduct.

A royal decree on digital asset businesses went into effect on May 14. The new legislation was enacted to regulate digital asset offerings and businesses undertaking digital-asset-related activities.

Pursuant to the royal decree, digital assets cover cryptocurrencies, digital tokens and any other electronic data unit, as specified by the SEC.

Sellers of unauthorised digital tokens and those setting up unauthorised seminars to solicit cryptocurrency investment will be fined no more than twice the value of the digital transaction or at least 500,000 baht. They could also face a jail term of up to two years.

Sellers of unauthorised digital tokens and those setting up unauthorised seminars to solicit cryptocurrency investment will be fined no more than twice the value of the digital transaction or at least 500,000 baht. They could also face a jail term of up to two years.

Investors who make digital-asset-related trades will be liable for a 7% value-added tax (VAT) payment, on top of the 15% withholding tax on capital gains and returns from such investments.

Retail investors will be exempt from paying VAT if they trade digital assets through exchanges. Those who have no capital gains will only pay VAT. But investors will be required to pay VAT if their trades produce no capital gains.

Source: https://www.bangkokpost.com/business/news/1509446/digital-asset-licences-at-hand

Thailand

Thailand