Thailand: Current account under pressure

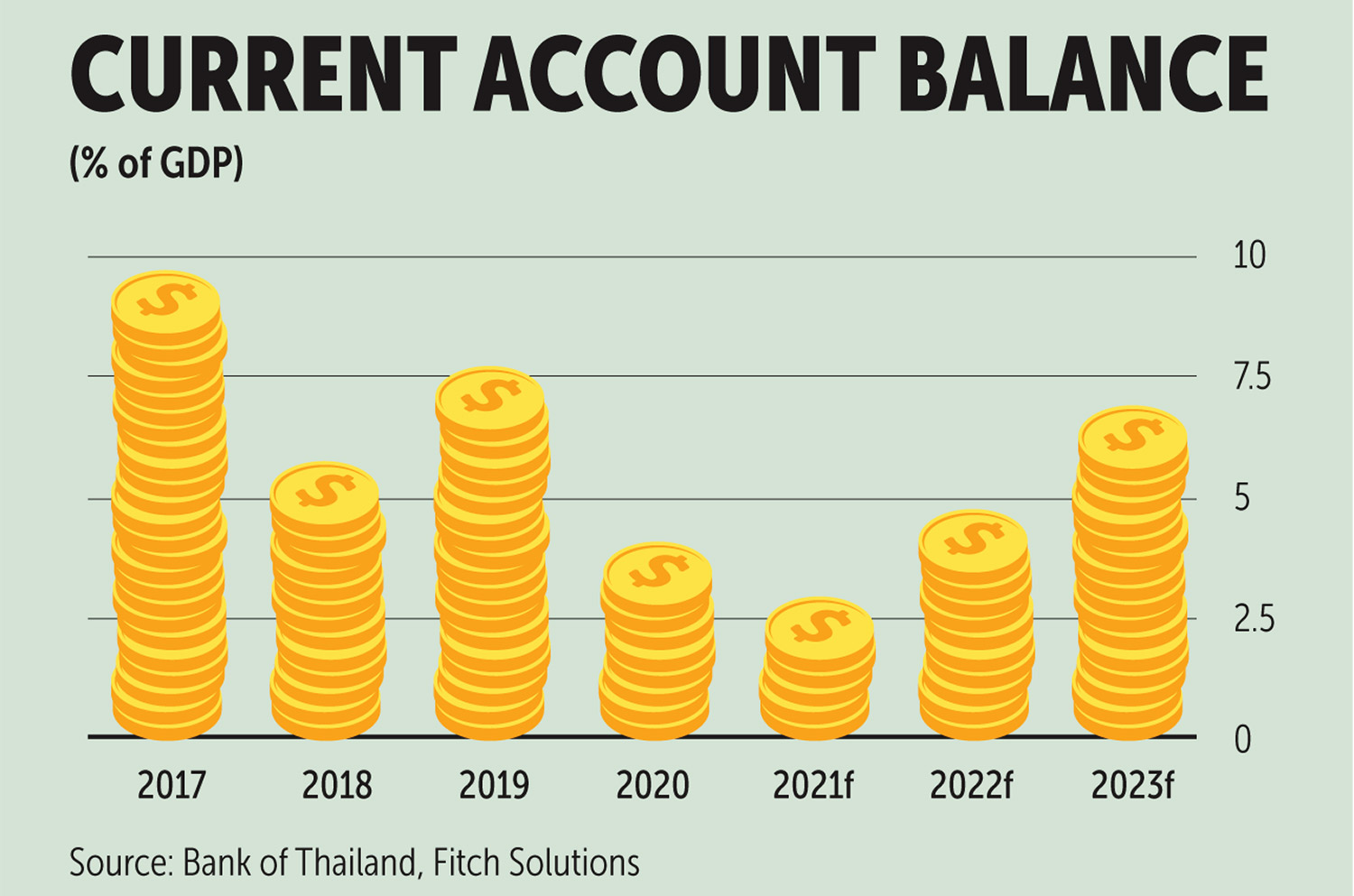

We believe Thailand’s current account surplus will shrink from 3.5% of GDP in 2020 to 0% this year, with the risk of falling into a full-year deficit.

For the year to July 31, the current account posted a US$9.3-billion deficit, compared with a surplus of $12.9 billion in the same period last year. This has led us to revise our forecast down from a surplus of 2.2% of GDP.

Continued weakness in tourism has handicapped service exports, while rising import costs due to higher commodity and freight prices have widened the deficit. We anticipate a cooling of domestic demand for imports in the second half of 2021 as Covid-19 disruptions weigh on private consumption and manufacturers pare back some purchases as uncertainty remains elevated.

Export growth will also ease due to weaker demand from Asia and supply-chain disruptions. And we do not expect a notable rebound in tourism until 2022 given the country’s difficulties containing Covid.

However, overall risks to the external position are low given large reserves and the temporary nature of the surplus decline; we forecast the current account to rebound to a surplus of 2.4% of GDP in 2022.

The trade surplus is forecast to narrow to 7.4% of GDP this year from 8.1% last year, before widening to 8.0% in 2022. We anticipate growth of goods exports to be strong and have revised up our forecast to 15% year-on-year from 10% predicted earlier.

GOODS TRADE BRISK

In the first seven months of this year, goods exports were up 19.4% as global demand rebounded. Thailand’s place in the supply chain for exports such as automobiles, electronics and intermediate goods has meant it benefits significantly when the global trade cycle is on an upturn.

The reopening of the US and European economies has provided a boost, although we note softening demand in Asia due to regional lockdowns and slowing growth in China.

Indeed, as base effects fade through the second half of 2021, we expect export growth to slow. Compounding this will be supply-chain issues that could weigh particularly on the auto sector. A shortage of semiconductors is likely to curb car production into 2022. We forecast goods exports to grow 5% in 2022 as these supply-chain constraints ease.

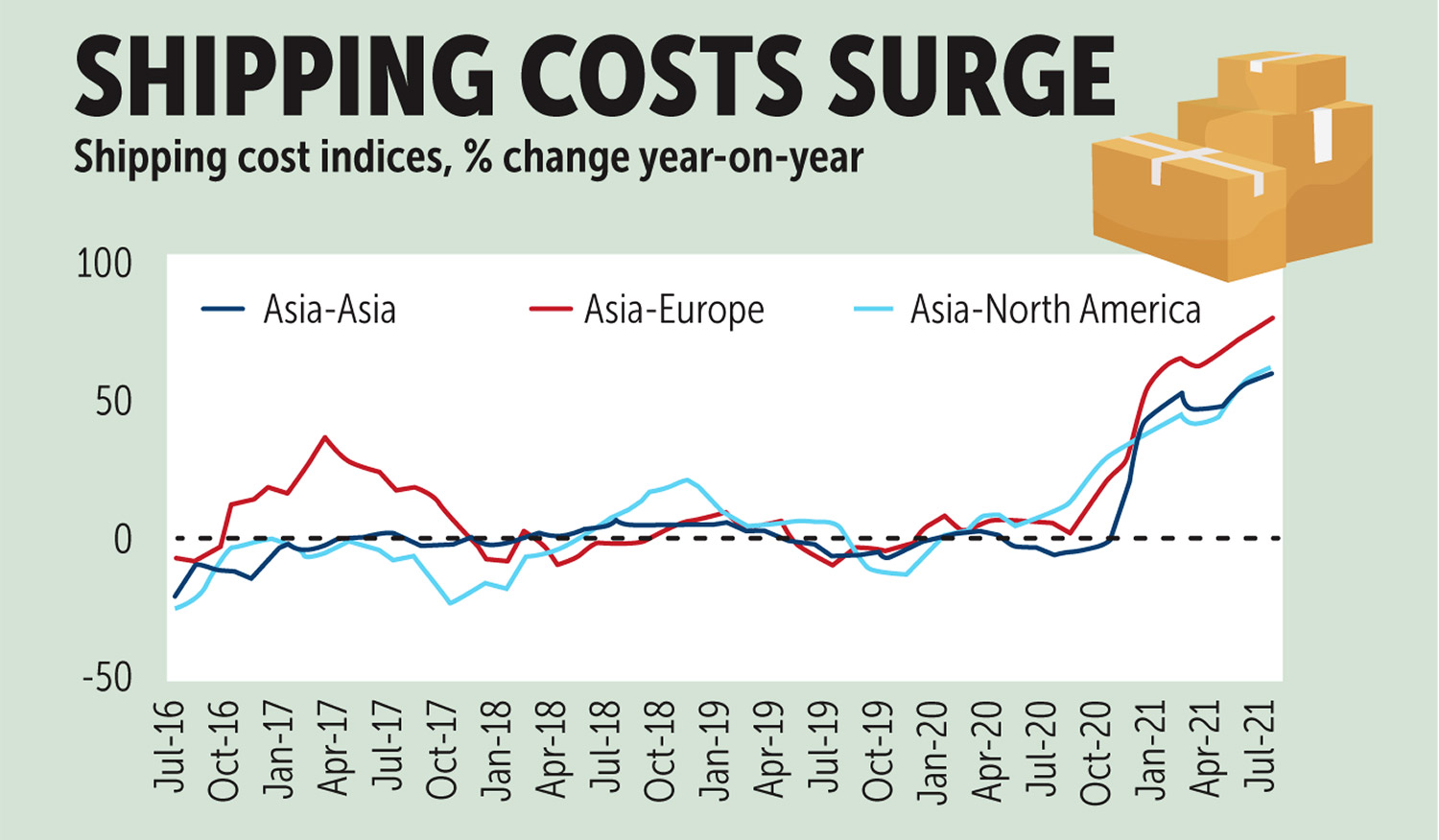

Strong import growth will drive the narrowing of the trade surplus. We forecast goods imports to rebound from a contraction of 13.8% in 2020 to growth of 20% in 2021. The key driver will be higher commodity prices, rising shipping costs and the front-loading of input purchases in the first half of 2021 due to supply disruptions.

Indeed, Thailand’s goods imports were up 25.5% year-on-year from January to July. But lockdown measures in the third quarter, general economic uncertainty and supply-chain disruptions will keep demand for consumption and investment imports contained. As such, we expect goods imports to grow a further 3.0% in 2022, with domestic consumption and investment picking up.

The major drag on the current account balance will be the widened services deficit. In 2020, Thailand posted its first services deficit since 2011, at 3% of GDP. We expect the deficit to widen further to 5.4% in 2021, given still lacklustre tourism and higher freight costs.

Despite a partial reopening via the Sandbox initiative, tourism has failed to rebound strongly. Less than 100,000 visitors arrived in the year to July, compared with 23.1 million in the same period of 2019.

Authorities hope for an uptick in the second half of 2021 but a low vaccination rate and the surge in cases in the third quarter will likely mean that activity remains subdued. We forecast service exports to fall 20%, having already contracted 60.9% in 2020, reflecting the economic drag from the loss of tourism.

Services imports have proved more resilient, with a contraction limited to 17.7% in 2020 and growth of 12.5% expected this year. We flag potential upside over the coming quarters given surging freight service costs.

Shipping costs have soared globally due to the sudden rebound in trade and disruptions to ports and air travel. As of July, shipping cost indices for Asia-Asia, Asia-Europe and Asia-North America were up 58.1%, 76.9% and 60.2% year-on-year (see chart). This will put upside pressure on service imports, which will only partially be offset by weakened demand for other services amid the Covid disruption.

LIMITED RISK

Given our forecast for the current account to be broadly balanced in 2021, there is a high possibility of it slipping into a deficit if external demand weakens or import costs continue to rise. However, we believe this would pose limited risks to the overall external position.

Reserves coverage is high, despite a 5.1% year-to-date decline in foreign reserves as of Sept 3. We forecast the import coverage ratio to stand at 10.3 months in 2021, down from 12.7 months in 2020 but far exceeding the minimum of three months recommended by the IMF.

External debts have risen only moderately relative to GDP through the pandemic as well, from 34.2% in the fourth quarter of 2019 to 35.9% in the first quarter of 2021.

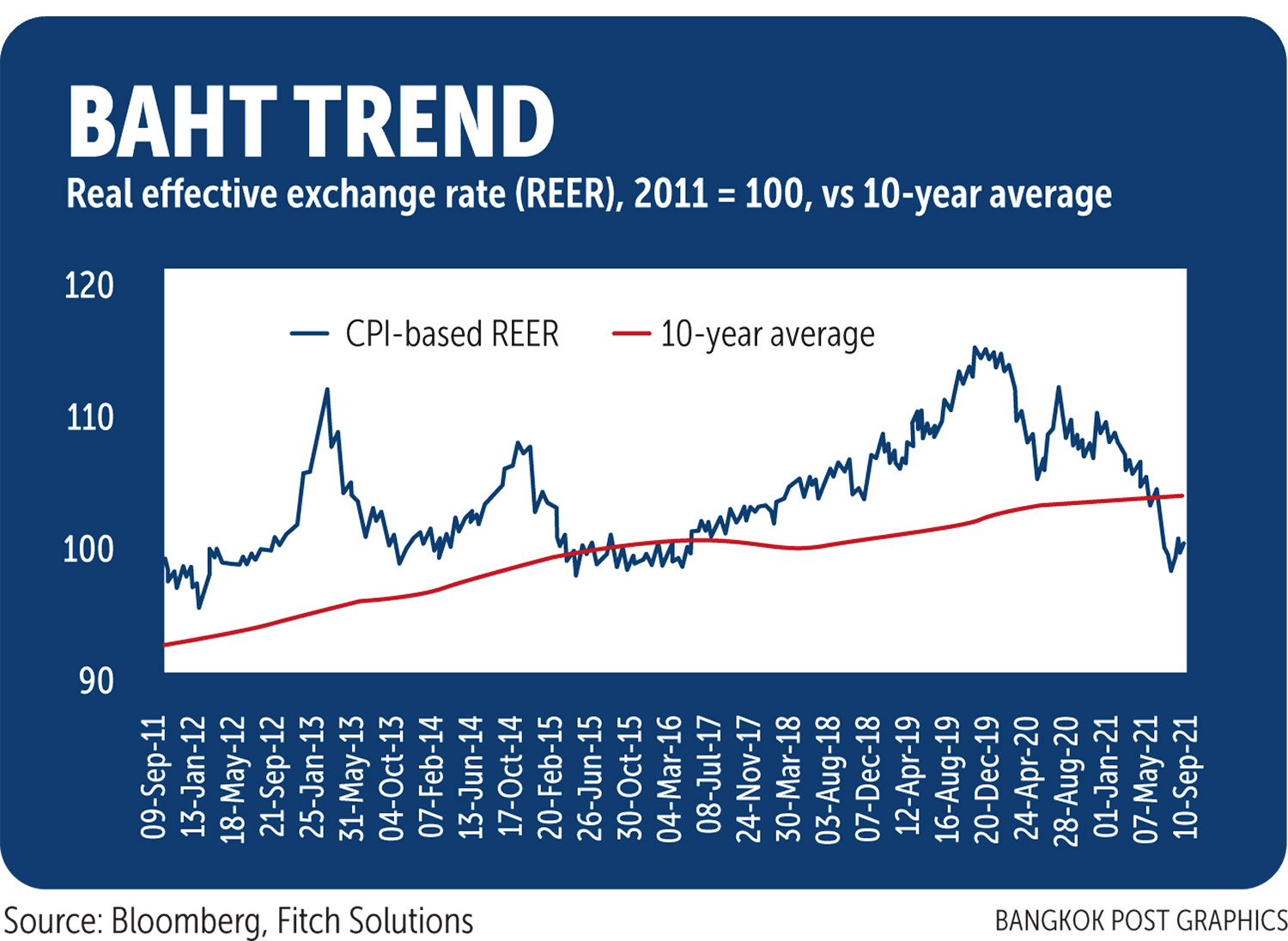

The potential depreciatory effect of a current account deficit on the baht could provide some upside for the tourism sector. The baht appears to have reverted to being undervalued relative to its long-term average. This has not occurred since 2016 and could spur a faster than expected revival in tourism once pandemic uncertainty abates.

Source: https://www.bangkokpost.com/business/2186387/current-account-under-pressure

Thailand

Thailand