Thailand: Credit inquiries climbing as household debt swells

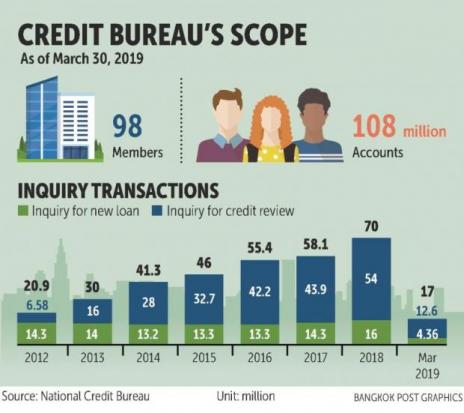

Credit inquiries at the National Credit Bureau (NCB) are expected to hit another record high this year amid mounting anxiety over swelling household debt.

The number of credit inquiries for existing borrowers is estimated to reach 60 million this year after 12.6 million were made during the first three months, said NCB chief executive Surapol Opasatien.

Increasing household debt has stoked demand for credit reviews to check debtors’ payment ability, he said.

Last year, inquiries for credit reviews set a record at 54 million transactions, up from 43.9 million in 2017, 42.2 million in 2016, 32.7 million in 2015, 28.1 million in 2014, 16 million in 2013 and 6.58 million in 2012.

Credit inquiries for new loans are also expected to set a record in 2019 after tallying 16 million last year, Mr Surapol said.

During the first quarter, inquiries for new loans reached 4.36 million transactions.

The increase in credit inquiries could partially be attributed to the government’s mortgage scheme for 1 million low-cost homes, while the Bank of Thailand’s stricter mortgage requirement will come into force from April 1, he said.

Growing demand for auto loans also raised the number of credit checks for new loans, Mr Surapol said.

In 2012, credit inquiries for new loans numbered 14.3 million when the Yingluck Shinawatra government launched the excise tax rebate under the first-time car buyer scheme.

Thailand’s household debt amounted to 12.6 trillion baht and represented 77.8% of the country’s GDP at the end of last September, according to central bank data.

Household debt rose 5.9% year-on-year, faster than the economic growth rate of about 4%.

“The 2019 motor show [which ended earlier this month] delivered rapid growth in both new car sales and auto loans,” Mr Surapol said. “This led to concerns about asset quality and household debt, which explains why the central bank is closely monitoring the situation.”

The number of new car loan accounts is expected to be higher than last year, assuming that new car sales will exceed 1 million units.

New auto loan accounts for both new and used cars totalled 1.56 million in 2018, up from 1.33 million in 2017 and 1.23 million in 2016.

Delinquent auto loans have continued to increase over the past few years, largely from Generation Y. In 2018, 450,000 auto loan accounts with total lending of 130 billion baht to millennials turned sour.

Auto loans are a concern for the Bank of Thailand, and the market expects car lending to come next on the central bank’s list for tougher criteria to prevent financial stability from deteriorating after measures to control credit cards, personal loans, car title loans and mortgages were launched.

Mr Surapol said the regulations will control household debt but the increase in income is also needed to bring down overall household debt.

Source: https://www.bangkokpost.com/business/news/1662672/credit-inquiries-climbing-as-household-debt-swells

Thailand

Thailand