Thailand: Condo joint ventures trending

More foreign developers have been coming to Thailand to form joint ventures with Thai developers in recent years. Japanese developers in particular have been pursuing long-term relationships in the country since 2013.

The two pioneering ventures involving Japanese firms were Ananda Development Plc with Mitsui Fudosan and AP Thailand with Mitsubishi Estate. More Japanese firms have followed, and Chinese companies are also showing growing interest in teaming up with Thai partners on projects that can be marketed to Chinese buyers.

Most of the joint-venture projects being built are condominiums, since the Condominium Act allows foreigners to own up to 49% of the residential space in a condominium. But some Thai developers have embarked on detached housing projects with their foreign partners, because they are keen to learn about innovation from foreign developers, especially energy-saving systems.

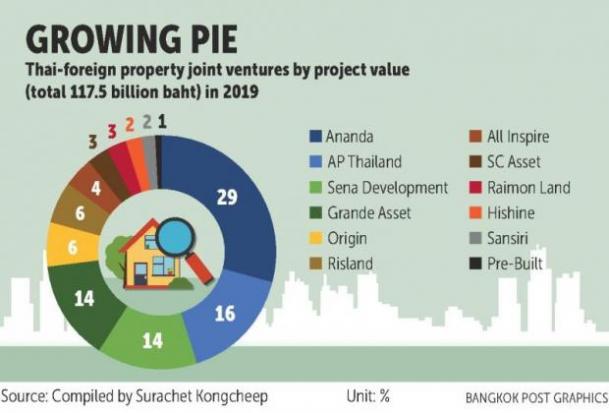

The cumulative value of joint-venture property projects involving Thai and foreign developers is now more than 500 billion baht and shows every sign of growing further. Twenty-five such projects announced already in 2019 call for a total investment value of 117 billion baht, an increase of 7% from last year.

Most of the new projects are in areas along the existing skytrain and subway lines in inner areas of Bangkok. But joint-venture companies have announced plans for three housing estates in Bangkok suburbs with a total value of 17.2 billion baht.

Thai developers with Japanese partners are not expecting to attract buyers from Japan, but they do want to tap into advanced technology and innovation from that country. Developers from China and Hong Kong, however, are keen to market projects developed with Thai partners to Chinese buyers, who are becoming the largest foreign buyer group in Thailand. Consequently, Chinese developers expect a significant degree of management control over the business, so their joint ventures are all with small and medium-sized Thai developers rather than large, established players.

Current market conditions, however, might slow the momentum of Thai-foreign joint ventures. Most foreign developers expect to see an investment return from condominium projects in a relatively short term. But unit sales and transfers have been slowing lately, primarily due to a market glut and the impact of tougher mortgage lending rules. As a result, developers gearing up to launch new joint-venture condominiums will be keeping a close eye on the number of unsold units in their inventory.

Source: https://www.bangkokpost.com/business/news/1671300/condo-joint-ventures-trending

Thailand

Thailand