Thailand: BoT tempers GDP outlook

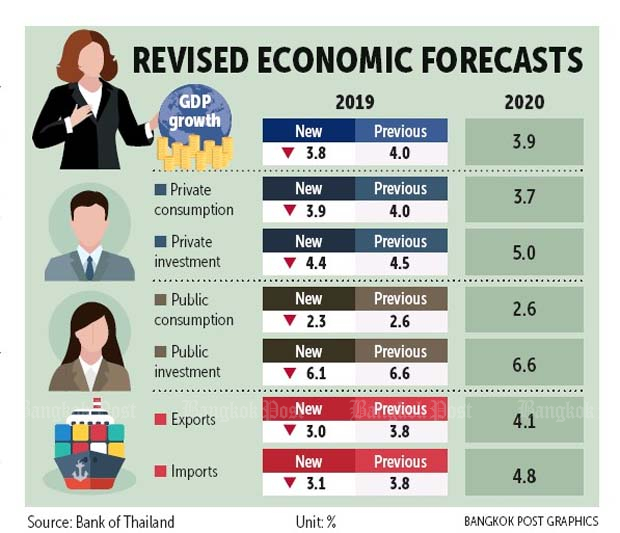

The Bank of Thailand is less optimistic about the country’s economic outlook, trimming its 2019 growth forecast to 3.8% from 4% amid sluggish export demand and keeping the policy rate unchanged as widely expected.

The seven-member Monetary Policy Committee (MPC) voted unanimously on Wednesday to maintain the policy rate at 1.75% for a second straight meeting after hiking it, by 25 basis points, in December for the first time in more than seven years. At February’s meeting, with one member absent, the MPC voted 4-2 for a rate pause.

The accommodative stance contributes to continued economic growth and is appropriate given the inflation target, according to a Bank of Thailand statement.

“The committee assessed that the economy would expand around its potential, but at a slower pace than previously assessed because of a slowdown in external demand,” the central bank said.

Against the backdrop of heightened global economic uncertainty, the Bank of Thailand slashed its projection for payment-based exports this year to 3% from 3.8% predicted in December, said MPC secretary Titanun Mallikamas.

The import growth forecast was cut to 3.1% from 3.8%.

The downward revision could be due to softer global demand amid the trade spat between the US and China.

In December, the central bank cut its 2019 economic growth forecast to 4% from 4.2% predicted in September.

The private consumption growth forecast was marginally trimmed to 3.9% from 4% predicted three months ago, while the private investment view was cut to 4.4% from 4.5%.

Although domestic demand will continue to gain traction, private consumption is restrained by elevated household debt, Mr Titanun said.

The growth projection for government consumption was lowered to 2.3% from 2.6% seen in December, and the public investment forecast was reduced to 6.1% from 6.6%.

The central bank will further monitor the domestic and global economies, including the US-China trade dispute, while a data-dependent approach continues when considering the policy rate.

“The central bank will also use both micro- and macroprudential measures to manage monetary policy,” Mr Titanun said. “After using measures to control the asset quality of mortgages, the Bank of Thailand will pay more attention to elevated household debt.”

Tim Leelahaphan, an economist at Standard Chartered Bank Thai, said that “domestic drivers such as ongoing financial stability risks and strong domestic demand (even as the US-China trade conflict has affected Thai exports) support our view that hikes will resume this year”.

He predicted one rate hike each in the second and fourth quarters, by a quarter-point each time.

“We note that inflation is playing a reduced role in monetary policy decision-making, with the inflation target of 1-4% likely to be adjusted next year,” Mr Tim said.

JP Morgan said in a note that it was difficult to determine whether the shift in vote composition was a function of Wednesday’s meeting being just a few days before the general election or whether a more durable change in policy bias is emerging in response to a more uncertain growth outlook.

Source: https://www.bangkokpost.com/business/news/1648332/bot-tempers-gdp-outlook

Thailand

Thailand