Thailand: BoT cuts shipment outlook as contraction lingers

The Bank of Thailand has become cautious in its export outlook, predicting the country’s payment-based outbound shipments will shrink in the first quarter after a year-on-year contraction in January exports.

The export contraction is expected to extend into February and persist through the first quarter, given external risks and a high-base effect, said Don Nakornthab, senior director of the economic and policy department.

“The central bank is reviewing forecasts for export growth and overall economic data, as is normal practice on a quarterly basis,” Mr Don said. “If the export growth projection is slashed, this year’s economic growth forecast will remain steady if it is offset by other engines.”

The central bank’s Monetary Policy Committee (MPC) is scheduled to review its economic growth forecast at the upcoming meeting on March 20.

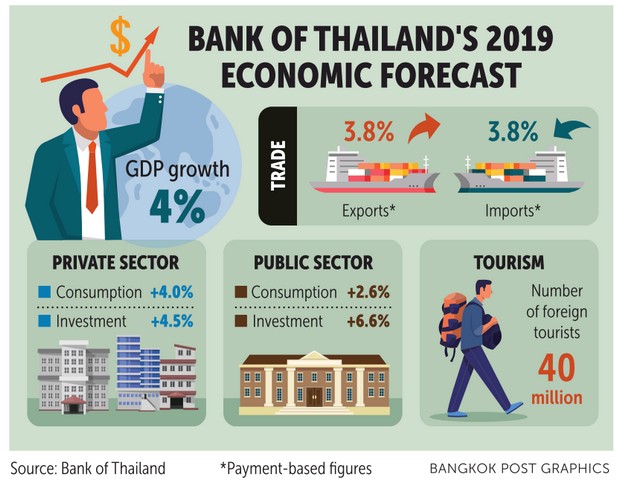

In December, the Bank of Thailand slashed its forecast for payment-based 2019 export growth to 3.8% from 4.3% predicted in September, and economic growth for the year to 4% from 4.2% projected previously.

In January, the value of payment-based merchandise exports contracted 4.7% from a year earlier, widening from a 1.6% fall in December. The contraction is in line with the regional economic slowdown based on weaker global demand and protectionist trade policies between the US and China.

On a month-to-month basis, however, exports fared better in January and the momentum continued into February.

Thailand’s shipments to China fell 10% in January as the mainland’s demand was thin, though exports to other major economies expanded. Thailand’s export contraction is mid-range, like its regional peers, although other currencies gained against the US dollar at a slower pace than the baht.

Mr Don said the MPC has requested the central bank monitor the effect from the export decline on domestic consumption, but none have been detected yet.

The central bank, however, will continue to monitor the situation, he said.

The country’s employment rate has remained in a healthy range.

Internal demand also showed positive momentum, especially domestic consumption and investment, said Mr Don.

In January, private consumption continued to expand in all categories and purchasing power also increased in tandem with the improved consumer confidence index.

Higher private investment was attributed to both domestic and foreign direct investment (FDI).

FDI in January amounted to US$898 million (28.3 billion baht), rising significantly from $727 million in the previous month partly because of property purchases by offshore buyers, particularly Chinese and Hongkongers, he said.

In addition, Mr Don said geopolitical factors created higher risk, particularly the unexpected India-Pakistan border crisis.

In addition, Mr Don said geopolitical factors created higher risk, particularly the unexpected India-Pakistan border crisis.

The external risk strengthens the dollar and leads to a weaker baht in line with other regional currencies.

On Thursday the baht weakened to 31.48 against the dollar after reaching a five-year high last week just shy of the 31 mark.

The local currency retreat was attributed to cautious trade talks and the growing tension between India and Pakistan.

The baht has emerged as the best performing currency in Asia, gaining around 3.5% so far this year.

Mr Don said it is too early to predict how the India-Pakistan border crisis will pan out, and the central bank needs to monitor the situation.

Thai exports to India represent 3% of the country’s total shipment value, while Indian inbound tourism represented 4.2% of the total.

Thailand has no significant trade exposure to Pakistan.

Central bank governor Veerathai Santiprabhob said the unexpected India-Pakistan border crisis will create higher risk globally and it could impact the Thai economy.

Domestic demand remains strong and could lend support to the Thai economy, he said.

Meanwhile, Finance Minister Apisak Tantivorawong said the ministry could launch economic stimulus measures during the general election campaign period if they are needed to maintain growth momentum.

The ministry has refrained from using fiscal policy to boost the economy during the election campaigns to avoid being criticised for political tinkering, he said.

A raft of economic stimulus packages have been rolled out ahead of the poll date on March 24 to prevent economic momentum from losing steam as the ministry saw risks in the first three months this year, he said, without noting the timing of such pump-priming measures.

Over the past three years, the government has unveiled measures to help fragile sectors including welfare and subsidies for low-income earners, in additional to a series of the economic stimulus measures.

Commenting on the mounting tension between India and Pakistan and the lingering trade dispute between the US and China, Mr Apisak said the impact is global.

Source: https://www.bangkokpost.com/business/news/1637046/bot-cuts-shipment-outlook-as-contraction-lingers

Thailand

Thailand