Thailand: BoT chews over e-marketplace proposal

The Bank of Thailand is mulling requests made by six financial institutions to offer their own e-marketplace platforms, viewed as an effort to gain a first-mover advantage in online financial services to guard market share ahead of the full-scale entry of technology and payment behemoths.

Five of the institutions are banks and the other is a non-banking firm that is a bank subsidiary, said Siritida Panomwon Na Ayudhya, the central bank’s deputy governor.

The Bank of Thailand has issued regulations governing financial institutions engaged in the e-marketplace, effective from Jan 16, 2018. According to the regulations, those interested in operating in the e-marketplace are required to inform the central bank at least 30 days before setting up shop.

The central bank will also provide consumer protection by requiring service providers to report business transactions and volume, consumer complaints and solutions on a quarterly basis. The reports must be submitted to the Bank of Thailand 15 days after the end of the quarter.

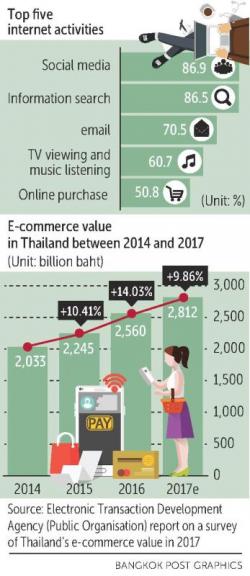

Amid the digital age, social media and payment giants through online financial services can grab market share from brick-and-mortar financial institutions, forcing the latter to jump onto the online financial service bandwagon to stay afloat.

Kasikornbank recently announced its readiness to launch an e-marketplace platform, while Siam Commercial Bank is also keen to get in on the action.

With the e-marketplace regulations, the central bank allows banks and non-banking companies to display, buy, sell and offer payment services for goods and services sold via the platform. But these firms are barred from providing logistics services.

Financial institutions can cooperate with logistics providers to serve consumers, Ms Siritida said.

“Financial institutions that want to offer the service should have knowledge of merchants, goods and services, as well as customer quality standards well before operating on the platform,” she said. “This will lead to consumer trust in each financial institution.”

Ms Siritida said the e-marketplace drive comes amid changing consumer behaviour. The platform will allow local online vendors to operate with lower costs, while giving small and medium-sized enterprises better access to funding.

Online payment through both internet and mobile banking numbered 589 million transactions as of June 2017, compared with 825 million for the whole of 2016, according to the central bank.

Pawoot Pongvitayapanu, president of the Thai E-Commerce Association and founder of Tarad.com, said it’s crucial for banks to enter the e-marketplace to protect their customer bases and revenue because global e-commerce giants provide a complete ecosystem: e-commerce, e-payment and lending.

“Those global giants are versed in big data analytics, which can analyse sales,” Mr Pawoot said. “They can also give loans to consumers to buy products via their platforms, threatening banks’ revenue.”

Banks only have customer databases without transaction details, so when they are expanding into the e-marketplace they will get more customer data, he said.

“Banks need to team up with local e-marketplace players to make a swift transition, as the service requires different know-how and skills,” Mr Pawoot said.

Source: https://www.bangkokpost.com/business/news/1404662/bot-chews-over-e-marketplace-proposal

Thailand

Thailand