Thailand: Banks off to a bright start with earnings growth

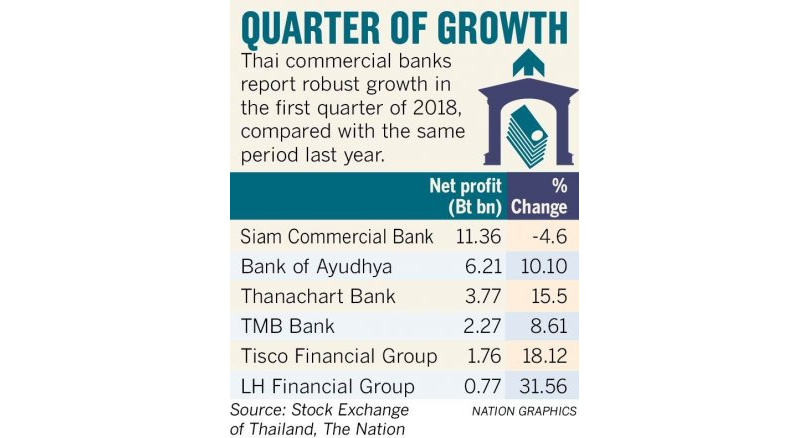

ALL but one of the six banks that have reported for the year’s opening quarter have enjoyed strong earnings growth, benefiting from the country’s sustained economic growth that is driving demand for new loans, bank executive say.

The five listed commercial banks on the plus side of the ledger posted solid growth in net profit for the first quarter.

LH Financial Group led the way with a jump of 31.56 per cent in net earnings from the same period of last year to Bt771.08 million.

For Bank of Ayudhya Plc, or Krungsri, its net profit of Bt6.2 billion was a record for the lender, up 10.1 per cent from the same quarter of last year.

TMB Bank Plc announced net profit of Bt2.27 billion for the quarter, up 8.61 per cent.

Tisco Financial Group raked in net profit of Bt1.76 billion, a jump of 18.12 per cent from the first quarter of 2017.

Thanachart Bank’s Bt3.7 billion in net profit marked a rise of 15.5 per cent from the same period last year.

Bucking the positive trend was Siam Commercial Bank Plc, which reported net profit of Bt11.36 billion for the three months, down 4.6 per cent from the year-earlier quarter.

Krungsri president and chief executive officer Noriaki Goto said that the bank has made a strong start to the year with its record earnings for a quarter. The result was a 9.4 per cent increase from the fourth quarter of last year.

The record result came despite the recurring seasonal impact generated by loan repayments in the first quarter, Goto said.

The solid performance was largely attributed to higher operating income and effective expense management, which underscores the bank’s competitive strengths and well-balanced portfolio. With the continued improvement in asset quality, the bank’s first-quarter non-performing loan (NPL) ratio was further reduced to 1.96 per cent, a fresh low since the Asian financial crisis, Goto added.

On the business outlook for 2018, Goto said the company expects the economic momentum to gain further traction, supported by sustained growth in export and tourism sectors together with the accelerated implementation of public infrastructure investments. These would provide catalysts for private investment and loan demand, he said.

“Under this favourable outlook, we maintain our GDP forecast of 4 per cent, which will contribute to Krungsri’s broad-based loan growth in the range of 6-8 per cent for 2018,” Goto said.

TMB Bank Plc’s CEO Piti Tantakasem said yesterday that the bank’s results for the quarter showed momentum in both deposit and loan growth as well as the lender’s prudent management of asset quality.

TMB generated Bt5.109 billion of pre-provision operating profit (PPOP), which represented 7 per cent growth from the same period last year. The bank set aside Bt2.305 billion for provisions to maintain coverage ratio at a high level of 142 per cent, while the NPL ratio stayed relatively low at 2.4 per cent. After provisions and tax, TMB reported net profit of Bt2.28 billion, a 9 per cent increase from the same period last year.

Meanwhile, performing loans grew by 0.4 per cent to Bt628 billion, driven mainly by the retail segment as mortgages continued to grow, by 4 per cent, in the first quarter. The momentum on mortgage is a result of process improvement and more efficient turnaround time, Piti said, On the commercial lending side, large corporate lending registered 2 per cent growth and small and medium-sized enterprises (SMEs) continued their recovery momentum with 1 per cent growth from the previous quarter.

Overall, TMB generated total operating income of Bt9.383 billion, a 5 per cent increase, while operating expenses were Bt4.265 billion, an increase of 4 per cent, he said.

Thanachart Bank Plc’s chief executive officer and president Somjate Moosirilert said that in the first quarter of this year its customer-focused strategy continued to produce strong results, with earnings growing for a 30th straight quarter.

“We have continue to create and deliver value to our customers while driving top-quartile efficiency gains,” he said. “Our market leading position in hire purchase loans grew almost 9 per cent and we registered good gains in our retail franchise, particularly in the SME segment. Our risk culture is strong, our NPL ratio continues to be among the best in the sector, and we remain well capitalised with a capital adequacy ratio of 18.8 per cent.”

Source: http://www.nationmultimedia.com/detail/Corporate/30343503

English

English