Thailand: Baht surges to 5-year high near 31

The baht soared to its highest level against the dollar in more than five years on Wednesday, on hopes that the US and China would be able to secure a trade deal and avert retaliatory tariffs. Analysts expect the local currency to continue marching past the 31-baht mark.

The baht’s rapid gain could be due to dollar weakness as investors place bets that the US-China trade talks will reach a deal and that the US Federal Reserve will pause rate hikes for the rest of the year, said Roong Sanguanruang, head of global market research and analysis at Bank of Ayudhya.

She said the baht is the target of foreign fund inflows, due to Thailand’s high current account surplus.

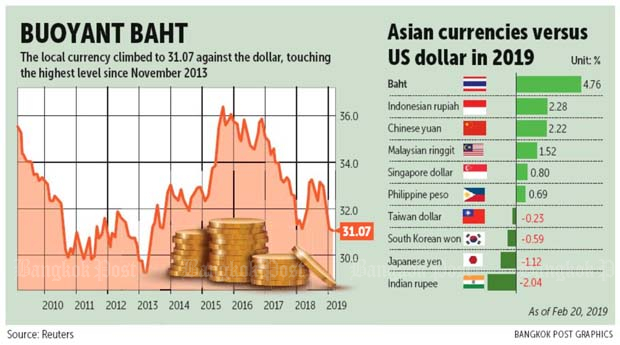

The baht is the best-performing currency in Asia, rising 4.7% so far this year to Wednesday’s 31.07 — the highest level against the US dollar since November 2013. Indonesia’s rupiah is second with a 2.3% gain, followed by the Chinese yuan at 2.2%.

Local exporters’ sell-off of the US dollar for the baht and foreign direct investment (FDI) to Thailand gave a boost to the baht this year, though portfolio investors have a net selling position, she said.

Given the US central bank’s signalling of a pause throughout this year, fund inflows could be reversed to Asia and the baht is likely to rise above 31 against the greenback, Ms Roong said.

Bank of Thailand governor Veerathai Santiprabhob last week voiced concerns over the rapid baht run-up but insisted that the stronger baht did not stem from December’s 25- basis-point policy rate hike, given net fund outflows worth nearly US$300 million (9.33 billion baht) as of Feb 13 from investment portfolios.

Bank of Thailand governor Veerathai Santiprabhob last week voiced concerns over the rapid baht run-up but insisted that the stronger baht did not stem from December’s 25- basis-point policy rate hike, given net fund outflows worth nearly US$300 million (9.33 billion baht) as of Feb 13 from investment portfolios.

The governor’s comment was echoed by the Monetary Policy Committee’s minutes from the Feb 6 meeting, released Wednesday, which said the baht strengthened mainly due to the weakening dollar.

The baht’s movement was in line with those of emerging markets and regional currencies, while the nominal effective exchange rate index appreciated due to Thailand’s strong external stability, which was partly reflected by the sustained current account surplus, the minutes said.

The committee added that the economy is likely to reach its potential but would experience increased uncertainties from external and domestic factors that could affect economic growth in the period ahead.

These uncertainties include trade protectionism measures between the US and China that could be prolonged and effect trading partners’ economies and consequently Thailand’s merchandise exports, a worsening outlook for Chinese economic growth, and the progress on infrastructure investment projects that could have important consequences for private investment.

A trader at Krungthai Bank, Jittipol Pruksamethanon, cited high demand for the baht prompted by the country’s current account surplus, the bright outlook of the US-China trade negotiations and the US dollar’s retreat.

“These factors could push the baht to strengthen further to 30.75 to the dollar,” Mr Jittipol said.

Kasikorn Research Center said that if the US-China trade talks show positive signs and the Fed follows through on its hints of slower rate hikes at the March meeting, the dollar will be pressured and the baht will climb higher.

Source: https://www.bangkokpost.com/business/finance/1632290/baht-surges-to-5-year-high-near-31

Thailand

Thailand