Thailand – Arkhom: 40m arrivals by 2024

Thailand is expected to return to the pre-pandemic level of international arrivals of almost 40 million in five years, according to Finance Minister Arkhom Termpittayapaisith.

Speaking at a seminar held on Wednesday by the Securities and Exchange Commission (SEC), he said the tourism sector is expected to recover gradually, with a great number of foreign arrivals in 2023 once the country opens to more international tourists as the pandemic spread eases.

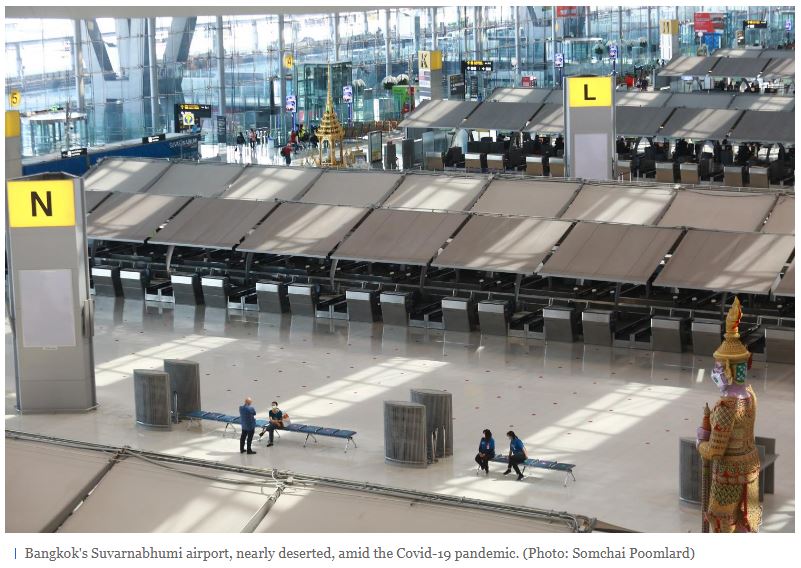

Foreign tourist arrivals reached 6.7 million last year, generating revenue of about 300 billion baht, a far cry from almost 40 million arrivals in 2019 generating revenue of almost 2 trillion baht.

Tourist receipts account for 12% of Thailand’s economy, the second largest tally in Southeast Asia.

Once the economy recovers, Mr Arkhom pledged his ministry is set to ramp up the tax base, enticing as many people as possible to enter the tax system to create government revenue.

Regarding Thailand’s capital market development, he said the market has been fully digitalised and he wants responsible bodies to pay heed to two vital issues: cybersecurity and cyber-resilience of the capital market.

Cyber-resilience is the ability of an organisation to enable business acceleration (enterprise resiliency) by preparing for, responding to, and recovering from cyberthreats. A cyber-resilient organisation can adapt to known and unknown crises and challenges.

Personal information protection is also crucial, as any privacy disclosure requires prior consent from users, said Mr Arkhom.

He said to develop the country’s capital market, the Finance Ministry has proposed to related authorities using existing mechanisms or market networks to help businesses hit hard by the pandemic. The goal is to create a level playing field for enterprises of all sizes to gain easier access to the financial and capital markets.

The ministry also proposed amendment of strict capital market laws and regulations, in line with the changing context of digital assets and cryptocurrency.

The capital market should be promoted for fund mobilisation for social and environmental businesses, and as a venue that promotes good corporate governance, said Mr Arkhom.

He suggested the capital market beef up its digital infrastructure development, applying digital innovations to build the market, while speeding up promotion of digital capital mobilisation via security token offering (STO) through altering regulations to accommodate such fundraising. An STO is a type of fundraising where a company offers tokenised securities.

Source: https://www.bangkokpost.com/business/2089215/arkhom-40m-arrivals-by-2024

Thailand

Thailand