Thailand: 2020 budget signals greater stimulus

The passing of the budget for the 2020 fiscal year highlights the growing importance of government stimulus in supporting the Thai economy.

The delayed passage also means the boost from the planned increase in expenditure is heavily weighted to the latter quarters of the fiscal year that began on Oct 1, 2019.

The package supports the country’s infrastructure drive and the desire to attract foreign investment as part of the Thailand 4.0 scheme. Further stimulus packages to support the export sector and lower-income households could also be announced if external headwinds intensify.

We forecast the central government budget deficit to come in at 1.9% of GDP in fiscal 2020, from an estimated 1.7% in fiscal 2019.

The budget passed in the House of Representatives on Jan 11 following a four-day debate with the backing of 253 members, as 196 members of the opposition chose to abstain. It is expected to receive Senate approval on Jan 20 and then royal endorsement, meaning it will not come into effect until February.

MILESTONE FOR COALITION

Despite the delays, which were because of the late formation of the coalition government following the March 2019 election, the budget was a key milestone for the government. A failure to pass the budget would have resulted in either the resignation of the government, which holds a slim majority, or the dissolution of parliament and increased political uncertainty.

With the economy slowing further to an estimated 2.5% growth rate in the 2019 calendar year, we expect fiscal stimulus to play a key role in driving a modest rebound to 3% growth in 2020.

In addition to fiscal stimulus, the focus will be on funding infrastructure and the development of employment opportunities. The total budget expenditure will be 3.2 trillion baht, up 6.7% from the previous year. This represents a sharp rise in fiscal expenditure, given a five-month delay in the distribution of funds.

The budget calls for an overall budget deficit of 469 billion baht, up 4.2% from fiscal 2019.

Several ministries saw their budgets cut, including Higher Education, Defence and Public Health. Indeed, the decision to slash funding to the Defence Ministry — to 124.4 billion baht from 227.7 billion in the previous year — was contentious, given the influence of the army on the current government and the backlash from opposition MPs after the initial proposal saw a slight increase in defence funding.

The main winner of the budget was the Labour Ministry, which saw funding increase 19.8%. The decision to channel funds away from the two education ministries and towards the Labour Ministry is likely an effort to support the upskilling of a large pool of low-skilled workers over developing a smaller pool of higher-skilled workers.

Infrastructure spending will complement the “Thailand Plus” package announced in September 2019, which aims to encourage foreign direct investment (FDI) and support the Thailand 4.0 scheme.

Prime Minister Prayut Chan-o-cha aims to boost development of the eastern provinces of Chachoengsao, Chon Buri and Rayong, with industries such as automotive, food processing, medical tourism, aviation and logistics identified as key areas of focus.

A total of 16 billion baht was allocated to the Eastern Economic Corridor project, which our infrastructure team has highlighted as a key driver of construction activity.

Other funding went to transport and logistics development (95.4 billion baht), special economic zones (6.9 billion) and water resource management (58.8 billion).

MORE DELAYS A RISK

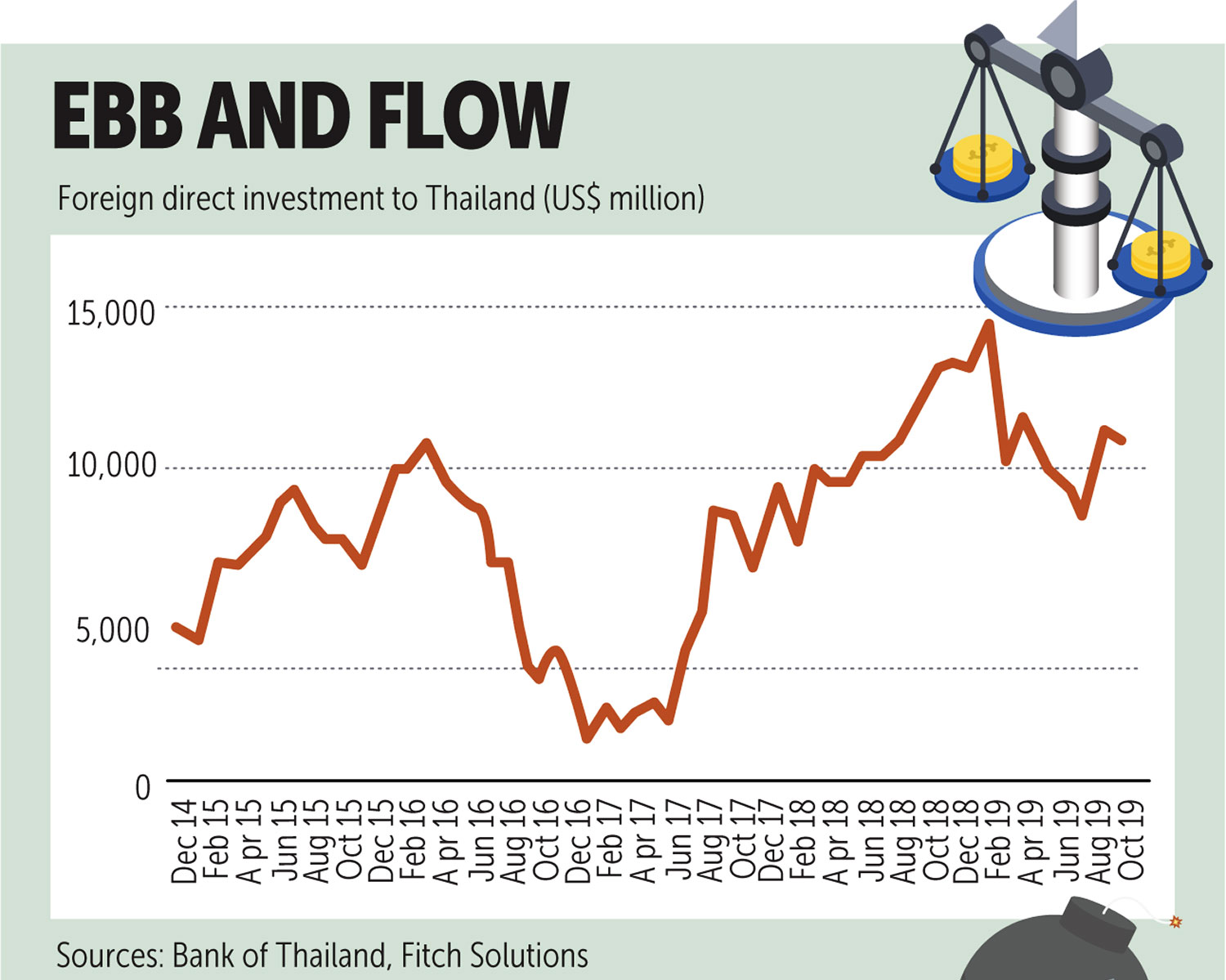

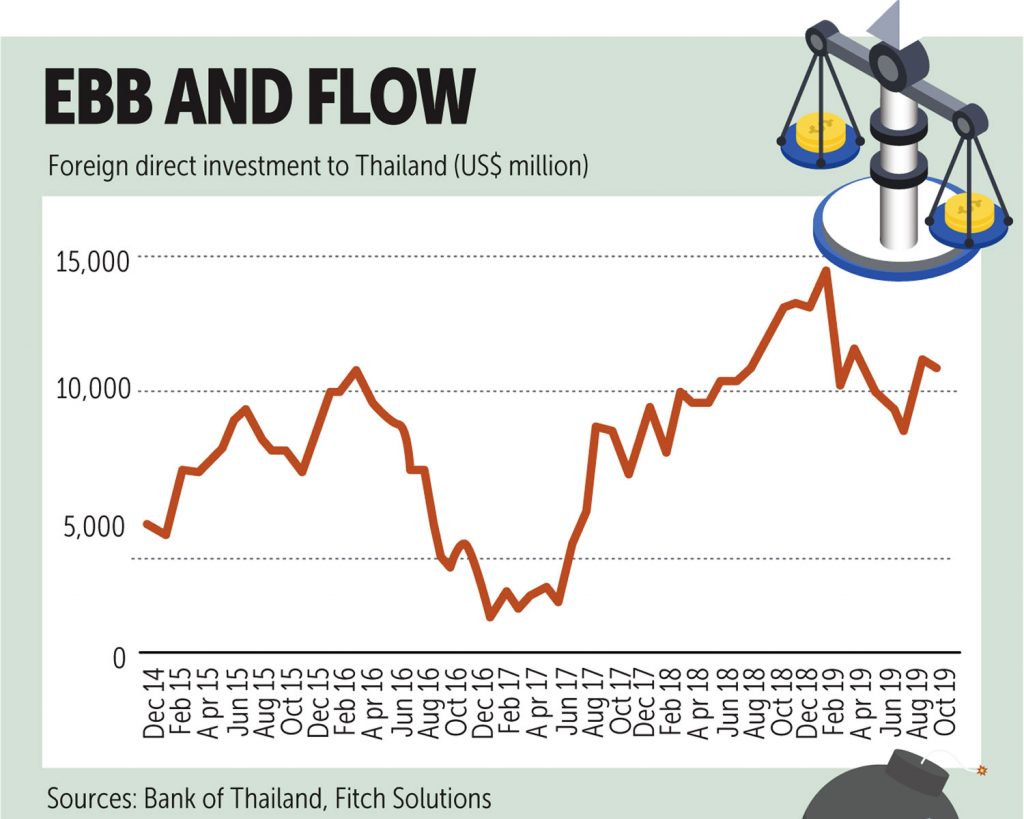

Improving infrastructure will go some way to encouraging companies relocating away from China to invest in Thailand. In the 12 months to October 2019, Thailand received $10.8 billion in FDI inflows.

However, risks of further delays to the implementation of projects and disbursement of funding are high and thus fiscal stimulus may prove less supportive than we forecast.

Fiscal stimulus is vital to supporting the economy and we see scope for further stimulus packages to be announced through 2020, given limited scope for monetary easing and the challenges faced by the export sector. The Thailand Plus and August 2019 stimulus packages signal the willingness of the government to use fiscal measures to support the economy.

Monetary policy faces constraints from already record-low rates and a highly indebted household sector. Moreover, the export sector faces headwinds from still subdued external demand and the strength of the baht, which is eroding competitiveness.

With Thailand still running a current account surplus and accumulating sizeable reserves, there is scope for a greater increase in fiscal stimulus over the coming years.

Indeed, public debt as a percentage of GDP stood at 41.3% in November 2019, according to the Public Debt Management Office, and productive investments will mean that over the long run, spending should not raise the debt ratio.

Source: https://www.bangkokpost.com/business/1836904/2020-budget-signals-greater-stimulus

Thailand

Thailand