Thai hotels set sights on global growth

Thai hospitality is globally recognised for its unique service standards, which have assisted many homegrown hotel companies in their international expansion over the past few decades.

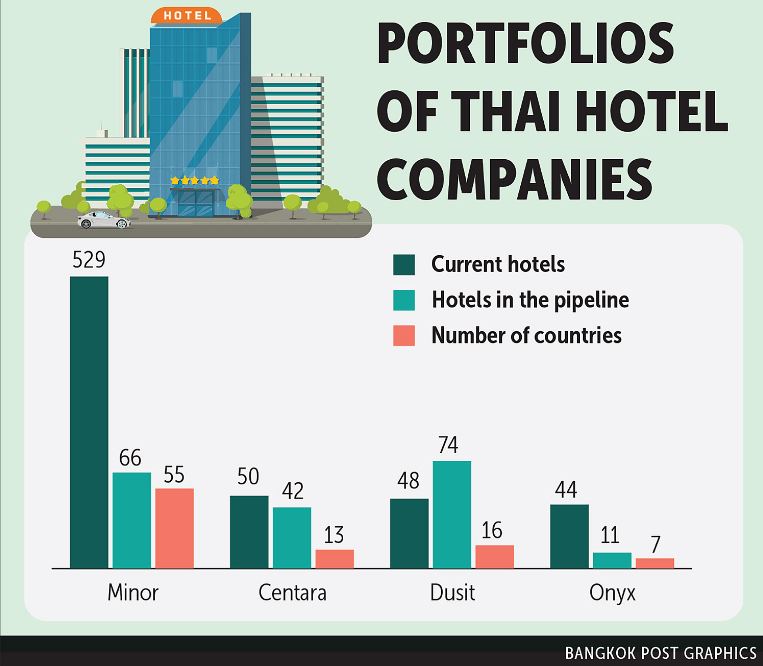

As the hotel industry has started to see a promising recovery post-pandemic, Thai hotel management companies such as Minor International (MINT), Centara Hotels and Resorts, Dusit International and Onyx Hospitality Group have found ways to grow their portfolios again.

ANOTHER BIG MOVE

SET-listed MINT has an aggressive expansion plan, with 66 hotels in the pipeline.

The giant hospitality company currently has 529 hotels across 55 countries, of which 366 are owned, leased and joint-venture properties, while 163 are under management contracts.

Dillip Rajakarier, chief executive of MINT, said the company is focusing on management contracts to expand its portfolio.

These include a joint-venture project with China’s Funyard Hotels & Resorts, one of the largest developers in China with about 10-15 hotels in the pipeline, which could help capitalise on the potential of the country’s large population.

In terms of investment, project highlights for this year include Avani Maldives, Anantara Ubud Bali Resort, and the NH Collection in Sydney and Frankfurt.

Meanwhile, SET-listed Central Plaza Hotel Plc (Centel) — the owner of the Centara brand — is developing 42 hotels, which will be added into its current portfolio of 50 properties.

Centel has 19 owned properties, most of which are in Thailand.

The upcoming projects to watch this year include the company’s first property in Japan, Centara Grand Osaka in the Namba area, which is a joint venture between Centel and the Japanese developers Kanden Realty and Taisei Corporation.

NEW TERRITORIES

Dusit International, which currently owns six brands, will see new locations being added to its existing 48-hotel portfolio this year.

Of the 74 hotels in the pipeline, the company will set up shop in Europe for the first time with Dusit Suites Athens in Greece in the first quarter, alongside two new hotels in Nepal under the management of Dusit Thani and Dusit Princess in the second quarter.

Other new international hotels include properties in China, India, Japan and Kenya.

Meanwhile, Dusit is still growing domestically, driven by expansion of its boutique lifestyle brand ASAI.

New Thai properties will include the 106-room ASAI Bangkok Sathorn in the second quarter.

Other hotels in the pipeline include destinations in Khao Yai, Bangkok and Phatthalung.

Private hotel firm Onyx Hospitality, under Italthai Group, is developing 11 new hotels which will open in 2-3 years.

Onyx currently has 44 properties across the brands Amari and OZO, and serviced apartments via Shama.

Yuthachai Charanachitta, chief executive of Onyx Hospitality, said Thailand, Malaysia, Hong Kong and the Maldives remain top strategic markets for investment this year.

He singled out Malaysia as the outstanding location for hotel expansion, with its potential stemming from a large market size and high purchasing power.

The company is to launch two Shama serviced apartment offerings in Malaysia, which will make the country the second market after Thailand to house all three of its brands.

Additional highlights include a rebranded property, Amari The Tide Bangsean, and Amari Raaya Maldives, in which Onyx has co-invested.

Other destinations for hotels in the pipeline include Japan, Laos, Sri Lanka and China.

Source: https://www.bangkokpost.com/business/2501346/thai-hotels-set-sights-on-global-growth

Thailand

Thailand