Thai banks forecast at least 4% growth for 2018

The research houses of two Thai banks have painted an upbeat picture for the country’s economic growth in 2018, forecasting its pace will be at least 4%, underpinned by exports, domestic investment and tourism.

But they expect private consumption to remain a drag on economic growth this year.

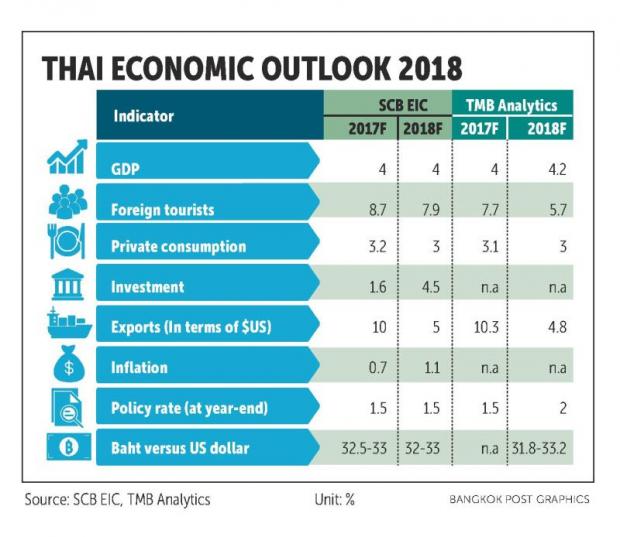

Economic Intelligence Center (EIC), a research unit under Siam Commercial Bank (SCB), predicts the Thai economy this year will grow 4%, similar to last year, said Phacharaphot Nuntranas, head of economic and financial market research.

The rebounding global economy will continue to support Thailand’s exports and tourism this year, he said. Rising capacity utilisation in export-related sectors will also propel private investment growth.

EIC forecasts export growth in 2018 will be halved from last year’s 10% growth outlook because of the high base effect and softer global farm product prices.

IT investment by large firms preparing for the digital era will also drive private investment, said Mr Phacharaphot.

“In Thailand, IT investment for 2017 amounted to 420 billion baht and it is expected to increase to 500 billion this year, led by consumer-related industries, especially the retail and financial sectors, to prepare for the digital age and maintain their customer bases,” he said.

Prospects are bright for investment in transport infrastructure, warehouses and online payment technology, given the rise of e-commerce business over the past two years. The government’s spending on infrastructure projects and the Eastern Economic Corridor will also facilitate domestic investment.

EIC forecasts domestic investment growth of 4.5% compared with 1.6% last year. The research unit estimates private investment this year will rise to 3% from 1.7% last year, while public investment growth will jump to 8.7% from 1.5%.

TMB Analytics, a research unit of TMB Bank, is more optimistic about Thailand’s economic outlook.

TMB’s research house predicts that the country’s GDP will grow 4.2% this year, with exports, domestic investment and tourism the key engine drivers, said senior vice-president Naris Sathapholdeja.

Both EIC’s and TMB Analytics’ growth forecasts are both higher than the Bank of Thailand’s 3.9% estimate for this year.

TMB Analytics projected Thailand’s export growth rate will slow to 4.8% in 2018 from 10.3% last year. But private investment and public investment will improve this year to 4% and 12% from 2.4% and 3.2% in 2017, respectively.

Public investment is expected to show historic growth this year on the back of the country’s economic roadmap, the 2018 fiscal budget framework and aggressive budget disbursement.

Private consumption is forecast to continue pressuring purchasing power of low income earners amid falling farm product prices. The research unit forecast that private consumption will marginally fall to 3% in 2018 from 3.1% last year.

Unlike EIC’s view that the Bank of Thailand’s Monetary Policy Committee will leave its policy rate on hold throughout next year, TMB Analytics expects two rate hikes in the second half, rising to 2% from 1.5%.

HSBC is pessimistic over Thailand’s economic prospects, estimating that the pace will slow to 3.7% this year from 3.9% in 2017, it said in a report, “Asean in 2018: A Land of Contrast”.

The government is planning to keep the overall budget relatively steady at 2.8% of GDP, but spending on priority infrastructure projects should be a growth tailwind for the country in 2018, it said.

Public investment has slowed down this year after decreases in capital budget disbursement following the completion of short-term stimulus packages and delays in some megaprojects.

“We expect public investment to accelerate and make a more significant growth contribution, on the back of an increase in the fiscal 2018 capital budget by 21.8% [year-on-year], 45.7% growth of state enterprises’ capital budgets and the start of public investment projects in 2018. [Those projects include] the US$5.4 billion (174 billion baht) first phase of the Sino-Thai high-speed railway project. There is fiscal space to support mega infrastructure projects given the government’s relatively low public debt level,” it said.

“We expect the government to implement more short-term stimulus packages to support rural and low-income household consumption to help ease debt — which is key to helping boost domestic demand.”

Thailand’s headline inflation this year has been restrained by low fresh food prices stemming from a recovery of agricultural production amid favourable weather. Demand-side pull inflationary pressure has also remained tempered, as domestic demand has lingered at a low level due to slow wage growth, high household debt and the year-long mourning period for the late King.

“Looking ahead, disinflationary risks have already dissipated while pressing inflationary risk is absent. While headline inflation is on track to gradually climb back to the Bank of Thailand’s 1-4% target range in 2018, supported by an increase in oil prices and normalisation of raw food prices, there is no impetus from inflation for a policy rate change in 2018,” it said.

Source: https://www.bangkokpost.com/business/finance/1392666/thai-banks-forecast-at-least-4-growth-for-2018

Thailand

Thailand