South-east Asia to see stronger growth in 2022 despite subdued China outlook: Barclays economists

SOUTH-EAST Asia is expected to see stronger growth in 2022, propelled by reopening and still-supportive monetary policy, Barclays economists said in the Barclays Asia Economic Outlook for 2022 webinar on Nov 23.

While the larger continental economies such as India and China will see slower growth in the year ahead, South-east Asia’s growth will improve as domestic activity levels rise, said Rahul Bajoria, Barclays chief economist for India and the Antipodeans.

The recovery is likely to be subdued in the first quarter of 2022, with the slow pace stretching into Q2 for some, as governments remain cautious in reopening, said Barclays regional economist Brian Tan.

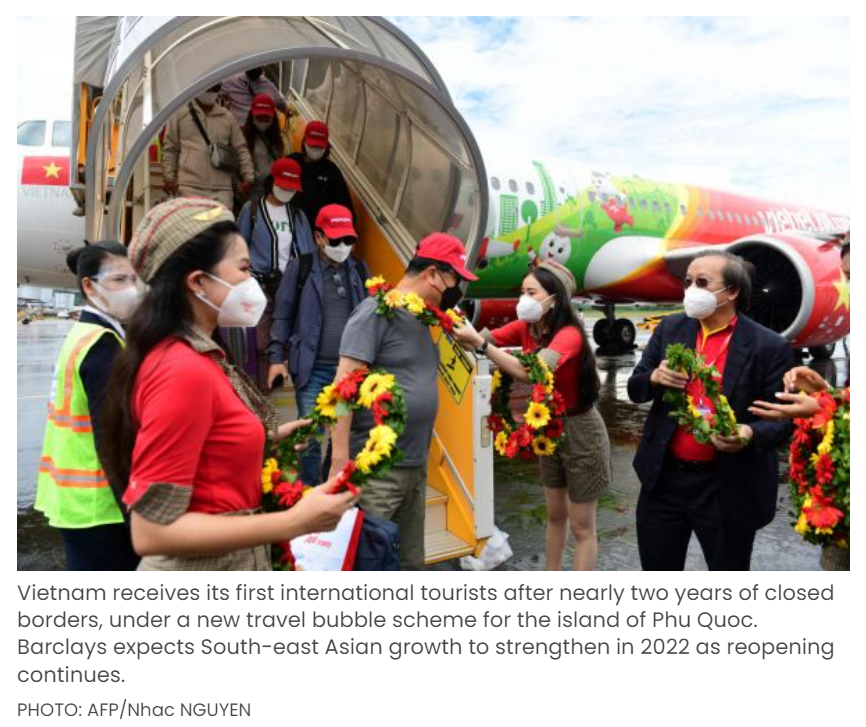

But such caution “should set up these economies for better growth in the second half of next year”, he added, as those which have lagged in Covid-19 vaccinations catch up, and more economies become comfortable with border reopenings, allowing tourism to resume.

Granted, headwinds will persist. Global supply chain issues will continue to weigh on growth, with “no material resolution” expected till the second half of 2022, as bottlenecks ease over the next six to twelve months, said Barjoria.

He named three key challenges for Asia in 2022: continued risks related to Covid-19, imported price inflation – particularly as Asia is a large importer of energy – and changes in the policy stances of developed markets, whether monetary or fiscal.

“There is a breaking of ranks happening within the developed markets’ central banks,” he noted. If more central banks tighten policy, this could have some negative spillovers on the region – although that is not Barclays’ base case scenario.

In the region itself, however, Barclays maintains its view that Asia remains a laggard within the emerging markets spectrum as far as monetary policy normalisation is concerned, as inflation is still relatively in check.

From Q2 2022 onwards, normalisation instincts may rise amid central banks in South-east Asia, “but we don’t reckon that it will be an aggressive rate hiking cycle”, he added. “It will be more of moving the dial back from very accommodative policies to still conducive and supportive policy conditions.”

“With the exception of Singapore, a lot of the South-east Asian central banks are not really in a rush to do any kind of normalisation any time soon,” agreed Tan.

Singapore has been ahead in both reopening and normalisation efforts, he said. The difference between Singapore and the rest of the region is that economic recovery has “started to show up a bit more in inflation numbers” in the former, he added, noting the surprise uptick in the Republic’s core inflation figures that morning.

In contrast, the outlook for China has clouded further in recent months, said Barclays chief China economist Jian Chang.

Reasons for concern include the government’s regulatory crackdown; uncertainty over the implications of the “common prosperity” drive; the Evergrande crisis; the power crunch; and the recent outbreaks of Covid-19 even as the zero-Covid stance persists.

In the year ahead, Barclays continues to see significant headwinds, with its forecast of 4.7 per cent growth being below market consensus. Their base case scenario is that the property sector will be a drag on growth, with property investment contracting 5 to 8 per cent, and property sales contracting 10 to 15 per cent.

The government’s green commitment will also continue to weigh on heavy industries, said Chang, who sees the government facing greater pressure to meet its commitments for total energy consumption in 2022, given that it missed them in 2020 and is likely to miss them in 2021 as well.

Meanwhile, with the country’s zero-Covid policy expected to persist through 2022 – or at least until the next party congress – this suggests further lockdowns, she added.

One spot of optimism, however, is an improvement in United States-China relations. Despite “oftentimes hawkish rhetoric”, the working relationship among high-level officials has been improving, she said. “Discussion about a mutual reduction in tariffs should be ongoing in the background.”

Source: https://www.businesstimes.com.sg/asean-business/south-east-asia-to-see-stronger-growth-in-2022-despite-subdued-china-outlook-barclays

Thailand

Thailand