Singapore private home prices jump 2.9% in Q1, raising prospect of cooling measures

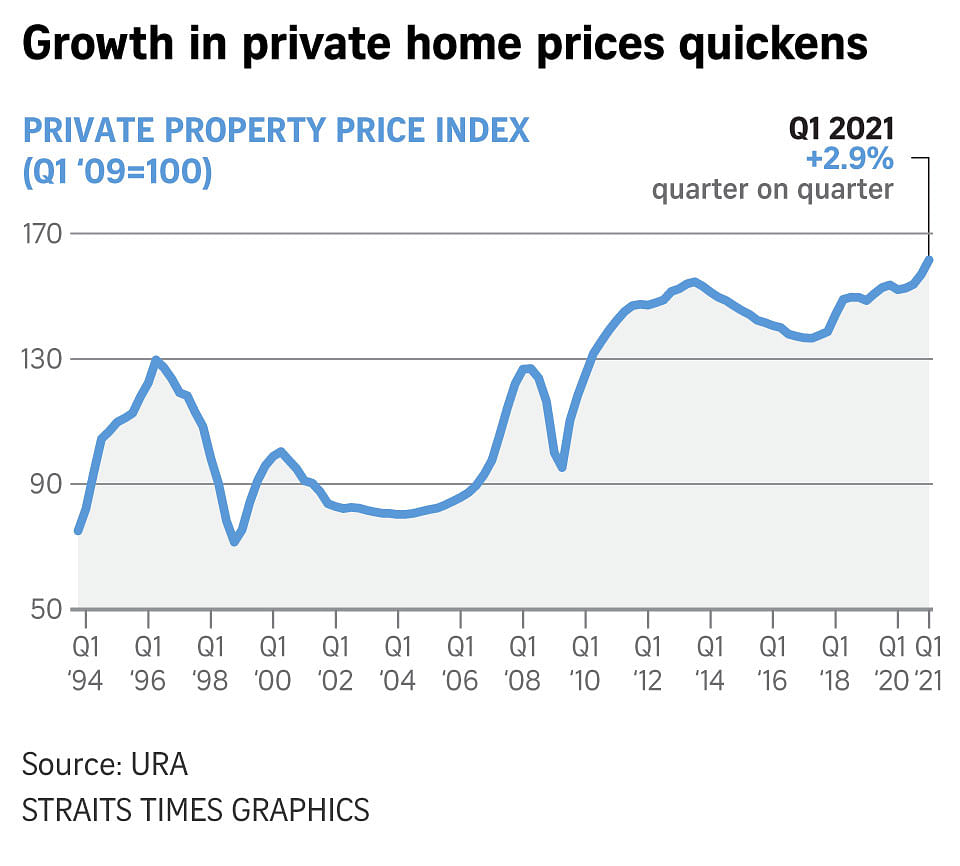

SINGAPORE – Private home prices in Singapore rose for a fourth straight quarter, jumping 2.9 per cent in the first three months of this year, raising bets on a fresh round of cooling measures.

This is the steepest quarterly increase since the second quarter of 2018, when private residential prices rose by 3.4 per cent before property curbs hit in July that year.

It follows an increase of 2.1 per cent in the fourth quarter last year and 0.8 per cent in the third quarter, according to the Urban Redevelopment Authority’s (URA) flash estimate released on Thursday morning (April 1).

Year on year, prices have jumped 6.2 per cent.

Precipitating the July 2018 round of cooling measures were four consecutive quarters of price increases totalling 9.1 per cent, as well as higher-than-expected bids for government land sales and record-high collective sale prices.

Mr Ismail Gafoor, chief executive of PropNex noted that the pace of price growth, particularly in the last two quarters will certainly draw the government’s attention and may heighten the risk of new cooling measures being introduced.

“We believe the final pricing data for Q1 and Q2 this year will be closely watched and a stronger pick-up in home values could likely trigger new measures to keep prices in check.

He added that private resale home prices have also rsien in recent months, driven by strong demand, firm new launch prices and a recovery in HDB resale prices.

But some market observers threw cold water on prospects of another round of cooling measures.

Mr Nicholas Mak, head of research and consultancy at ERA, pointed out that the current pace of price growth isn’t as fast as that in the period before the July 2018 cooling measures.

“The property price index is not the only indicator that will influence whether there would be another round of market curb. The government probably studies many other indicators, such as property transaction volume, the size of the household debt and the size of the total loans granted by banks in Singapore that are related to real estate loans,” he said.

Further, the Singapore economy is still weak and the construction sector is one of the harder-hit sectors with output contracting 35.9 per cent last year, he added.

A fresh round of cooling measures would hit the property market and in turn, the construction industry, which could dampen the economic recovery, Mr Mak said.

A persistently strong increase in private home prices over the next few quarters will raise the prospect of more cooling measures being rolled out, analysts said.

Other factors that may be considered include whether housing price increases are outpacing the economic recovery, and whether they are occurring across the board or remain localised in certain areas.

URA’s latest data showed that prices of non-landed properties rose 2.1 per cent in the first quarter, after edging up 3 per cent in the prior quarter.

Meanwhile, the prices of landed properties climbed 5.6 per cent in the first quarter, reversing from a 1.6 per cent fall in the previous quarter.

The price increase in the first quarter was driven mainly by pricier non-landed homes in the city fringe, or rest of central region (RCR), which jumped 6.1 per cent quarter on quarter, compared with 4.4 per cent in the previous three months, OrangeTee & Tie’s senior vice-president of research and analytics Christine Sun said.

For instance, The Reef at King’s Dock ($2,257 per sq ft, 337 units), Amber Park ($2,445 per sq ft, 66 units), Avenue South Residence ($2,099 per sq ft, 43 units) and One Pearl Bank ($2,407 per sq ft, 34 units) were transacted above $2,000 per sq ft.

Normanton Park, which registered the highest transaction of 720 units last quarter, changed hands at a median price of $1,765 per sq ft. This is higher than the $1,704 per sq ft median price for non-landed homes in the RCR in the fourth quarter of 2020.

Prices of non-landed homes in the city fringe and the suburbs reached their record highs last quarter, Ms Sun added. In the suburbs or outside central region, prices were up 0.9 per cent, after a 1.8 per cent increase in the previous quarter.

In contrast, prices in the core central region (CCR), or prime areas, dipped 0.3 per cent in the first quarter, reversing from a 3.2 per cent increase in the previous quarter.

Knight Frank Singapore research head Leonard Tay believes that the price index for the CCR will be higher when the final numbers are out on April 23.

This is due to the brisk take-up of units at GuocoLand’s 558-unit Midtown Modern condominium in Bugis, which sold about 340 units or 61 per cent at its launch earlier this month, he said.

Prices in the CCR have not grown as swiftly in the past year due to a lack of new launches in this region, as well as travel restrictions dampening foreign investor interest. But Singapore’s attractiveness among the globally mobile wealthy as well as Asian family offices will draw foreign buyers to new CCR launches such as The Atelier and Irwell Hill Residences,” Mr Tay said.

According to URA realis data downloaded on Thursday, 43.1 per cent of non-landed private home sales in the first quarter came from 2,527 units in the city fringe, while 20 per cent were luxury homes in the CCR and 36.9 per cent were mass market homes in the suburbs.

With foreign homebuying demand already crimped by travel restrictions, a new round of cooling measures, which will likely include a hike in stamp duties, could further dampen demand from this group, said Mr Tay.

Meanwhile, prices of landed properties climbed 5.6 per cent in the first quarter, reversing from a 1.6 per cent fall in the previous quarter.

This is due largely to interest in good class bungalows (GCBs) from ultra-high net worth individuals, especially those who have converted to Singapore citizens, said Mr Tay.

According to Knight Frank’s Wealth Report 2021, the number of individuals with a net worth of US$30 million inclusive of their primary residence rose 10.2 per cent in 2020 from the previous year despite the recession.

“With landed home supply not likely to increase significantly, these homes have become the new blue chip,” Mr Tay said.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment, and data on units sold by developers up till mid-December. The statistics will be updated on April 23 when the URA releases its full set of real estate statistics for the first quarter.

Source: https://www.straitstimes.com/business/property/singapore-private-home-prices-jump-29-in-q1-stoking-cooling-measures-talk

Thailand

Thailand