Singapore Moves to Ease Public Concern Over Impending Tax Hike

(Bloomberg) — Singapore is taking steps to ease growing concerns over an imminent increase in taxes, including explainers on social media and in local newspapers over recent weeks to justify the need for the move.

From Facebook posts by the finance minister to articles and opinion pieces in the city-state’s main English-language newspaper, Singapore is seeking to win over a populace facing the largest price spikes in years and a tentative recovery from the pandemic.

The government has signaled its intention to announce an increase in the Goods and Services Tax to 9%, from the current 7%, in the upcoming budget Feb. 18, after opting not to do so last year after the coronavirus plunged the country into its worst recession since independence in 2020.

Officials have said that such a move is necessary now to address a sharp rise in health care and social spending, and restore finances after two years of pandemic-induced deficits.

In two Facebook posts this week, Finance Minister Lawrence Wong shared videos explaining the need for a GST hike. The additional revenue will go toward supporting “growing health care needs and enable us to better take care of our seniors,” he said in a post Wednesday.

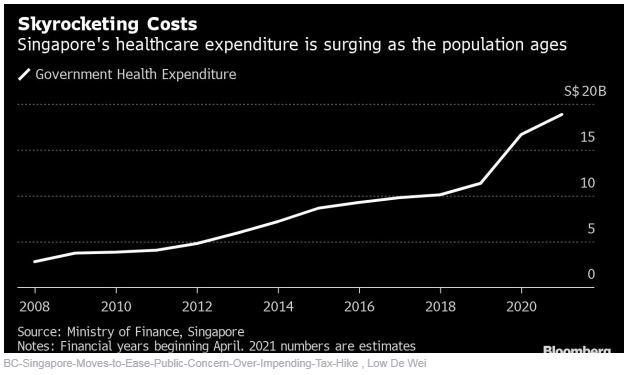

Singapore’s health care expenditures have surged in recent years as the population ages, jumping to over S$18 billion ($13 billion) estimated for the current fiscal year, from less than S$4 billion in 2010, according to government data.

Economists at Maybank Kim Eng Research Pte. forecast that a 2 percentage point rise in GST will increase annual collections by S$3.6 billion, which would make it the second-largest contributor to the government’s operating revenue after corporate income tax.

Rising energy and food costs, which have pushed prices higher for things as varied as electricity and cakes, is complicating the drive for a tax hike. The fastest core inflation reading in seven years prompted a surprise tightening of monetary policy by the central bank last month, while Singapore’s recovery is set to slow after rebounding in 2021.

A GST rise may also pose a political risk to the government, after the main opposition Workers’ Party won a record number of seats in the 2020 general election on a manifesto that included opposition to the tax increase. A move now could further cost the ruling People’s Action Party, Han Fook Kwang, a former editor of the Straits Times newspaper, said in an opinion piece last week.

So far, officials have rebuffed growing calls for a delay. Households will be insulated from the brunt of the GST hike by a S$6 billion package announced in the budget in 2021, the finance ministry said in a reply to a forum post last month in The Straits Times. And irrespective of when the tax is raised, the actual impact will be delayed for years, it added.

“I know many of you are concerned about the cost of living and this is why we will have a comprehensive set of measures in place to cushion the impact of GST on lower income and middle income households, as well as retirees,” Wong said in Wednesday’s video, adding that the government will permanently enhance a GST voucher policy to assist lower-income families.

Other levies may also be announced in the upcoming budget, including an increase in carbon taxes and new wealth taxes.

Thailand

Thailand