Singapore economy to grow at faster than usual pace, with output already back to pre-Covid-19 level: MAS

SINGAPORE – After suffering fits and starts for most of 2021, the Singapore economy is now set to grow at a faster than usual pace, with economic output already returning to its pre-pandemic level in the third quarter, the central bank said on Thursday (Oct 28).

With the resurgence of Covid-19 a lingering threat, the Monetary Authority of Singapore (MAS) also expects rising inflation – both at home and abroad – to challenge the outlook for Singapore’s trade-driven economy.

But if all goes well, MAS said the growth momentum in the last three months of the year and through 2022 would be supported by ebbing infection waves of Covid-19 and rising vaccination rates worldwide, allowing more countries – including Singapore – to gradually lift pandemic-related curbs on economic activity.

In its macroeconomic review released on Thursday, MAS kept its 2021 forecast for Singapore’s gross domestic product (GDP) growth at 6 per cent to 7 per cent, and said expansion in 2022 should be slower but still “above-trend”.

With regards to “above-trend” growth, economists estimate that the Singapore economy has expanded at an average of 2 per cent to 3 per cent in the last several years before the pandemic. Most of them have pencilled GDP growth of 4 per cent to 5 per cent for 2022.

Underlining the unexpected turmoil caused by Covid-19 this year, the central bank said successive waves of infections led to the re-imposition and subsequent lifting of movement restrictions, subjecting the economy to “fits and starts”.

“Disruptions to activity in certain sectors contributed to a flatlining of the overall GDP profile in the second and third quarters,” it said.

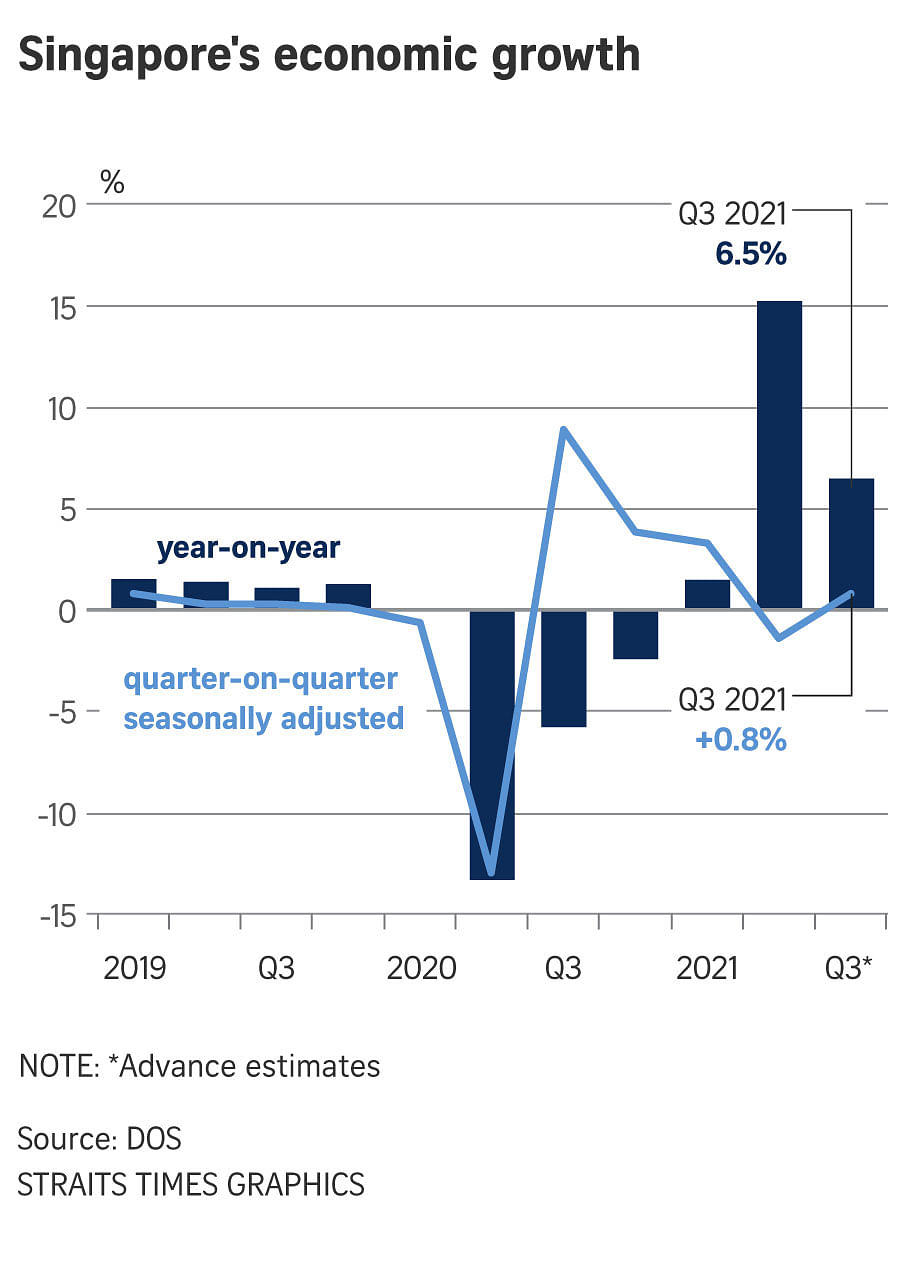

Singapore’s GDP contracted in the April-June period by 1.4 per cent from the previous quarter on a seasonally adjusted basis before expanding by 0.8 per cent in the July-Sept period. On an annual basis, GDP expanded by 15.2 per cent in the second quarter before moderating to 6.5 per cent in the July-Sept period.

As restrictions this year were not as stringent as the circuit breaker of 2020, when Singapore slipped into its worst recession, MAS said economic output returned to its pre-pandemic level in the third quarter despite the significant disparities in performance across industries.

“The domestic-oriented sector should see a gradual pickup in activity, while prospects for the travel-related sector have also improved slightly. Meanwhile, the trade-related and modern services clusters will be supported by firm global demand.”

While trade-related and modern services clusters surpassed their pre-pandemic levels by around 10 per cent and 5 per cent in the third quarter, the domestic-oriented cluster remained some 10 per cent below its pre-crisis level.

The travel-related cluster continues to lag substantially behind, with output at only half its pre-Covid-19 level, MAS said.

Alongside the recovery of the domestic economy, MAS believes the labour market recovery is also likely to continue, as evident in the drop in resident unemployment rate in August after the uptick in July, and the pick-up in wage growth in the second quarter amid signs of manpower shortages.

Singapore’s resident joblessness rate eased to 3.6 per cent in August, from 3.7 per cent in July.

“As labour market slack dissipates over 2022, resident wage growth is likely to firm,” the MAS said.

However, falling unemployment, rising wages and the emergence of supply chain bottlenecks worldwide – which have forced up the prices of a range of commodities and manufacturing inputs – should underpin a steady rise in inflation into 2022, it noted.

“Costs of freight, consumer durables, energy and food commodities have risen, and could remain elevated in the near term as global supply and demand mismatches linger.”

The central bank said that inflationary pressures across the world are expected to ease in 2022 as supply problems are progressively resolved.

However, there is a risk that the untangling of global supply bottlenecks may take longer than expected.

“Supply bottlenecks are expected to fade in the early part of 2022 as a decline in new Covid-19 cases and rising vaccination rates permit a fuller relaxation of mobility restrictions. Nonetheless, there is a risk that supply problems could become entrenched,” said MAS.

For Singapore, strengthening demand abroad and recovering private expenditures at home could increase imported and domestic costs pressures, said the central bank.

Recovering private consumption at home amid a more extensive economic reopening next year will likely allow greater pass-through of accumulating business costs to consumer prices, it added.

MAS therefore slightly raised the slope of the trade-weighted Singapore dollar policy band in October.

“This measured adjustment to the policy stance will complement fiscal policy and help ensure medium term price stability, while recognising the risks to the recovery,” it said.

Most economists believe MAS will take further measures to manage inflation in its April meeting, given signals of policy tightening by major central banks such as the United States Federal Reserve.

MAS projected global overall inflation at 2.6 per cent in 2021, and 2.4 per cent in 2022, compared with an average of 2.2 per cent over 2010-19.

For Singapore, MAS kept its inflation outlook unchanged. Core inflation here for 2021 will come in near the upper end of its zero to 1 per cent forecast, and increase to 1 per cent to 2 per cent in 2022. Overall inflation is forecast to come in around 2 per cent this year and average 1.5 per cent to 2.5 per cent next year.

Source: https://www.straitstimes.com/business/economy/spore-economy-to-grow-at-faster-than-usual-pace-with-output-already-back-to-pre

Thailand

Thailand