Singapore: Economists stick to forecast of 3.2% GDP growth for 2018, but more are wary of external risk factors

CONFIDENCE in the manufacturing sector as a growth driver has risen, with Singapore’s overall economic prospects on track for previous forecasts, according to the latest survey of private-sector economists, which was released on Wednesday.

But a growing number of watchers have flagged external growth as a factor that could affect the economy, although whether it will be a boon or a bane to the Republic is unclear. The domestic property market has also lost some of its shine, on surprise real estate cooling measures.

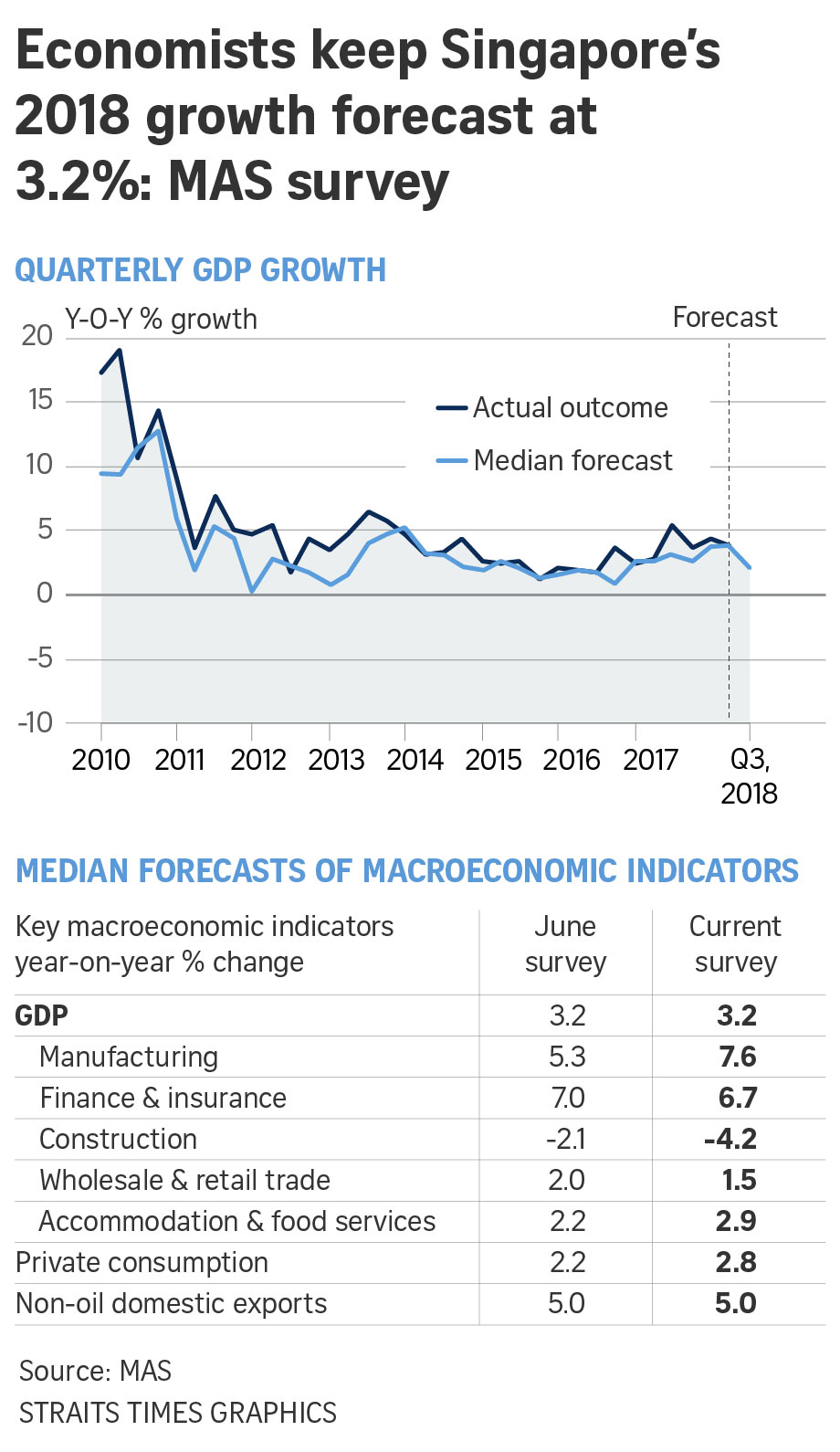

The economists pegged gross domestic product (GDP) at 3.2 per cent for 2018 – unchanged from the year’s first two rounds of polls – in the quarterly survey by the Monetary Authority of Singapore (MAS).

The most likely outcome is for the Singapore economy to grow by between 3 and 3.4 per cent, they said, although the chances of growth in the 3.5 to 3.9 per cent window have improved.

The official forecast from the Ministry of Trade and Industry was kept at between 2.5 and 3.5 per cent in August, after Singapore’s economy grew by 4.5 per cent in the first three months and 3.9 per cent in the second quarter.

Despite earlier fears of a factory slowdown, the economists have hiked their forecasts for full-year expansion in the manufacturing sector, to 7.6 per cent year on year, from 5.3 per cent in the June survey and an estimate of 4.3 per cent in March.

Projected growth in accommodation and food services was also bumped up a notch, to 2.9 per cent, from the previous prediction of 2.2 per cent.

But growth forecasts were pared for finance and insurance, from 7 per cent growth to 6.7 per cent; and for wholesale and retail trade, from 2 per cent expansion to 1.5 per cent.

And the construction sector is expected to fare even worse, finishing the year with a contraction of 4.2 per cent – widening from the 2.1 per cent decline that was predicted in June.

Still, the private economists remained bullish on non-oil domestic export (Nodx) growth, sticking to their expectations of 5 per cent year-on-year growth. Government planners are eyeing a more conservative 2.5 per cent to 3.5 per cent increase in exports.

The outlook for private consumption is also rosy, with the economists anticipating 2.8 per cent growth, up from the 2.2 per cent they predicted in June.

Headline inflation for the year was pegged at 0.7 per cent, dipping from 0.8 per cent in the June survey, while the core inflation figure used by the MAS, which strips out housing and private road transport costs, is expected to edge up to 1.7 per cent, from 1.6 per cent before.

Unemployment is predicted to come in at 2.1 per cent at year-end, unchanged from the previous survey.

Wider dangers remain, as external factors continued to weigh on the economists’ minds, with 47 per cent putting external growth on their list of potential upsides, up from 32 per cent in June, thanks to a stronger showing in the United States.

Meanwhile, 42 per cent fretted over weak external growth as a risk, compared with the 11 per cent who flagged it previously, on the back of the liquidity crunch in emerging markets.

Higher interest rates were flagged by 37 per cent of respondents, down from 47 per cent before.

China was also singled out for concern, with 37 per cent of the private economists flagging a slowdown in the world’s second-largest economy as a downside risk, against 21 per cent earlier, amid a climate of credit tightening.

Trade protectionism was cited as a risk by 89 per cent of the economists, similar to the 84 per cent before, as Washington continues to escalate its rhetoric on trade and more tit-for-tat tariffs kick in. “Notably, 37 per cent of the respondents cited the dissipation of trade tensions as a possible upside, as it would remove uncertainty from the forecast horizon,” said the MAS.

And the overnight property cooling measures that went into force in Singapore in July have dimmed economists’ hopes for the domestic property market, with the proportion of respondents who named it an upside factor falling to 26 per cent, from 47 per cent in June.

Singapore’s GDP is projected to grow by 2.7 per cent in 2019, downgraded a tad from the June prediction of an expansion of 2.8 per cent.

The latest MAS survey reflects the views of 23 analysts who monitor the Singapore economy. It was sent out on Aug 13, 2018.

Source: https://www.businesstimes.com.sg/government-economy/economists-stick-to-forecast-of-32-gdp-growth-for-2018-but-more-are-wary-of

Thailand

Thailand