Singapore Budget 2018: PayNow to be extended to businesses, public agencies

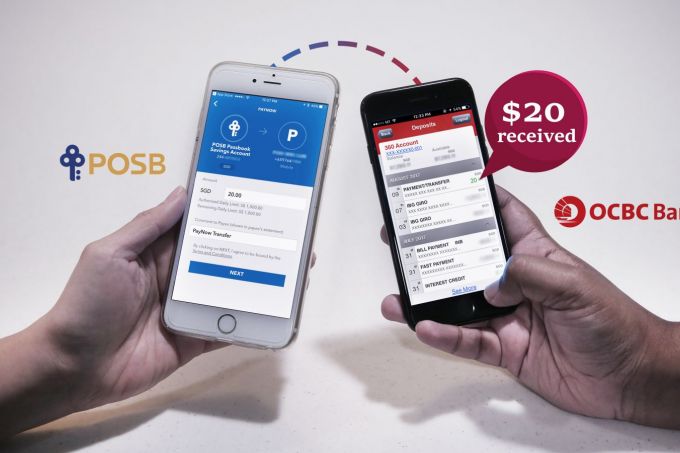

BUSINESSES will soon be able to receive payments from other businesses and even consumers through homegrown funds transfer tool PayNow, announced Vivian Balakrishnan, Minister-in-Charge of the Smart Nation Initiative, at the Committee of Supply debate yesterday.

The Business Times understands that PayNow Corporate will be launched around August this year, and will likely impact B2C (business-to-consumer) transactions more than B2B (business-to-business) transactions.

To use the service, businesses will first need to link their bank accounts to their Unique Entry Numbers (UENs). This is akin to consumers linking their bank accounts to their mobile numbers for the purpose of receiving funds, BT has learnt.

Consumers will be able to use PayNow Corporate to pay merchants for their purchases. Merchants can, for instance, display their UENs at their payment counters and have consumers make payments directly to their bank accounts using the UENs.

Consumers paying via PayNow Corporate instead of credit cards can potentially enjoy savings in credit card fees, although there will still be a segment of consumers who prefer to pay by credit cards to earn reward points, BT understands. Whether merchants will enjoy similar savings is less certain, as banks may charge merchants for their use of PayNow Corporate.

A spokesman for the Association of Banks in Singapore (ABS) told BT that PayNow Corporate will ride on existing payment mechanisms such as Fast and Giro, both of which, BT understands, are currently used by businesses for B2B transactions.

She added: “PayNow Corporate is an enhanced funds transfer service that will allow businesses to send and receive money without the need to know the account number. It will make funds transfers more convenient and efficient. Only the recipient’s mobile number, NRIC (for individuals) or UEN (for businesses) is required.”

As of January, PayNow has amassed over 700,000 sign-ups, and to-date, recorded some two million transactions and over S$370 million in transaction volume. It was launched last July by ABS and is supported by seven banks here. (see amendment note)

On Thursday, Dr Balakrishnan announced that PayNow will be extended to public agencies as well.

From March, the Ministry of Education will pilot the use of PayNow to disburse Edusave Awards to ITE and polytechnic students. The CPF Board will also disburse lump sum withdrawals of CPF savings to eligible members above the age of 55 using PayNow, allowing members to receive their payouts on the same day instead of the current five working days.

Shailesh Naik, chief of Singapore-based mobile wallet startup Matchmove, told BT: “In the context of the government’s national agenda to promote cashless transactions, getting more of the public sector to adopt e-payments initiatives such as PayNow is most encouraging and shows the government’s clear intent of leading by example.”

He added that while the government has already made great efforts to encourage more people to use e-payments, the new guidelines and actions will encourage even greater usage of cashless methods, while protecting consumers and small businesses that have concerns over unauthorised transactions through their bank accounts.

Chia Tek Yew, head of financial services advisory at KPMG Singapore, noted that government agencies such as the Housing and Development Board and the Land Transport Authority process significant amounts of cash and cheque transactions.

He told BT: “With 2018 being the checkpoint year in Singapore’s 2020 Smart Nation push, it is timely that PayNow is extended to public agencies and businesses. It is a necessary step in the advancement of Singapore as a cashless society.”

This year, SGQR, a national QR code standard, will be launched. In 2019, Singapore is targeting to launch 25,000 unified POS terminals.

Dr Balakrishnan said: “We are not going cashless for its own sake. Certainly not for tax collection.

“The ultimate objectives are to lower transaction costs for both businesses and citizens, and to expand opportunities especially for small businesses, freelancers and entrepreneurs creating startups. Ultimately, this should enhance the competitiveness of our economy.”

Source: http://www.businesstimes.com.sg/government-economy/singapore-budget-2018/singapore-budget-2018-paynow-to-be-extended-to-businesses

Thailand

Thailand