Rising mechanisation in SE Asian regional sugar cane harvest

The mechanisation of the sugar cane sector, in particular in the harvesting of sugar cane, remains low across Southeast Asia relative to other major producing markets, namely Brazil, other countries in South America and India and China.

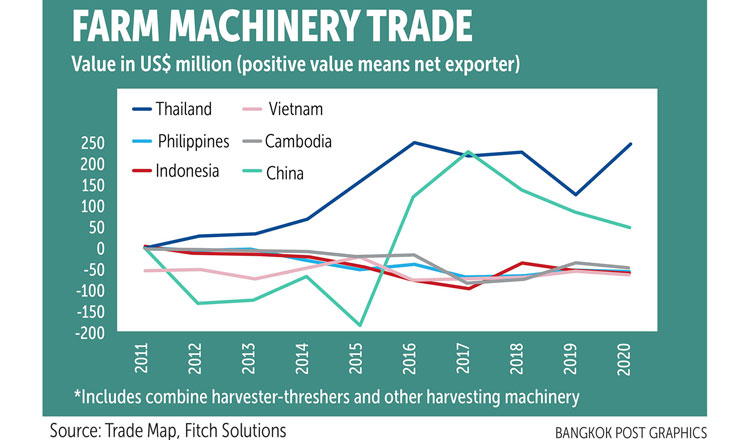

Thailand transformed from being a net importer of combine harvester-threshers and other harvesting machinery in 2011, to a net exporter that recorded the export of more than $240 million of equipment in 2020, according to Trade Map data. The top destination markets were other ASEAN countries including Cambodia, Myanmar and the Philippines.

Sugar exports from Cambodia witnessed a dip by 43.89 per cent in the first half of the season last year. As per data from the General Department of Customs and Excise, exports fell from $33.70 million to $18.95 million.

In Thailand, around 30 percent of the sugar cane crop is harvested by machine and it is even less among other ASEAN producers. This is despite the fact that many Southeast Asian countries have made notable moves to mechanise rice production. By comparison, around 95 percent of Brazil’s harvesting is mechanised.

A number of issues have hindered the use of combine harvesters and other high-tech harvesting machinery in the ASEAN sugar sector. First, production is dominated by small-scale farms. For example, in the Philippines, around 80 percent of producers own farms with fewer than five hectares. This reduces the financial viability of buying (or renting) expensive machinery.

Second, a lot of the sugar cane produced in Southeast Asia, especially by smallholder farmers, is grown on uneven and difficult terrain for a combine harvester to operate on.

Over the next five years, increased mechanisation of sugar production across Southeast Asia is expected, although machinery use will remain below that in Brazil and China. The challenges outlined above will persist despite some government and industry attempts to address them.

Indeed, in most Southeast Asian countries, sugar cane combine harvesters have been present for decades, but uptake has been slow because of the structural make-up of the sector.

The slow economic recovery from the Covid-19 pandemic will also weigh on mechanisation efforts in the short- to medium-term. Despite these continued challenges, some ASEAN markets are expected to outperform expectations.

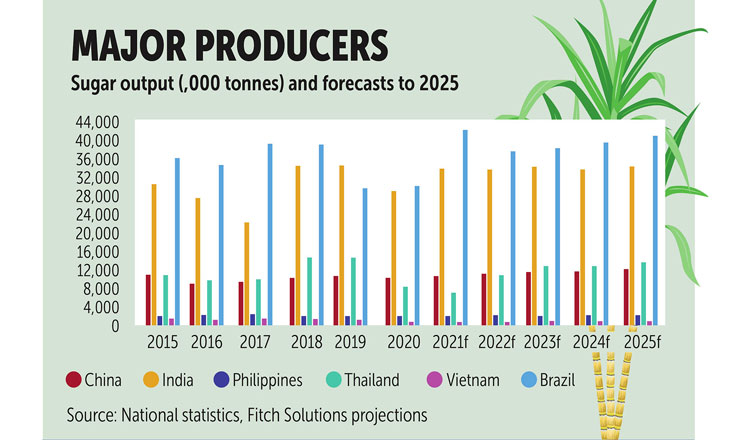

Thailand is seen as a key opportunity market for the mechanisation of sugarcane harvesting, with 6.5 million tonnes of absolute growth in sugar output between 2020 and 2021 and 2024 and 2025. In 2024-25, experts forecast Thailand to be the third-largest producer of sugar cane globally, behind Brazil and India.

This growth will be the result of recovery from drought, sugar cane yield improvements and strong export opportunities. In line with production growth, the use of machinery will increase. Good prospects for the sector will likely encourage investment, also supporting mechanisation.

Although the risks are highlighted to production caused by reform of Thailand’s sugar sector in response to pressure from Brazil, especially deregulation in 2018 and the elimination of the sugar cane price support programme, these changes could create the conditions for mechanisation.

In particular, the consolidation of the domestic market, including cane producers, would address the issue of small farm size and the lack of financial viability of machine use. Producers will also need to improve efficiency in order to compete with sugar prices on the international market, which can be achieved through mechanisation.

The Thai government is trying to stop the use of burning as a method of sugar cane harvesting, which in turn encourages the use of combine harvesters. Up to 80 percent of sugar cane in the country is still harvested through burning. Burning has negative environmental effects, as well as often reducing the weight of the sugar cane. In order to deter the use of burning, the government has set quotas for how much of the sugar cane collected by mills must be fresh.

However, labour shortages during the harvest season due to migration from rural areas to cities has meant that these quotas are often not successful in reducing burning rates over the past decade. Industry stakeholders have appealed to the government for support for farmers to buy or hire machinery to avoid the need to burn cane.

Some mills already assist sugar cane producers in accessing combine harvesters. As the government continues to work towards the goal of reducing sugar cane burning, increased support for mechanisation is expected to be considered.

As the use of sugar cane combine harvesters in Thailand increases, observers expect the country to also play a role in the production and export of these machines to other markets in the region including Cambodia. In Thailand’s sugar sector, around two-thirds of the combine harvesters used are imported, according to a study of 249 farmers in 2020.

The largest foreign manufacturers of sugar cane combine harvesters used in the country include John Deere, Cameo and Case IH. In 2017 Case IH established its first direct distribution centre for its agricultural equipment in Thailand, identifying Thailand as an emerging regional centre for sugar cane harvesting machinery.

However, domestic manufacturers are dominant in the production of small and medium-scale harvesters and would benefit from increased mechanisation by smaller-scale sugar cane producers. These manufacturers include Thai Roong Ruang Manufacturing, Samart Kaset-Yon Partnership and Pradit & Friends Machinery.

As Thailand’s use of sugar cane combine harvesters increases, it is believed the country will be a supplier of cane harvesting machinery to other producing countries in Southeast Asia. Although a lot of the machinery used in the sugar sector is imported, Thailand’s exports of harvesting machinery for different agricultural products (such as rice) have increased substantially in recent years.

Thailand has been the top supplier of harvesting machinery to Vietnam, the Philippines and Cambodia in recent years. As demand ncreases in Thailand, it is expected domestic production and exports of sugar cane harvesting machinery will also increase because of the country being a regional supply hub for agricultural machinery. This will be supported by increased use in the sugar sector in other Southeast Asian countries. Bangkok Post

Thailand

Thailand