Private consumption now Vietnam’s main growth driver: HSBC

The Hanoitimes – Vietnam has the second-largest consumption share in ASEAN, with the potential to outpace the Philippines soon. This should change the popular perception about ASEAN, in which Indonesia and the Philippines are usually considered the major domestic-oriented economies.

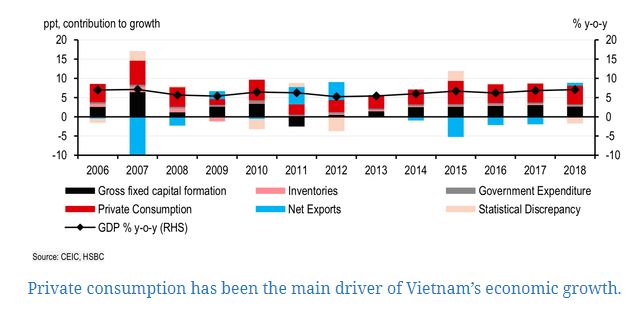

In a country like Vietnam, with exports as high as 100% of nominal GDP, it’s easy to underestimate the role of domestic consumption. In fact, private consumption is the economy’s main growth driver, according to HSBC’s latest report.

Over the past 15 years, private consumption has actually been the biggest contributor to GDP growth. Expanding at an average annual pace of 7.5%, private consumption accounted for roughly 75% of the most recent five years’ GDP growth.

Vietnam has the second-largest consumption share in ASEAN, with the potential to outpace the Philippines soon. This should change the popular perception about ASEAN, in which Indonesia and the Philippines are usually considered the major domestic-oriented economies.

|

Evidently, retail sales have risen 20-fold in the past two decades to reach almost US$200 billion in 2018. It is expected to easily surpass 2018, with retail sales rising 12% year-on-year as of October. With more spare money, people tend to diversify the products they purchase – tourism-related services and F&B are growing fast. That said, goods still dominate the consumption basket. Take motor vehicles as an example: the sales volume has jumped by 2.5 times in the past seven years. Japanese cars are favored – Toyota alone commands a 26% share of the market, followed by Honda, with 11%.

According to HSBC’s report, Vietnam’s robust consumption story came from declining unemployment rates, rising wages, a structural shift away from agriculture, growing optimism, and a booming middle-class.

Unemployment has gradually come down while wage growth has risen consistently. Monthly income per capita has doubled since 2010, especially with urban wages rising at a much faster pace. Unsurprisingly, this has translated into more spending power – in 2018, urban monthly spending reached US$152, representing 60% of wages. The structural employment shift is also supportive. Although agriculture is still the primary employment sector, more and more people are moving to manufacturing and services to improve their job prospects. This has not only driven up wage growth, but reinforced the urbanization trend, and these two factors have encouraged private consumption. Indeed, according to the UN’s projection, Vietnam’s urban population is expected to reach 65 million by 2050, almost doubling versus now.

Moreover, Vietnamese are more willing to spend than their regional peers. On October 9, the Conference Board Global Consumer Confidence Index gave Vietnam one of the highest ranks in the world as a result of an upbeat job security and economic growth outlook. At the same time, Vietnam’s middle class is growing fast. In 2016, Boston Consulting Group estimated that the country’s middle-income population would grow from 15 million (16% of total) in 2015 to 23 million (23%) by 2020, with the upper-middle class population expected to double to 10 million (11%).

Retail sectors considered main beneficiaries

There is little doubt that retail sectors such as transportation, F&B, and apparel & footwear, just to name a few, are the main beneficiaries of this positive consumption outlook. Apart from growing international tourism, increasing domestic demand has contributed to a steady expansion of the transport sector. According to Boeing, monthly domestic flights rose 3.5 times in the past decade, to 18,680 in 2019 – this number is likely to climb higher, as Vietnam has become one of the world’s fastest-growing aviation markets.

|

| Consumption-related sectors have enjoyed steady expansion. |

Meanwhile, F&B has fared well, with grocery dominating Vietnam’s retail market with a 44% share, according to McKinsey & Company. Among the major supermarket chains, most are foreign owned. With the F&B sector forecast to grow 6% per year, many companies have expansion plans. For example, Lotte (Korea) expects to expand to 60 stores by 2020 and Mega Market (owed by TCC Group Thailand) hopes to achieve five new stores per year between 2018 and 2020.

The same trend can be seen in the clothing and footwear retail industry. According to the Vietnam Association of Retailers, there are about 200 foreign fashion brands, representing 60% of the country’s global market share, revealed Business Sweden Analysis. This is not entirely surprising, as Vietnam allows 100% foreign ownership of retail businesses under certain conditions. Newcomers, such as Japan’s Uniqlo, are rushing into the market. On top of this, the luxury industry is booming – mainly targeting the growing affluent population.

Risks remain ahead

Despite this rosy picture, HSBC urged Vietnam to be mindful of the associated risks. The primary concern is rising household debt. Between 2013 and 2018, household debt rose sharply, from 25% of GDP to 51%. In per-labor-force terms, consumer debt jumped from 42% of the mean national annual income to 83% in the same period. Unsustainably rising consumer leverage would pose significant risks to Vietnam’s banking sector, as well as drag down future consumer spending as more income would be diverted to servicing debt.

Fortunately, the State Bank of Vietnam (SBV) has adopted some macro-prudential policies to contain consumer lending. It has introduced a cap on the share of cash loans and prohibited lending to borrowers with weak credit. Meanwhile, a strong labor market should support wage growth, thus improving debt-servicing ability.

Source: http://hanoitimes.vn/private-consumption-named-as-vietnams-main-growth-driver-hsbc-300043.html

Thailand

Thailand