Philippines: Government eyes new taxes in 2021 to recover stimulus costs

MANILA, Philippines — New taxes are being considered by the Duterte administration starting 2021 to partially offset the costs of this year’s stimulus measures meant to counter the pandemic’s economic impact.

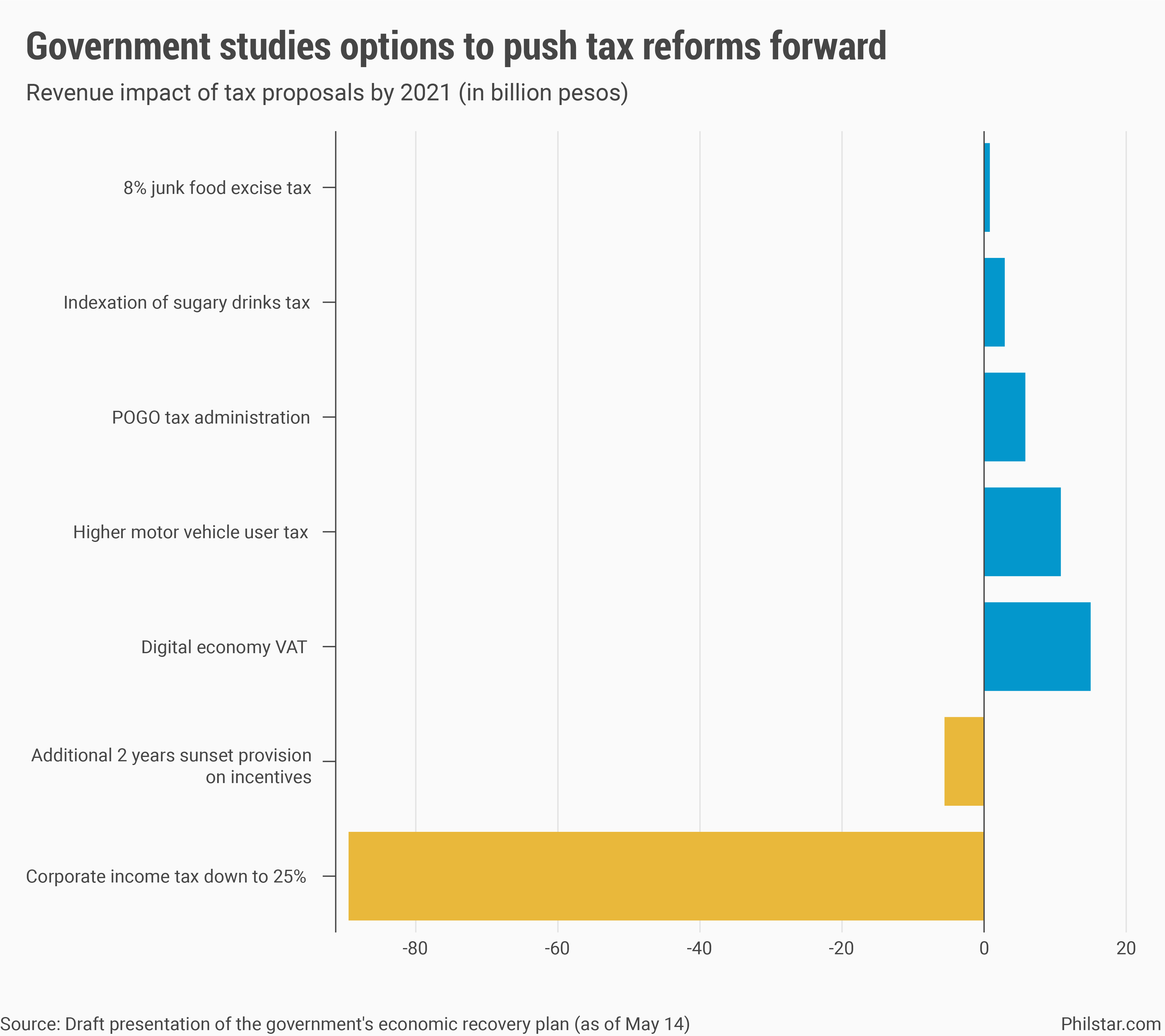

Costing was already started for a proposed digital economy value added tax (VAT), higher sugar-sweetened beverage taxes as well as new levies on junk food, particularly those with high trans fat and high sodium content.

The tax proposals are contained in a May 14 draft presentation of the Philippine Program for Recovery with Equity and Solidarity. A copy of the presentation was obtained by Philstar.com, the contents of which were confirmed under study by the government.

“What we want to see, aside from a return to pre-COVID-19 growth is that the return to growth is accompanied by a deficit which is sustainable and does not damage the overall creditworthiness of the country,” Finance Assistant Secretary Ma. Teresa Habitan said when asked about the tax plans.

The tax proposals form part of the government’s overall recovery and resiliency plan post-pandemic. The presentation noted that the government wants to “use the crisis as opportunity to do structural reforms” just as revenues are expected to plunge this year due to lack of economic activity.

Interestingly, some suggestions outlined were already raised by various quarters. For instance, the digital economy VAT that would see taxes on Netflix and Amazon was first proposed by Albay Rep. Joey Salceda, chair of the House ways and means committee.

Under the government’s plan however, the new tax is seen to raise P15 billion on its first year, P16.6 billion on the second and up to P18.4 billion on the third year, when President Duterte would have left office.

Another new levy, an excise tax on food containing high trans fat and salt, had also been supported by state think tank National Tax Research Center under the finance department, although the rate was suggested to be at a higher level. Under the drafted plan, the levy was set at 8% which is seen to raise between P800 million and P1 billion in three years ending 2023.

Indexing the present sugary drinks tax to 6% is also being considered. The yearly adjustment is projected to add P2.9 billion next year before rising to P6.4 billion in 2022 and P10.7 billion in 2023.

Higher motor vehicle user charges are also being supported. But the government specifically wants Salceda’s version under House Bill 6236 to pass to generate P10.8 billion in 2021, P25.8 billion in 2022 and P38.2 billion in 2023.

Finally, “better tax administration” or “aligning” of tax on offshore gaming operators with other sectors is seen collecting P5.8 billion next year, P6.2 billion the following year and P6.6 billion by 2023, the draft presentation stated.

In sum, the Duterte government is eyeing additional revenues of P35.3 billion in 2021, which will increase to P55.9 billion in 2022 and P74.9 billion by 2023.

CREATE bill to cost P103 billion by 2022

New revenues are seen to partially recoup losses from the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE), the amended version of the Corporate Income Tax and Incentives Rationalization Act, which cuts corporate income taxes to 25% instantly if passed July this year. The bill is intended as a stimulus measure to buoy private investments and help the economy recover from the pandemic.

As a bill, estimates showed CREATE would result into revenue losses worth P41.96 billion in 2020, P95.03 billion in 2021 before rising to P103 billion in 2022.

All tax proposals remain under study and would have to be submitted as bills before Congress to be deliberated.

“We want to see the deficit ratio trend down and the debt ratio not go up too much,” Habitan said.

Source: https://www.philstar.com/business/2020/05/26/2016551/government-eyes-new-taxes-2021-recover-stimulus-costs

Thailand

Thailand