Philippines: Government debt fetch low rates, but suffer shorter payment terms in June

MANILA, Philippines — Payment terms on government debts continue to shorten as of June, nearly cancelling out any benefits from falling borrowing costs at a time the country is turning to loans to fund its costly coronavirus disease-2019 (COVID-19) response.

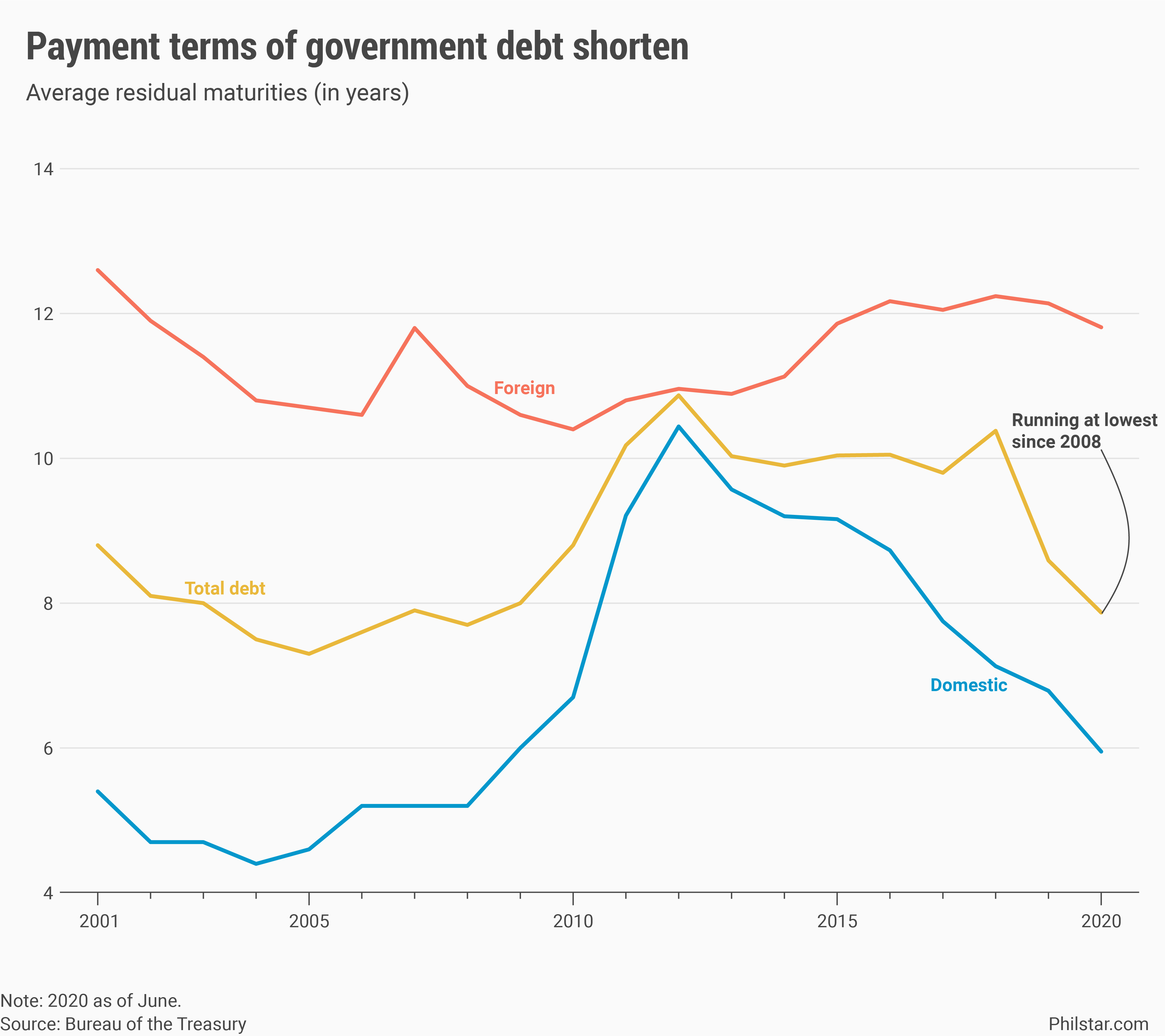

Data from the Bureau of the Treasury showed more government debts are actually falling due, with average residual maturity of existing liabilities shortening further to 7.87 years in end-June, running at its lowest since 2008.

The government usually prefers securing debts with longer repayment timetable so it can set aside more funds for social programs and other projects instead of earmarking them to settle obligations that are due soon. Based on data, payment terms were taking a hit from much shorter maturities of existing peso liabilities even as those of foreign debts have remained stable.

“Given the pandemic and heightened risk aversion, the Treasury has focused on issuing debt mainly at shorter tenors given the likely preference for borrowers for shorter dated securities,” Nicholas Mapa, senior economist at ING Bank in Manila, said in an email.

Figures showed sliding maturities for existing peso-denominated liabilities drove the overall shortening of payment terms. As of June, domestic debts, which accounted for 68.4% of the country’s P9.05-trillion debt pile, were payable an average of 5.95 years, also running at its lowest since 2008’s 5.2 years.

“This trend is typical before and even during a crisis. This tendency suggests that longer-term outlook is going to be poor and longer-term debts and its corresponding yields will continue to fall,” Ruben Carlo Asuncion, chief economist at UnionBank of the Philippines, said in a text message.

“Thus, a shorter tenor with a higher return is more attractive,” he added.

For her part, National Treasurer Rosalia de Leon said maturities of local debts “lengthened” already as of this month, figures on which will not be available until late September, after the government sold P516.3-billion in retail Treasury bonds, which included a bond swap to switch old debts with short maturities with longer-dated papers.

On the flip side, foreign debts were payable within 11.81 years on average in June, the shortest since 2015, but still benefiting from longer maturities offered by bilateral and multilateral agencies.

Under foreign liabilities, funds borrowed from multilateral agencies such as the World Bank, Asian Development Bank and Asian Infrastructure Investment Bank may be settled within 11.14 years, slightly up from 11.09 years.

Outstanding bonds held by foreign creditors, meanwhile, would fall due within 1.47 years, data showed.

At this level, analysts believe the government won’t have a hard time settling its ballooning liabilities, although such an outlook will depend on how quick the economy will recover from a pandemic-induced recession.

“The Philippines continue to have a strong fiscal foundation and will not likely have trouble servicing debt but these are all predicated on a return of the 6% strong economy of not so long ago,” Mapa said.

UnionBank’s Asuncion agreed: “I would say this is still very manageable, but moving forward, debt sustainability and the ability to repay should be top priority, especially if we really want to be able to protect our credit credibility.”

Costs still cheap

As it is, debts incurred as of June generally remain affordable. Weighted average interest rate of the entire debt load fell 4.64%, down from 5% when last year ended.

Based on Treasury data, domestic liabilities appeared more expensive than their foreign counterparts, not counting on foreign exchange costs involved in exchanging pesos for foreign currency to pay for debts.

On average, local debts fetched 5.14% interest rate in end-June, lower than 5.49% last year. Under this segment, shorter-termed Treasury bills carried an average of 3.02%, while T-bonds were charged a higher 5.48%.

Foreign obligations, on the other hand, got cheaper with a record-low 3.61% rate as June. Specifically, interest rates charged on loans from multilateral agencies averaged 2.45%, down from 3.09% previously.

Source: https://www.philstar.com/business/2020/08/19/2036462/government-debt-fetch-low-rates-suffer-shorter-payment-terms-june

Thailand

Thailand