Philippines: Fuel compounds costly food as February inflation peaks anew

MANILA, Philippines (UPDATE 12:06 p.m., March 5)— Inflation soared to a level not seen since it eroded growth in 2018 as new sources of price pressure appeared with rising crude costs, exacerbating the impact of costly food yet to be convincingly addressed.

Consumer prices rose 4.7% year-on-year in February, up from 4.2% in January and the highest since December 2008 when a rice supply shortage cut through prices, the Philippine Statistics Authority reported on Friday.

The pain from expensive basic goods and services was more felt by the poorest 30% Filipino households, whose lower purchasing power made them experience inflation at 5.5% year-on-year, also the fastest since December 2018.

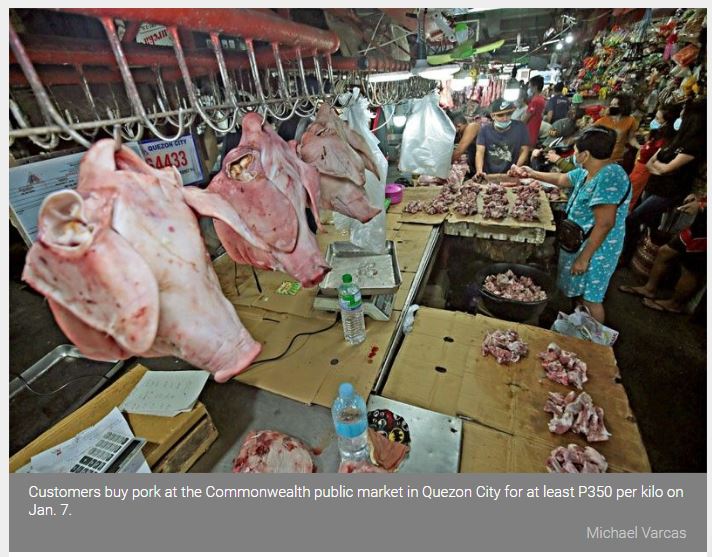

Costly food prices were again blamed for faster inflation outturn. Pork prices remain elevated because of tight supplies, as well as that of fish. The bright spot is prices of fruits and vegetables, which also tightened because of crop damage from typhoons last year, are beginning to taper down.

But with food inflation hardly resolved yet, other sources of inflation are also starting to emerge. Fuel prices, including cooking gas, are picking up following their global counterparts. Rice, which for most of last year was on a decline, has also seen upward movement in prices this month.

A government strategy to bring pork from provinces to replenish Metro Manila supplies and keep prices at bay also appeared to have backfired. While annual inflation in National Capital Region eased to 4.1% in February, that in other regions gained pace to 4.8%.

Meat prices also became more expensive outside NCR, and as a result moderated the impact of a 60-day price cap on pork and chicken in the capital enforced starting this month. In the entire archipelago, pork prices even accelerated 20.7% in February from January’s 17.1%. That of fish quickened to 5.1% from 3.7% int he same period, while rice costs increased 0.5% from being stable the previous month.

Commenting on the latest data, Governor Benjamin Diokno of the Bangko Sentral ng Pilipinas (BSP) remain convinced the current inflation episode unlike in 2018 is “temporary.” The February inflation fell comfortably within the BSP’s 4.3-5.2% forecast for the month.

“The overall balance of risks to future inflation continues to lean toward the downside owing mainly to the continued uncertainty caused by the pandemic…,” he said in a Viber message.

Despite this, last month’s inflation was a glimpse of months to come as policymakers outside the central bank scramble for a convincing defense while relying on the BSP to keep the cost of money cheap in hopes this would facilitate pandemic recovery. Both strategies of keeping prices under control and monetary easing have so far failed however, with inflation not only up but also bank lending hardly responding to a credit flush from the BSP.

Still, Diokno signaled he is not about to roll back over P2 trillion in liquidity he pushed toward the weakening economy last year. That is, even as BSP itself expect inflation to hit the ceiling of the 2-4% target for the year. “The sources of near term inflation are supply side shocks in nature that should not require a monetary response unless they lead to second round effects,” he said.

Unfortunately, Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said prices are only bound to go up further. “Moves by authorities to cap prices may not have the desired effect as such a directive may be disruptive and distortionary…,” Mapa said in an online exchange.

“No doubt supply side remedies work far more effectively than monetary actions to control prices during supply side induced inflation episodes,” he added.

On top of the food problem is rising transport costs. While last year’s uptick was largely explained by lockdowns that limited public transport on the road, that cap has remained unchanged to date when more of the economy are running, increasing demand for mobility options. From a 9% deflation in January, transport costs only dipped 0.2% year-on-year in February, with inflation on this segment within reach.

That oil prices are creeping up due to higher global oil prices is also not helping. Housing and utilities prices still declined 4.4% annually last month, but this was a much slower decline than the 5% reading in January. More than that, the cost of cooking gas has already started going up last month by 2.5% nationwide.

All these are bad news for consumers, whose spending represent 70% of the economy, relied upon by the government itself to return to economic growth this year, following last year’s record 9.5% slump.

“Unfortunately, all signs point to inflation remaining quite elevated in the near term, which compounds the challenges faced by households already struggling during the recession,” Mapa said.

Source: https://www.philstar.com/business/2021/03/05/2082159/fuel-compounds-costly-food-february-inflation-peaks-anew

Thailand

Thailand